If you run a small business, manage a team of freelancers, or sell at events, having a reliable credit card readers for your iPhone can make all the difference. You want to take payments easily without worrying about complicated hardware, downtime, or hidden fees.

After evaluating ten of the top solutions on the market today, we narrowed our list down to the five best credit card readers for iPhone that cover all the bases:

This guide will walk you through the best iPhone credit card readers. You’ll get a breakdown of how these readers connect to your iPhone, what apps they work with, and what fees you can expect.

Best credit card reader for iPhone compared

Company

Our Score (out of 5)

Card Reader

Key Features

Square

4.53

Easy setup, no monthly fees, free versatile POS

Stripe

4.35

Developer-friendly API, low transaction fees

SumUp

4.33

Flat-rate pricing, easy portability

Shopify

4.29

Seamless Shopify integration, multichannel support

Clover GO

4.16

Fast payouts, flexible payment options

Square: Best overall credit card reader for iPhone

Overall Score

4.53/5

Pricing & contract

4.25/5

Payment processing

4.5/5

Hardware features

4.5/5

Security & stability

4.25/5

User reviews

5/5

Pros

- Clear pricing model with no monthly fees

- Supports all major payment types

- Longer battery life than previous generations

- Works seamlessly with Square POS app

- Accepts offline payments

- Positive user reviews

Cons

- Contactless and chip reader doesn’t support swiped magstripe payments

- 1.75% fee for immediate transfers

- Not compatible with all business types

Why I chose Square

If you want an iPhone credit card reader that is affordable, has great features, and is hassle-free, Square is the best choice. It’s ideal for businesses that need more than basic payment processing but don’t want to deal with complicated setups or high fees.

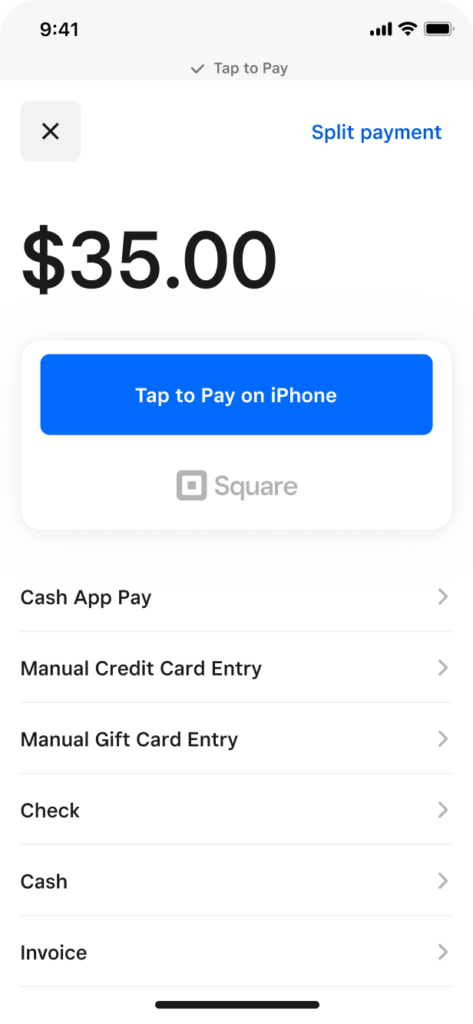

Setting it up with your iPhone is simple — just connect the reader via Bluetooth, and you’re ready to accept chip cards, contactless payments like Apple Pay, and even old-school swiped cards with Square’s free magstripe reader.

You only pay 2.6% + $0.10 per transaction for swiped, dipped, or tapped payments, which is competitive and keeps things simple.

If you’re comparing Square to SumUp, which is later on this list, Square wins in terms of overall features and ease of use. While SumUp charges 2.6% per transaction with a $54 card reader, it doesn’t offer the same range of business tools that Square’s app does, like in-depth sales reporting or seamless integration with other business software. Plus, with Square, you get your first magstripe reader free, and their contactless and chip reader is just $59. SumUp may look more affordable at first glance, but Square’s broader functionality makes it more versatile, which speaks to its scalability.

Another advantage is that your money gets deposited into your bank account the next day, or you can use instant transfers (for a 1.75% fee) if you need the cash right away.

Finally, with APIs and a huge range of integrations, it connects easily to other business software like accounting tools or eCommerce platforms, giving you more control over your operations.

Also read: Best Cloud POS Systems

Stripe M2: Best for online businesses

Overall Score

4.35/5

Pricing & contract

3.8/5

Payment processing

4/5

Hardware features

4.8/5

Security & stability

4.5/5

User reviews

5/5

Pros

- Top-tier security

- End-to-end encryption (E2EE)

- Accepts EMV chip cards, contactless payments and traditional magstripe cards

- Highly portable, weighing just 85 grams and measuring under 3 inches in width

- Developer-friendly API

Cons

- Only allows tipping through digital receipts

- High fees for international transactions

- No free POS hardware

Why I chose Stripe M2

With effortless integration with your e-commerce operations, a smooth connection to your iPhone via Bluetooth, and the ability to accept EMV chip, contactless, and magstripe payments — all in one compact, lightweight device — Stripe M2 iPhone credit card readers can hang with the best of them. The setup is simple, and if you’re already using Stripe to handle online transactions, the Stripe M2 fits perfectly into your existing payment flow.

The real advantage Stripe M2 has over competitors like Square lies in its deep integration with online payments. Stripe M2 allows you to consolidate both your in-person and online transactions into one system. Its unified API means all your payment data is synced, allowing you to track everything from customer analytics to revenue. This type of integration is something Square, while strong for in-person payments, doesn’t quite match.

When it comes to pricing, Stripe M2’s reader costs $59, similar to Square’s Contactless and Chip reader.

Stripe charges 2.7% + $0.05 for in-person transactions, which is slightly higher than Square’s 2.6% + $0.10. However, if your business primarily operates online, Stripe’s 2.9% + $0.30 per online transaction fee remains competitive across the board and allows you to scale your online business easily.

Another benefit is Stripe’s payout flexibility. You can receive your funds in as little as two days, with an Instant Payout option for a 1% fee, ensuring quick access to cash flow when needed. Square offers a similar Instant Deposit feature but at a 1.75% fee, making Stripe the more affordable option for immediate payouts.

For businesses focused on online sales, the Stripe M2 offers a unique advantage: it consolidates your payment processing tools under one umbrella, helping you stay organized without juggling multiple platforms. Square’s POS system offers great tools for retail businesses, but Stripe’s ability to handle complex e-commerce integrations with minimal fuss makes it ideal for companies that live in the online world.

Also read: Top Stripe Alternatives

SumUp: Best PIN-enabled readers

Overall Score

4.33/5

Pricing & contract

4.25/5

Payment processing

4.75/5

Hardware features

4.63/5

Security & stability

3.5/5

User reviews

4.33/5

Pros

- Send payment links via text or messaging apps

- Easy to set up, takes just a few minutes

- Free basic inventory tools synced across channels

- Competitive flat-rate fees

Cons

- Longer payout times

- Doesn’t offer comprehensive employee management features

Why I chose SumUp

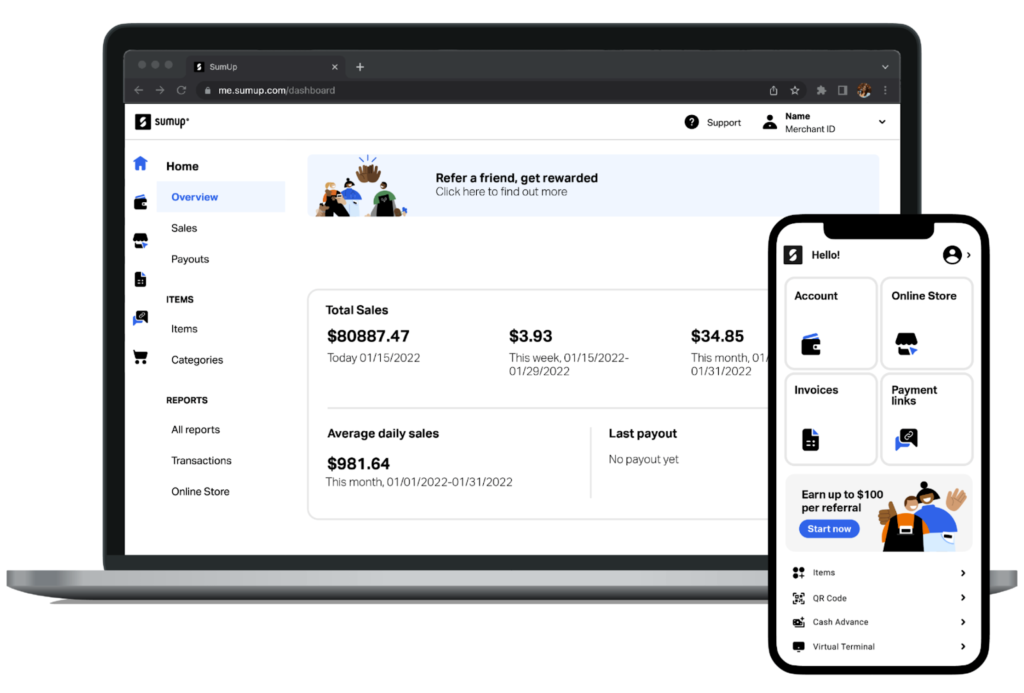

SumUp caters to businesses of all sizes by offering a diverse selection of card readers, allowing business owners to pick the device that best fits their specific needs. The options include the SumUp Plus, a sleek Bluetooth-enabled reader, and the SumUp 3G, which operates independently of any phone connection, offering unmatched portability.

SumUp’s pricing model is simple and transparent. You pay 2.6% + $0.10 per transaction for card-present payments, putting it in line with Square’s transaction fees. However, SumUp doesn’t charge any monthly fees, keeping operational costs low for small businesses and sole traders. While Square offers a larger ecosystem with its POS features, SumUp stands out for offering PIN-enabled mobile readers.

SumUp’s app, though more basic than Square’s, still provides essential features for tracking sales and managing inventory. However, Square’s app is more advanced, offering integration with third-party tools and more detailed reporting features, which makes it better for businesses looking for in-depth analytics. Where SumUp excels is in keeping things simple — its app is focused on ease of use and quick transactions.

It also offers hardware options that adapt to your business needs at lower processing fees, making it a very valuable iPhone credit card reader for businesses looking to save on costs without sacrificing mobility.

Also read: Best Free POS Systems

Also read: Lightspeed vs. Shopify: Best POS Systems

Shopify: Best for multichannel selling

Overall Score

4.29/5

Pricing & contract

3.94/5

Payment processing

4/5

Hardware features

4.5/5

Security & stability

5/5

User reviews

4.33/5

Pros

- Day-long battery life

- Sync in-person payments with your existing Shopify online store

- Supports multiple currencies

Cons

- Exclusive to the Shopify POS & ecommerce ecosystem

- No free plan

- Limited offline features

Why I chose Shopify

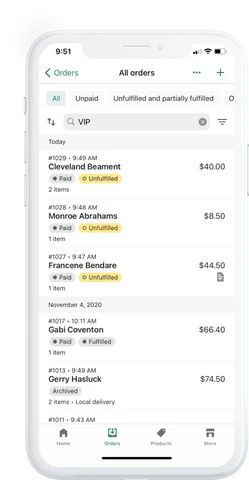

The core reason Shopify outshines competitors like Square in e-commerce integration is its deep synchronization between the Shopify card reader and its online store. Whether you make sales in-person or online, Shopify automatically updates your inventory, customer data, and orders in real time across all platforms. This integration makes it the ideal choice for retailers with both a physical and an online presence, allowing you to manage all transactions from a single system without needing third-party apps.

Square, while a highly versatile and user-friendly option, its online store offerings are relatively basic compared to Shopify’s sophisticated e-commerce tools.

When compared to Square’s hardware, Shopify’s Tap & Chip Reader is similarly priced at $49 for the reader, though Shopify offers a charging dock for an additional $39, which can add convenience for businesses running multiple transactions in a day. Shopify’s hardware also integrates directly into its broader POS and e-commerce ecosystem. Square offers this functionality too, but many users find the Shopify integration experience to be more user-friendly.

The Shopify app is designed to work hand-in-hand with the Shopify card reader and is iPhone-compatible, ensuring that all data is instantly available at your fingertips. The app also makes it easy to customize taxes, add discounts, and manage loyalty programs directly from your iPhone.

Shopify’s card reader is ideal for retailers who need to seamlessly manage both their online and in-person sales.

Also read: Square vs. Shopify: Which is Best for Your Business

CloverGo: Best user reviews

Overall Score

4.16/5

Pricing & contract

3.44/5

Payment processing

3.44/5

Hardware features

3.88/5

Security & stability

4/5

User reviews

5/5

Pros

- Offline payment processing

- Choice of merchant account on Fiserv network

- Next-day payouts

- Positive user reviews

Cons

- Compatibility with third-party hardware (like printers) is limited.

- Although Clover Go can process payments offline, there is a higher risk of transaction failure when syncing once the connection is restored.

Why I chose CloverGo

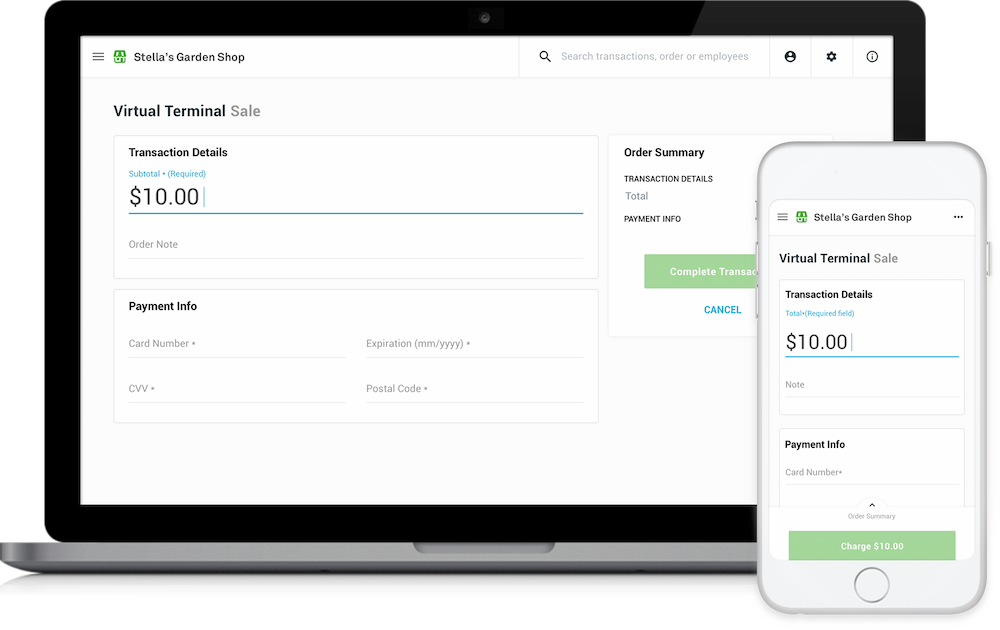

Clover Go is engineered specifically for mobile use, offering Bluetooth connectivity that pairs effortlessly with iPhones. Its portable design, combined with a powerful rechargeable battery, ensures that users can accept payments on the go without worrying about battery life.

Clover Go is widely available through major retailers and merchant account providers operating on the Fiserv network, making it a popular and widely-used solution. Though Square can also be purchased through retailers, Clover is the only option on this list that can work with many different processors.

In contrast, Square Reader, Clover Go’s closest competitor, offers similar functionality but lacks some of Clover’s advanced security features, such as end-to-end encryption. And, of course, Square’s hardware can only be used with Square’s payment processing.

Overall, the app itself is extremely highly rated, with a current 4.8 out of 5 rating on the Apple App Store. Only Square rivals Clover’s positive user reviews.

Key features of iPhone credit card readers

When choosing the right credit card reader for your iPhone, you’ll want to focus on a few key features that can make your life easier and ensure smooth transactions. Here are some fundamental points to consider:

Payment types: Look for readers that accept a variety of payments, including chip cards (EMV), contactless payments like Apple Pay and Google Pay, and magstripe cards (though these are becoming less and less common).

POS app: The app should handle transactions and offer business tools like inventory management, invoicing, and customer engagement features (e.g., Square POS, Shopify POS). Additionally, many corresponding POS apps have Tap to Pay, so you can accept contactless payments even without hardware. If you take orders over the phone, you may also want to check if the app allows you to manually key-in payments.

Connectivity: Most readers connect via Bluetooth for wireless use, though some budget options may require a plug-in format like a headphone jack or Lightning connector.

Battery life: Bluetooth-enabled readers generally last all day on a single charge, while plug-in readers don’t require charging. Either way, most card readers list how many transactions they can run on a single charge and how long it takes to charge the battery. Make sure the option you choose can handle your typical transaction volume, and/or has a portable charger that works with your setup.

Transaction fees and costs: Expect to pay a flat fee per transaction, around 2.6% + $0.10 for card-present payments, with most providers offering no monthly fees. However, it’s always a good idea to shop around for the lowest rates. And, of course, consider contract terms and whether the card reader comes with an annual contract, or if you’ll be able to use it as-needed with no obligations.

Choosing which solution is best for your business

Square is a go-to option for a versatile, all-in-one solution. Its easy-to-use hardware, competitive pricing, and POS app make it ideal for small businesses that need flexibility and scalability.

If your focus is on e-commerce, especially if you’re using Shopify, the Shopify reader is a seamless choice for managing both in-person and online sales in one system.

For businesses on a budget, SumUp offers an affordable option without sacrificing reliability. Meanwhile, Clover Go and Stripe M2 are excellent for those who need fast payouts or already use specific payment processors.

When choosing the right card reader for iPhone for your specific business needs, remember, your decision will depend on your payment volume, types of transactions, and integration needs. By evaluating these factors, you’ll find the solution for you and your team.