Cloud-based point-of-sale (POS) systems are POS solutions whose data are stored and accessed via an internet browser rather than on local servers. Cloud POS systems are great for businesses that need to take their operations on the go, want to access their business’s real-time data from anywhere, and prefer not to house servers in their storefront.

In this guide, we evaluated the top cloud-based POS systems on the market, scoring them based on dozens of data points, including pricing, features, and user reviews. Based on our evaluation, the best cloud-based POS systems for 2024 are:

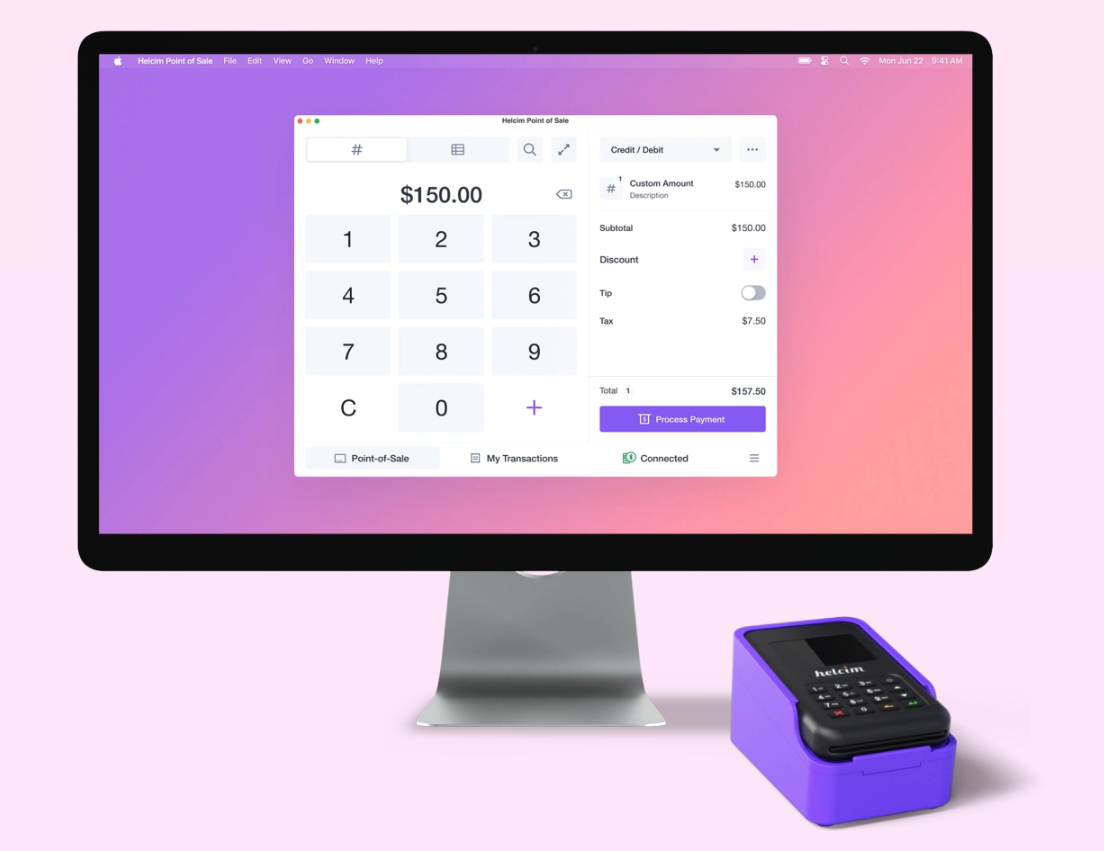

Software Spotlight: Helcim

Want to reduce – or eliminate – processing fees?In addition to free cloud POS software, Helcim offers some of the lowest payment processing fees on the market. With Helcim, you’ll get:

- Free POS software and low, interchange-plus pricing

- Options to pass processing fees on to your customers

- Dedicated merchant account with greater security and stability

Visit Helcim

Even though cloud-based POS systems tend to be less expensive than server-based options, they do not sacrifice functionality. In some ways, namely security, ease of use, and update abilities, cloud-based POS systems are often superior. The best cloud POS systems will also include integrated Payment Card Industry (PCI)-compliant payment processing, inventory management tools, customer relationship management, employee management, reporting, and industry-specific features.

Monthly Software Fees

In-Person Processing Fees

Mobile Compatibility

Square

$0–$192

2.5%–2.6% + 10 cents

Yes iOS and Android POS apps

Shopify

$39–$399

2.4%–2.6% +10 cents

Yes iOS and Android POS apps

Lightspeed Retail (R-Series)

$89–$269

2.6% + 10 cents

Yes Lightspeed Retail POS app for iOS (iPad only)

Helcim

$0

0.25%–0.4% + 6–8 cent

Yes iOS and Android POS apps

Clover

$0–$310

Rates vary based on processor

Yes Clover Go POS app for Android and iOS

Expert Tips

Still looking for more POS options? Check out our comprehensive Retail POS Buyer’s Guide.

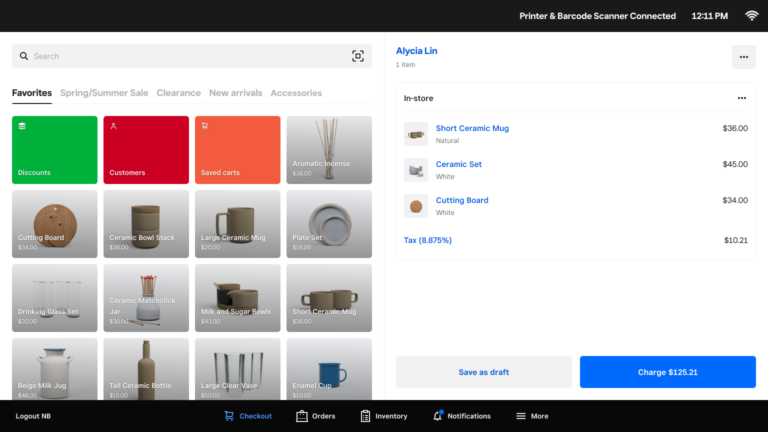

Square: Best overall cloud POS system

Pros

Cons

Our Rating: 4.22/5

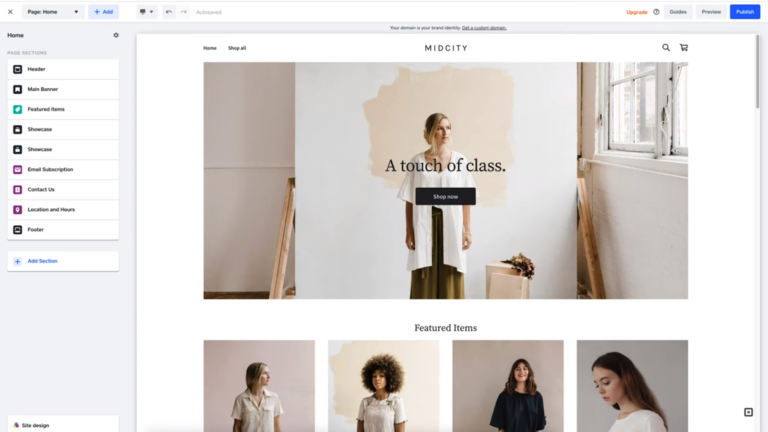

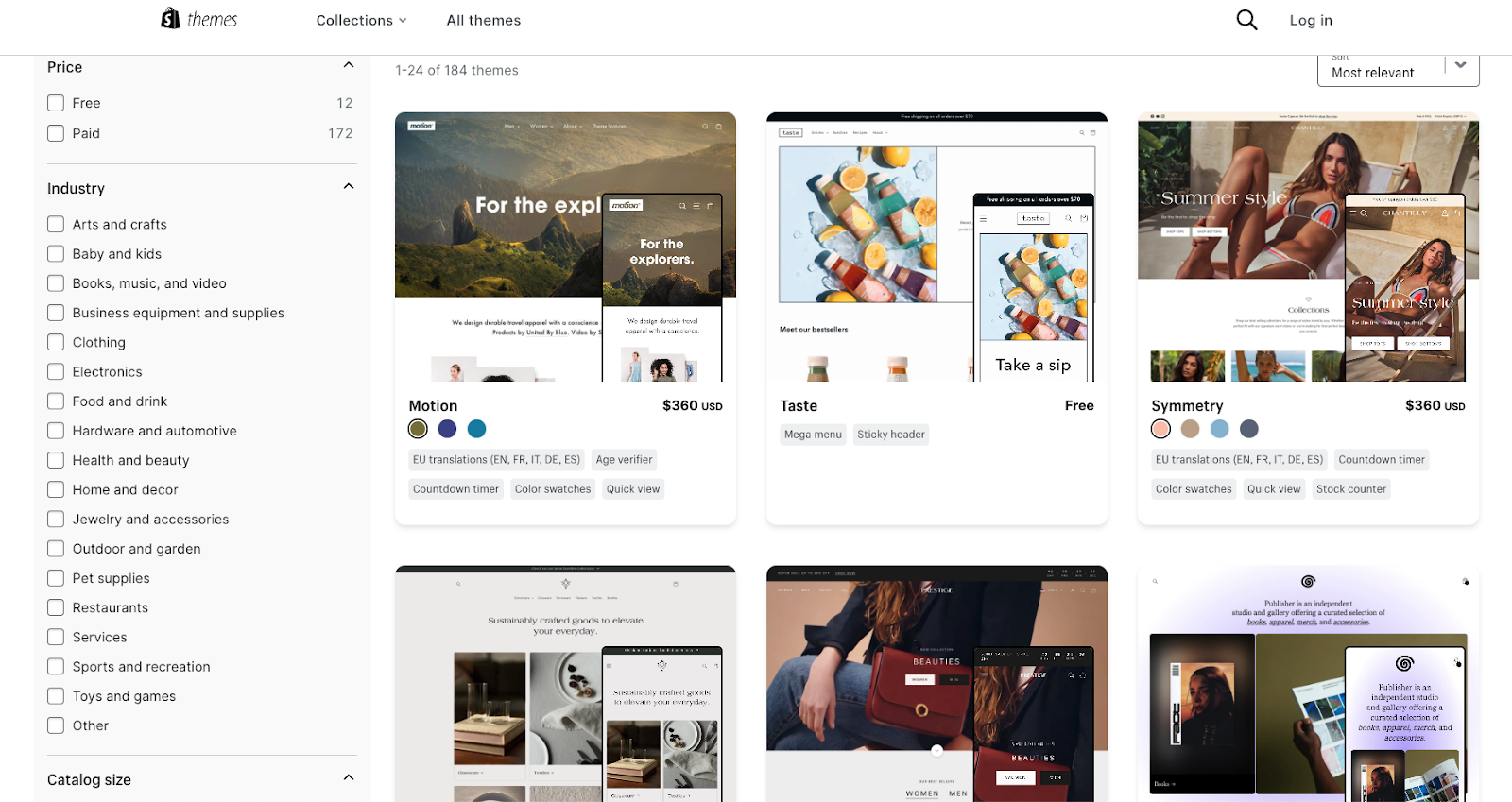

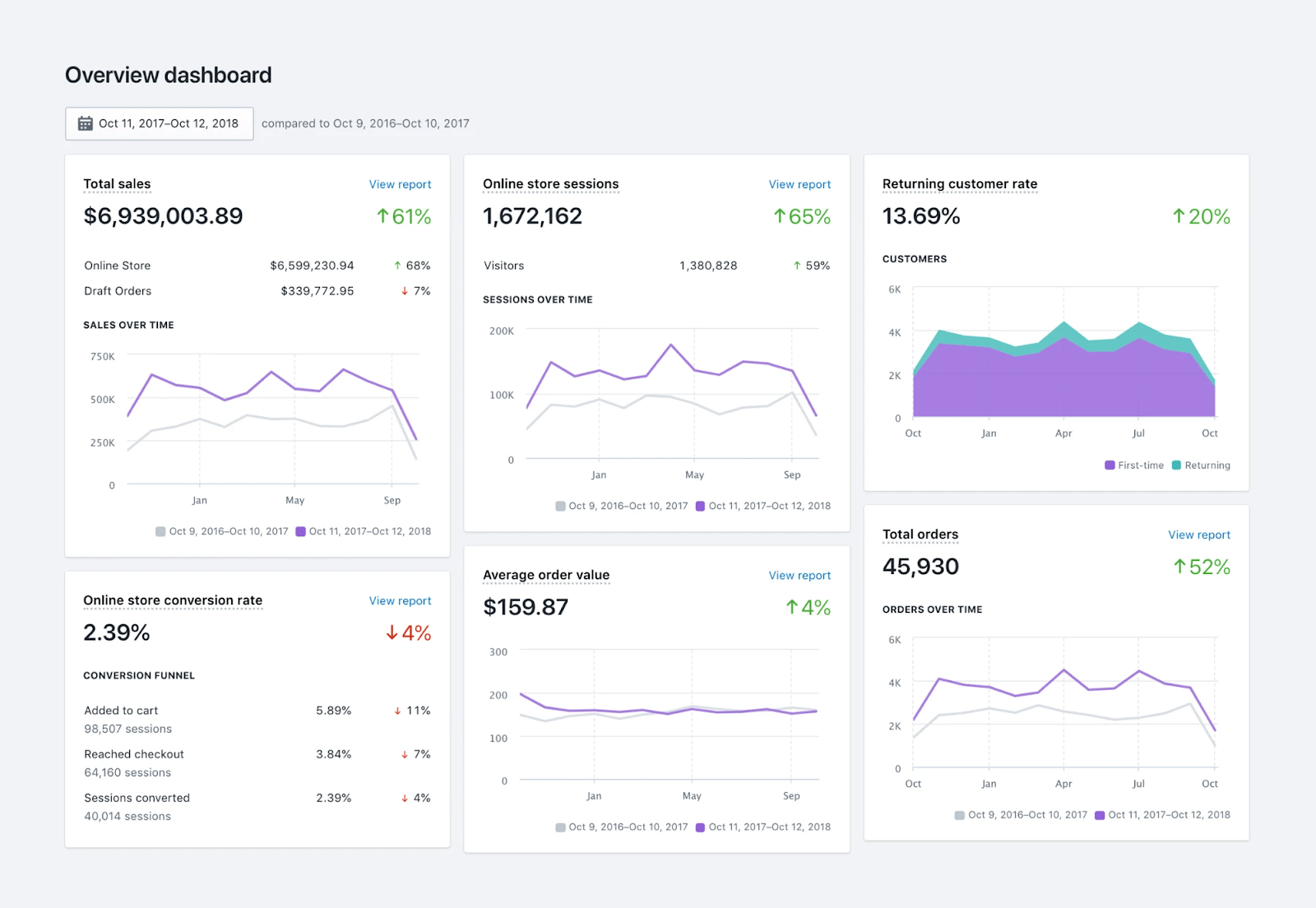

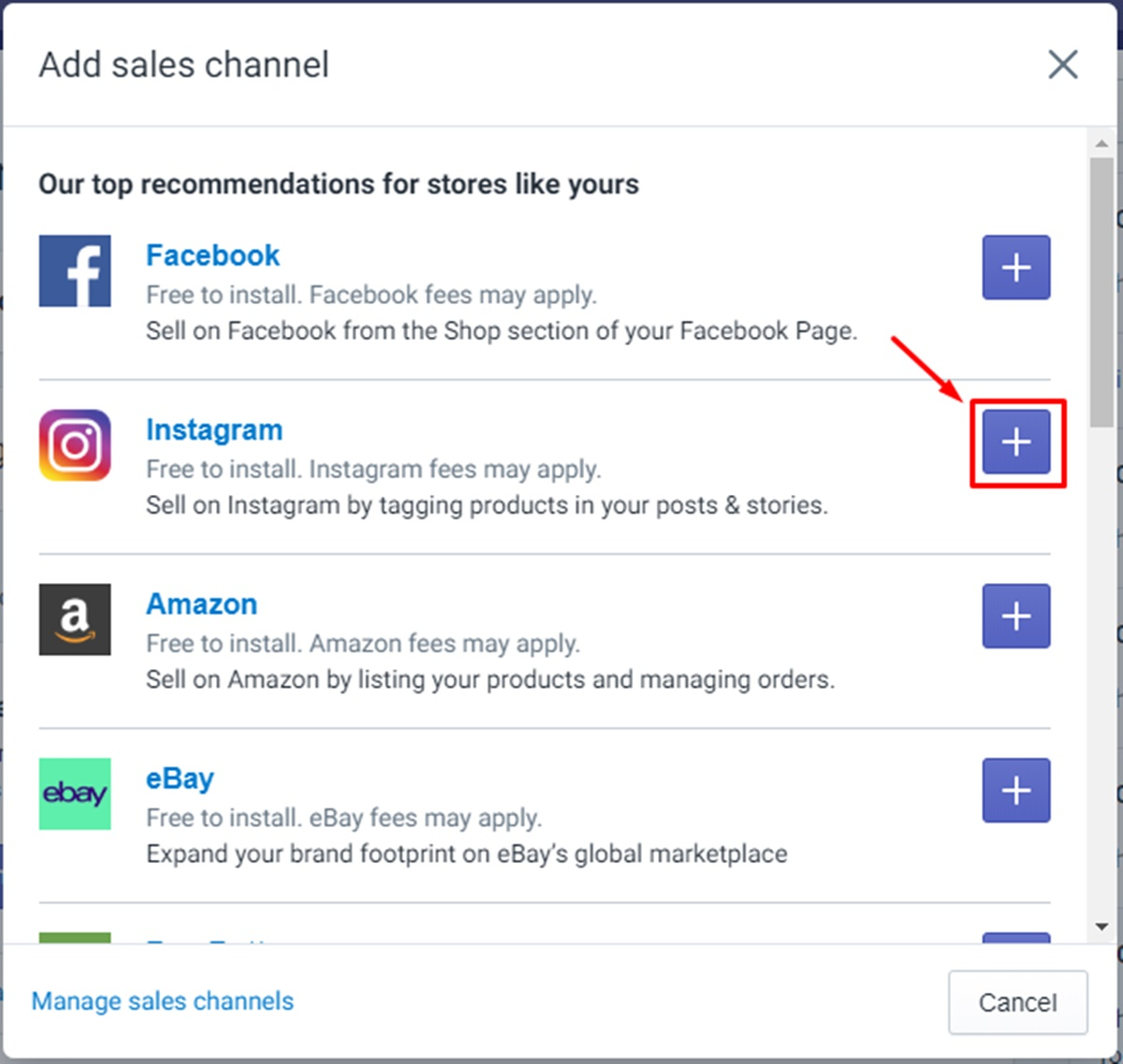

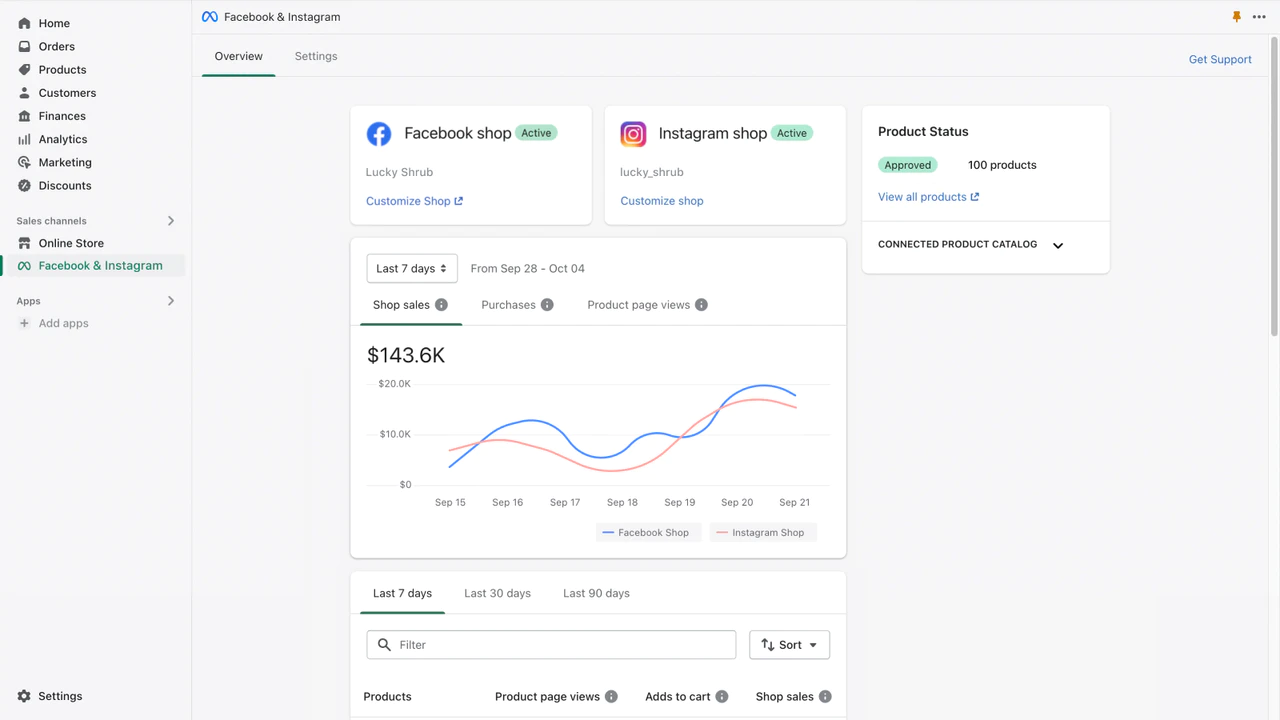

Shopify: Best for ecommerce

Pros

Cons

Our Rating: 4.11/5

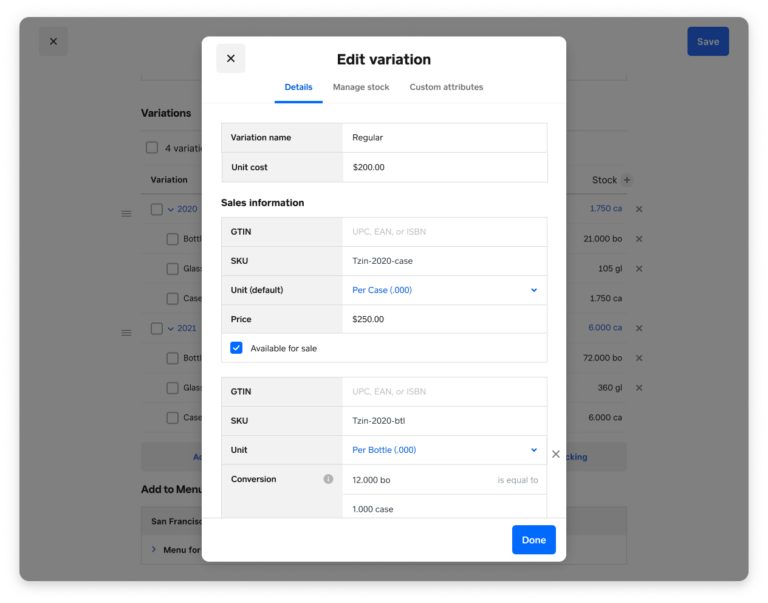

Lightspeed Retail (R-Series): Best for large, complex inventories

Pros

Cons

Our Rating: 4.10/5

Helcim: Best for professional services

Pros

Cons

Our Rating: 4.08/5

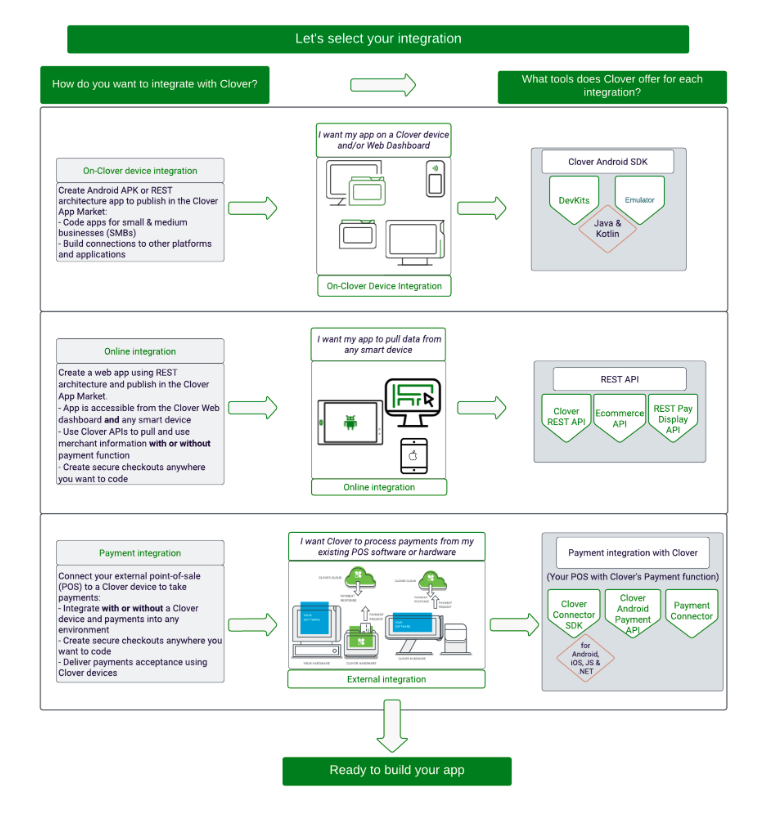

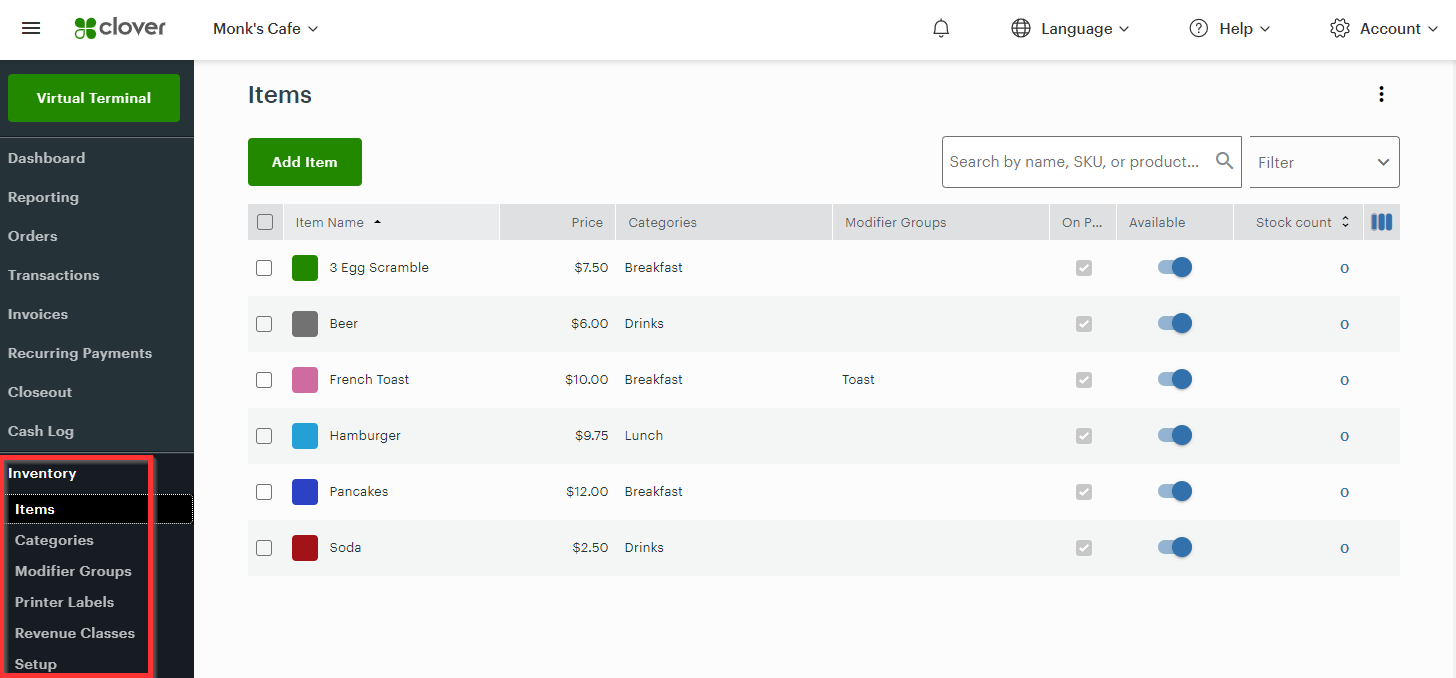

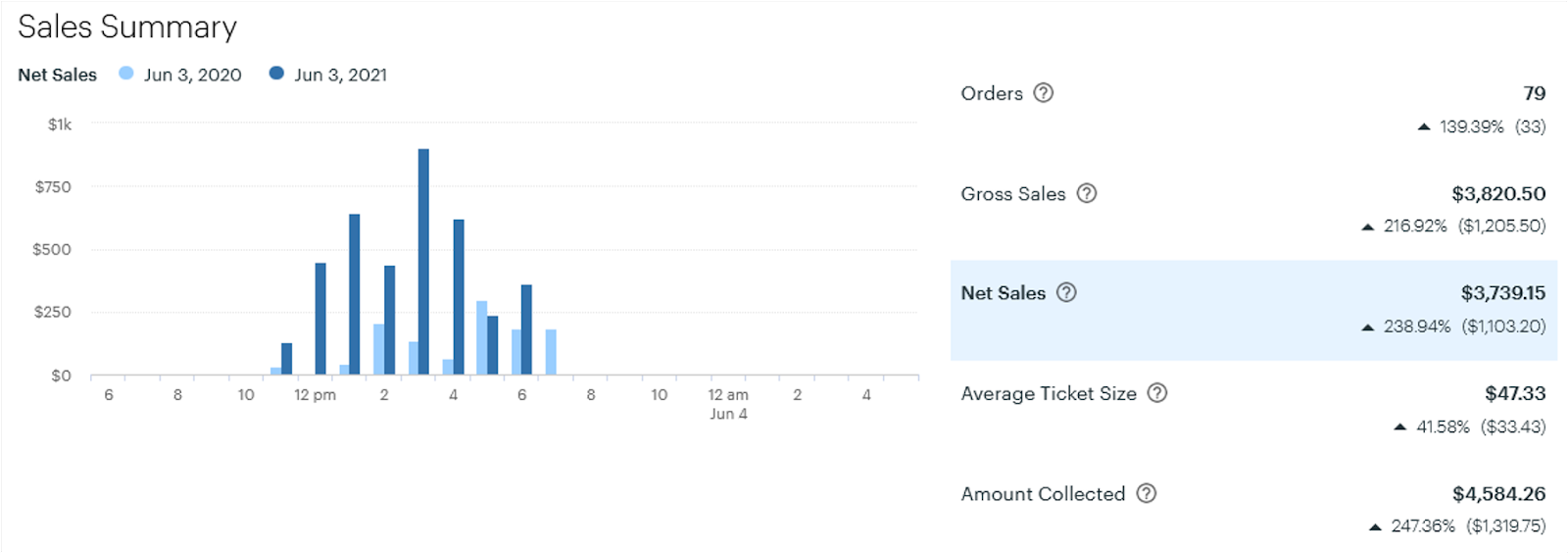

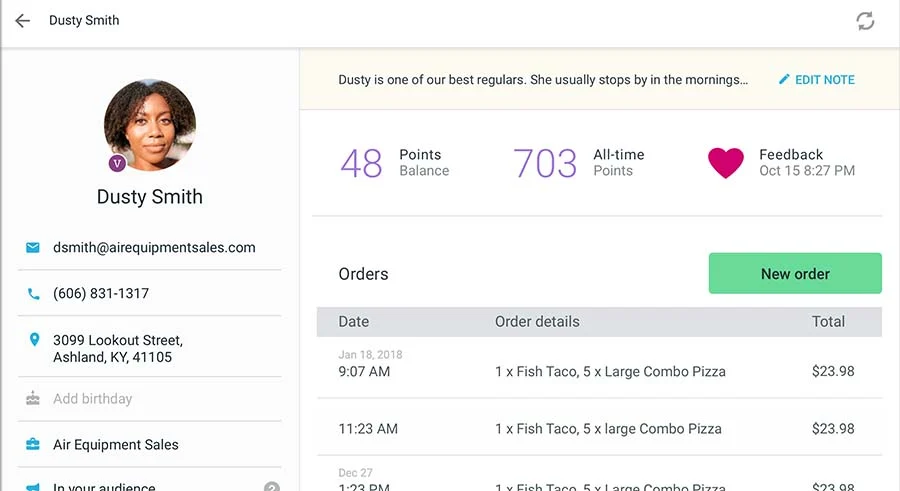

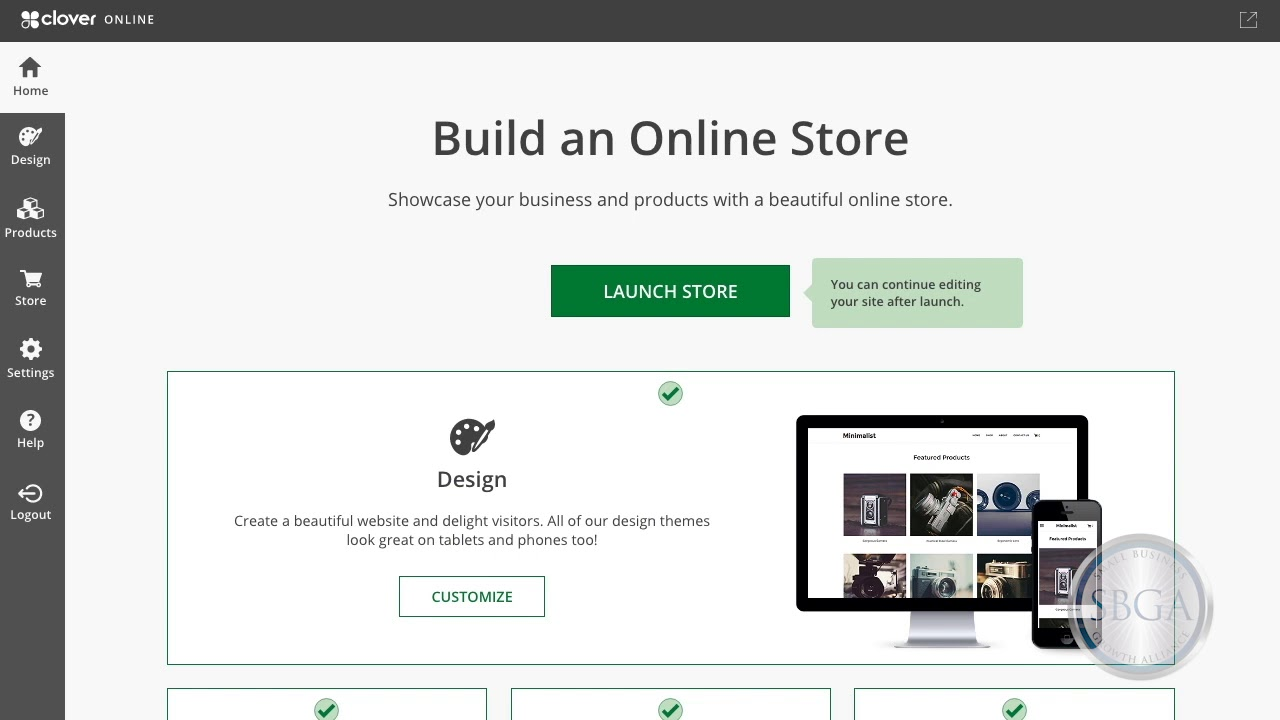

Clover: Best for third-party customizations

Pros

Cons

Our Rating: 3.87/5

Key features of cloud POS systems

If you are in the market for a cloud POS system for your business, you should look for the following features to ensure maximum functionality and value. Hardware: The best cloud POS systems will be able to operate without hardware, but will have hardware options for both mobile and in-store operations. Most POS systems will have an in-house option as well as third-party hardware compatibility.

Expert Tips

Learn more about the best POS hardware on the market with our guide Best POS Hardware for Business in 2024

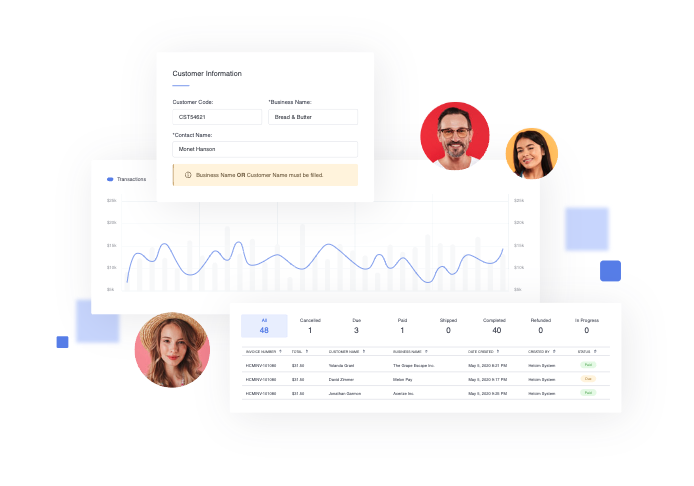

- Customer management tools: You should be able to create customer profiles that include contact information, purchase histories, and customer notes. The best systems will allow you to create these profiles from within your CRM directory and at the points of sale. You should also look for the ability to add existing customer profiles to transactions.

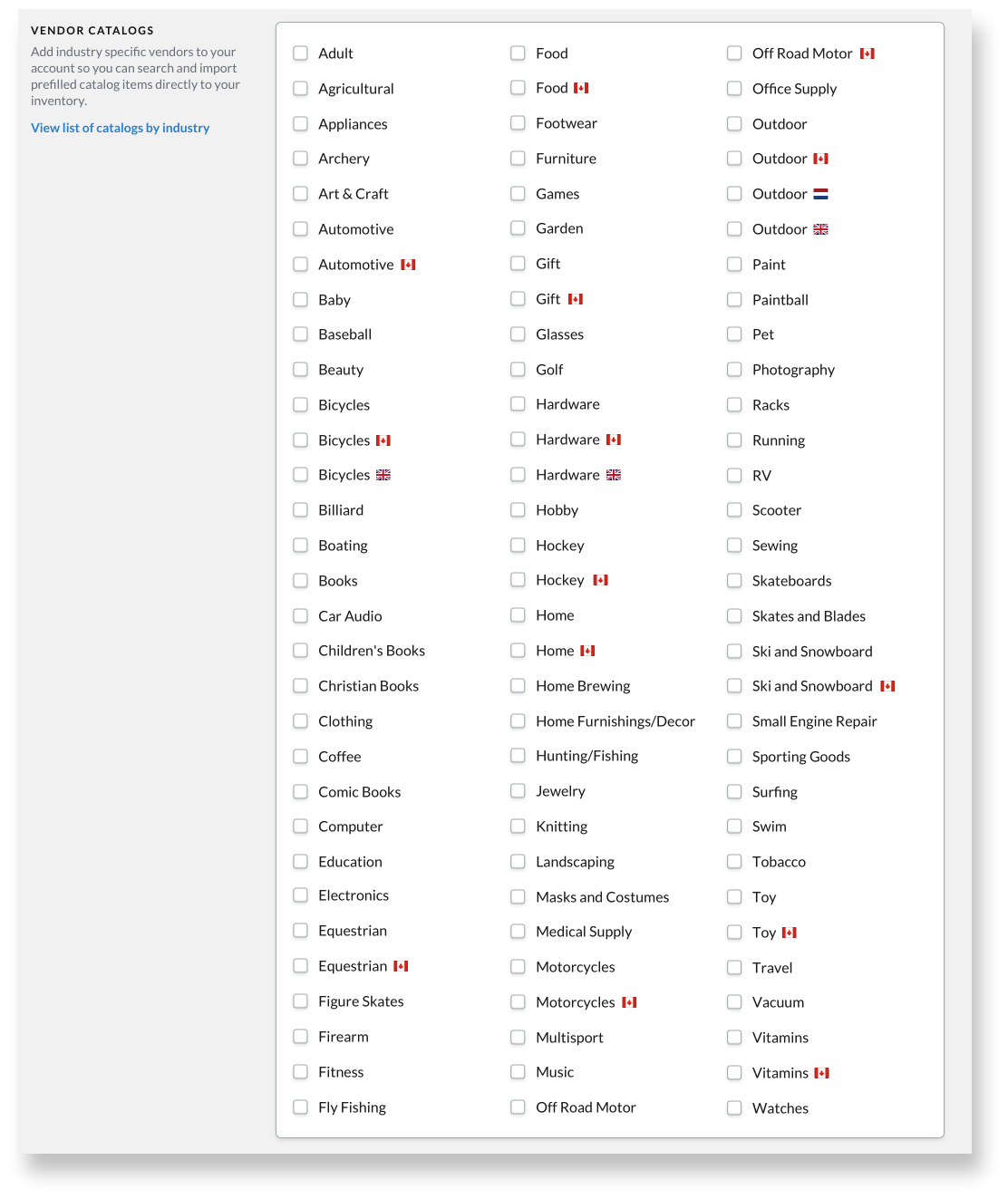

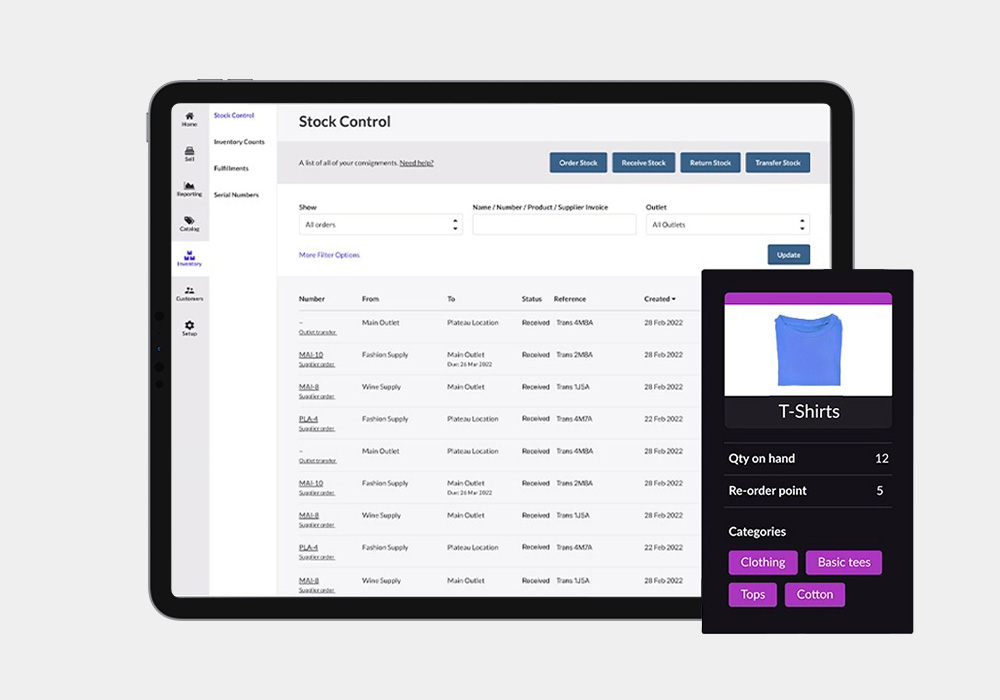

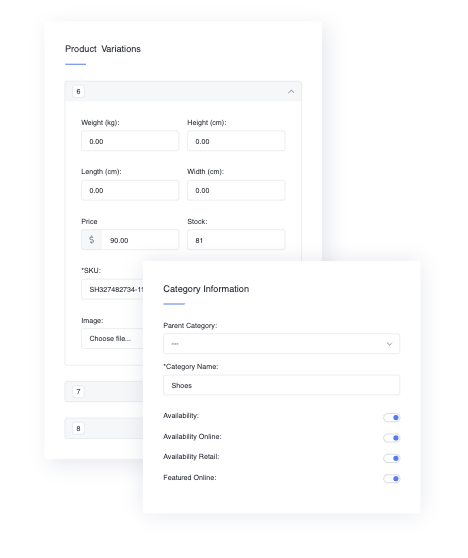

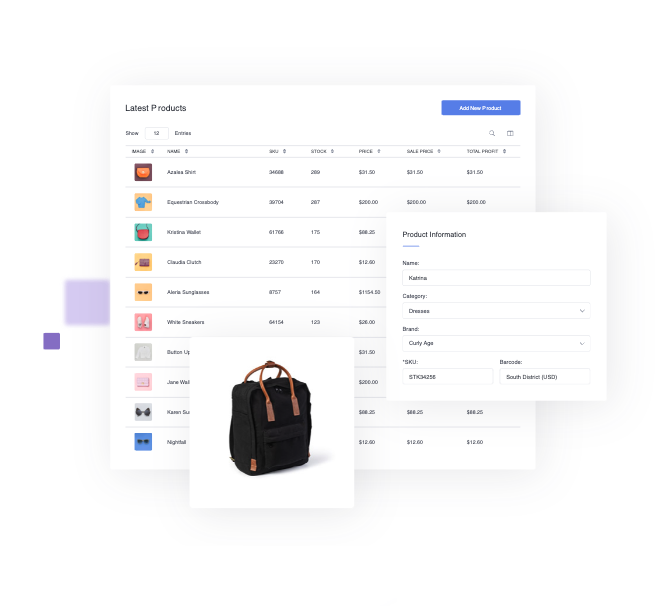

- Inventory management: At a minimum, you should be able to create detailed product pages that are logged in your inventory catalog, upload inventory in bulk, and track your inventory levels in real-time. The best systems will also send automated low-stock alerts, allow you to create purchase orders, create detailed inventory reports, and manage your vendors all from your POS.

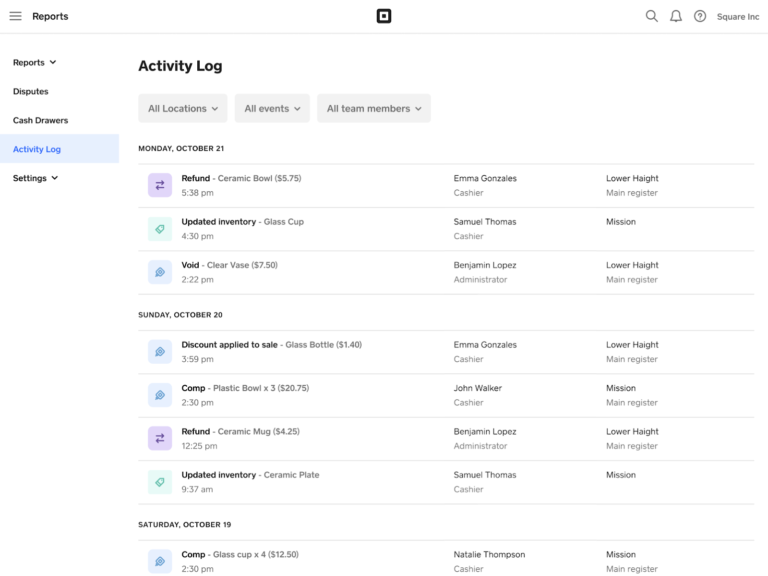

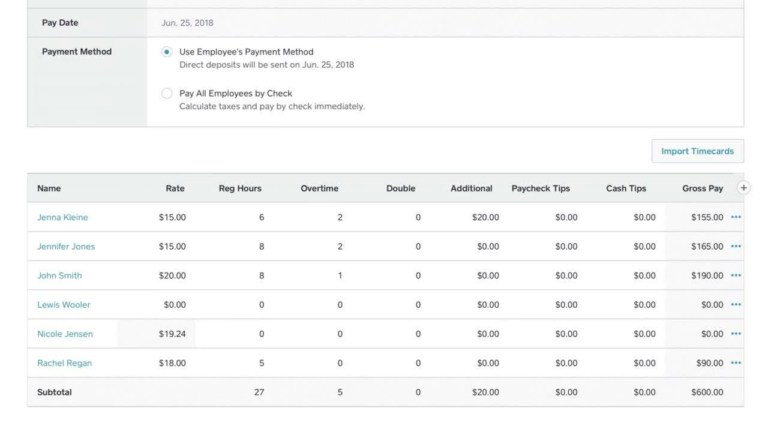

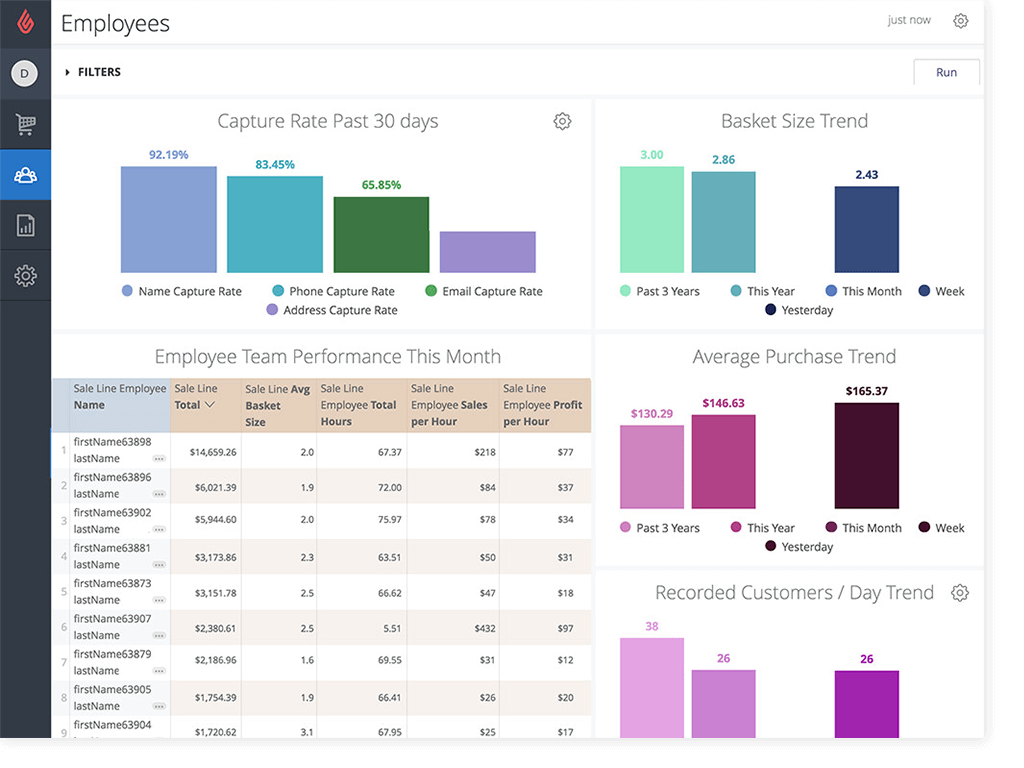

- Staff management: You should be able to create separate staff log-ins with set permissions so you can keep your business secure and track individual performances. The best systems will also have scheduling, payroll, time clock, and shift management tools.

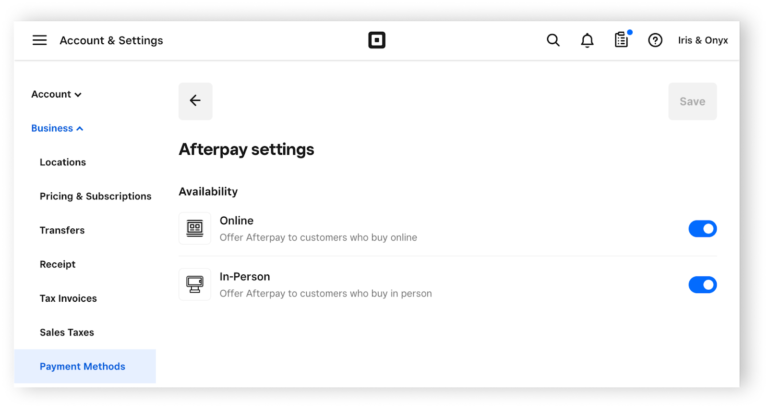

- Payment processing: Your POS systems should come set up with payment processing. Most systems offer an in-house system that is either flat rate (ideal for SMBs) or bulk discounted (ideal for enterprise businesses). The best systems will offer interchange plus rates or the option to integrate a third-party merchant so you can shop around for the best deal.

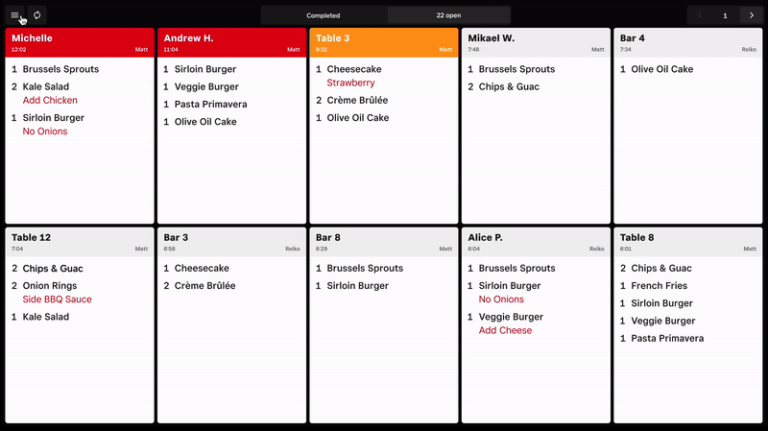

- Industry-specific tools: What you need your POS systems to do will vary from business to business. For restaurants, retailers, and service providers, you should look for industry-specific POS options to ensure you have the most relevant set of features.

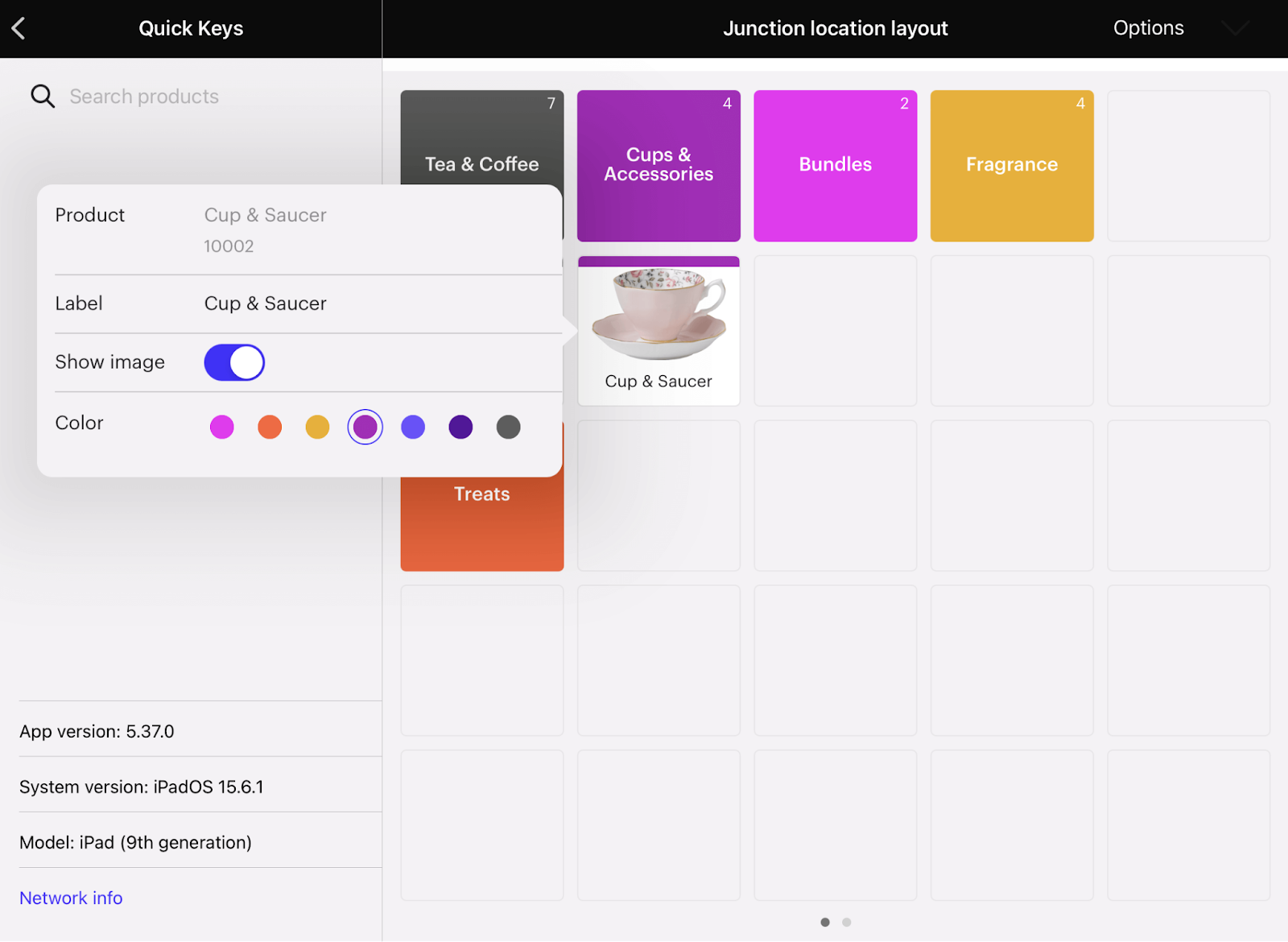

- POS app: Your cloud POS should include a POS app so you can take your business on the go and make sales from anywhere. The best POS apps include tap-to-pay functionality, so you need no additional hardware to process payments—just your mobile device.

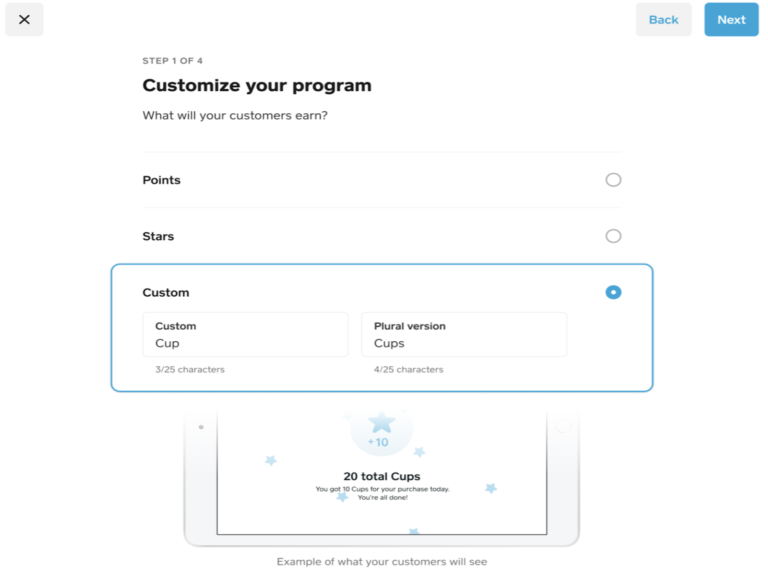

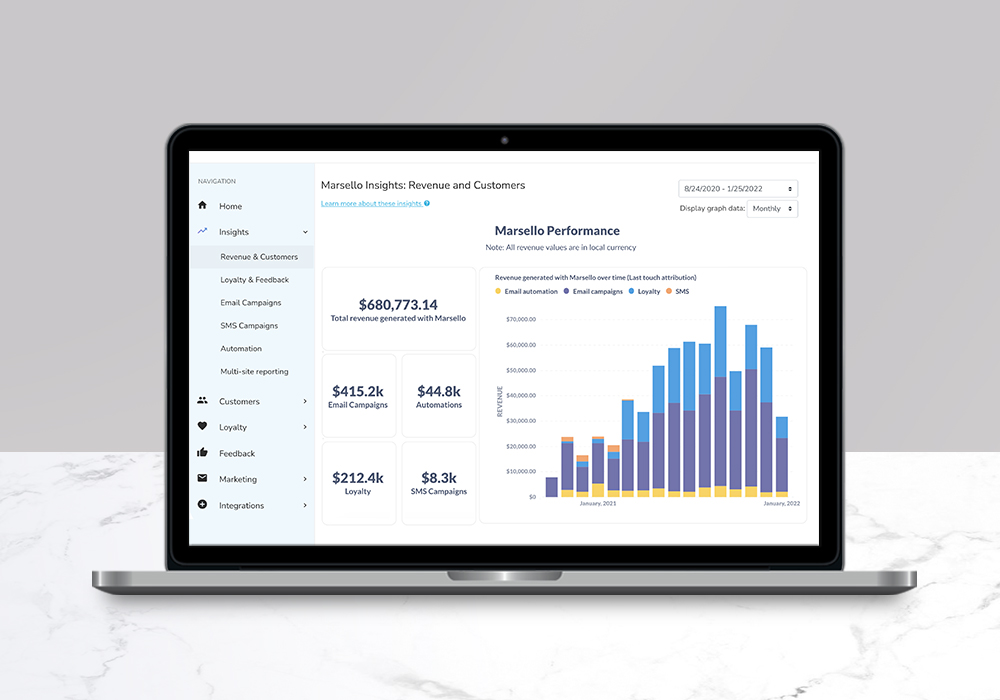

- Marketing tools: To help your business grow and keep customers engaged, you should look for an option that includes marketing tools like SMS and email marketing, automated triggers, a loyalty program, discounting and promotion management, and marketing reports to assess the success of your initiatives.

- Offline capabilities: To ensure you can keep your business going in the case of an internet outage, you should look for options that include offline payment processing and inventory syncing.

- Ease of use: Be sure to check out customer reviews and utilize any product demos to ensure your POS system is user-friendly. This will ensure that your staff can keep operations running smoothly and you can utilize everything your POS has to offer.

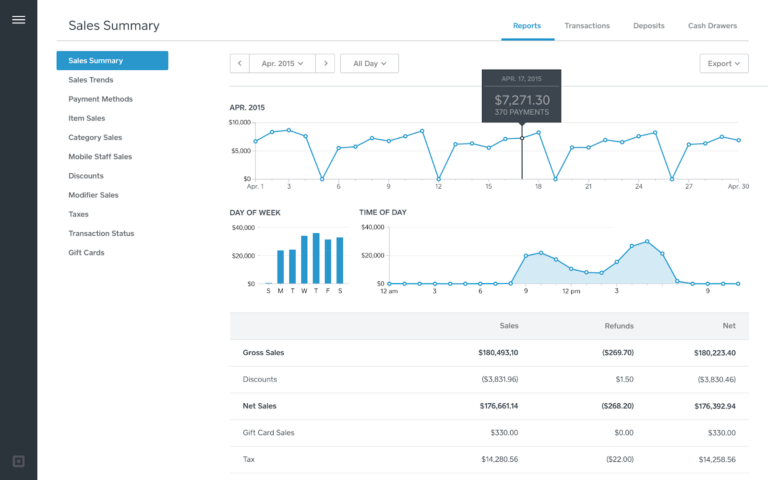

- Reporting: Your POS system should include sales and inventory reports, at minimum. The best systems will also include reports on taxes, discounts, payments, and more. They will also allow you to segment your reports by time and product categories, create custom reports, and even provide actionable insights into how you can use your store data to boost performance.

- Growth options: You should always assume your business will become more successful over time, and to avoid the headache of having to change POS systems as a result of your growth, you should look for options that have multiple plans that can grow with you. The best options will even include bespoke plans for enterprise-level operations.

- Integrations: While you should hope to keep most of your POS tools in-house for maximum ease, you should also look at what integration options the system has to offer. These add-on tools are great if you need a highly specific tool or are already using a certain platform and want the ability to seamlessly integrate it with your POS.

Finding the right solution for your needs

Cloud POS systems are a great option for businesses that want to access their business from anywhere, take their sales on the go, and not be bogged down by costly servers that are hard to update and have a pricey cost of entry.

We believe that Square is the best cloud POS solution on the market. It offers industry-specific tools, add-ons, growth plans, and a top-of-the-line user experience. The system is ideal for businesses ranging from single-man operations and mobile sellers to enterprise-level operations.

However, for businesses that operate primarily online, Shopify is going to be your best bet. For those with complex or large inventories, we recommend Lightspeed. Meanwhile, Helcim is ideal for the professional services industry and interchange plus processing deals. Clover is also ideal for businesses that crave third-party customization options.

You really can’t go wrong with any of the options on this list. Simply evaluate your needs and budget, and the solution you are searching for is here.