Using your mobile phone or an iPad as point-of-sale (POS) hardware can be convenient, but it might not be the ideal situation for some businesses. Choosing the best POS hardware comes down to finding the right pieces for your needs, whether you work in a busy restaurant, a brick-and-mortar retail shop, or pop-up shops in multiple towns. After carefully considering features, durability, and pricing, we picked the best POS hardware for various small businesses.

Best POS hardware at a glance

Our score

Hardware type

Cost

Clover

4.62

Handheld all-in-one POS and card reader

$599*

Square

4.61

Countertop touchscreen POS register with customer-facing display

$1899

Toast

4.3

Handheld mobile restaurant POS and card reader

$799.20**

PayPal

4.2

Handheld all-in-one POS and card reader

$199

Helcim

4.16

Handheld all-in-one POS and card reader

$329*

*Interest-free monthly installment plans available

**As part of a Starter Kit, which also includes a data security router and wireless access point. Also available for $0 upfront with a pay-as-you-go pricing plan

Related: What is a POS system?

Clover Flex

Overall Score

4.62/5

Hardware features

4.86/5

Payment processing

4.69/5

Pricing

4/5

Other features

4.69/5

User experience

4.88/5

Pros

- Choice of monthly or upfront price

- Built-in barcode scanner

- Includes integrated receipt printer

- Card and contactless payments allowed

- Portable POS hardware solution

- Inventory management included

- Full reporting options

- WiFi connectivity

Cons

- Only connects via WiFi or LTE

- Requires you use its payment processor

- 36-month contract required

- Some software features only on high-tier plans

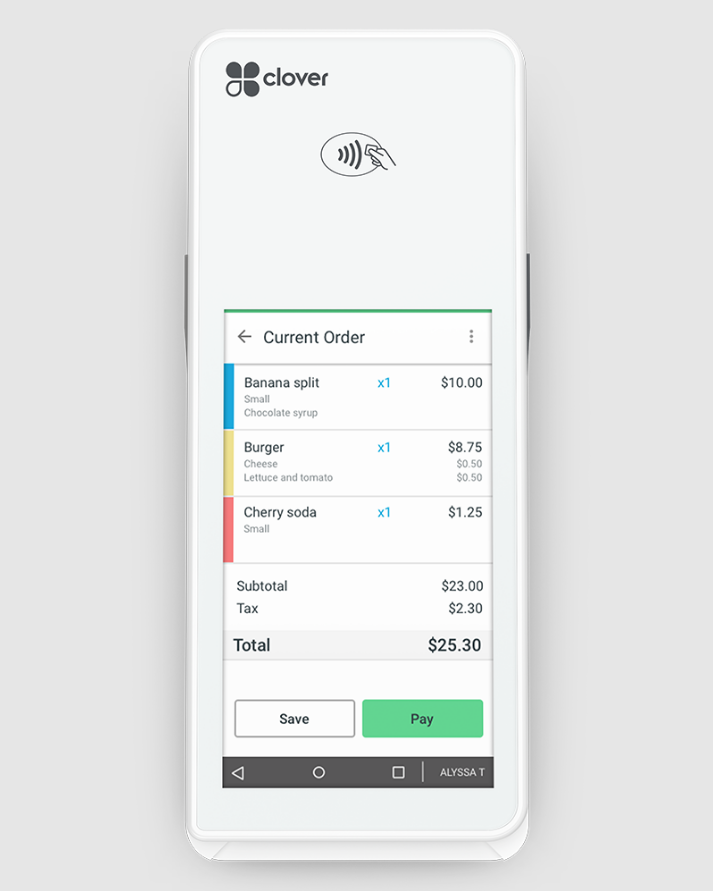

Why I chose Clover Flex

Clover Flex checks most of the boxes to earn it the title of the best POS hardware around. To start, it’s a handheld device with a nearly 6-inch touchscreen that’s easy to use. It includes a built-in receipt printer, or you can deliver a digital receipt if customers prefer. There’s also a barcode scanner to make it easy for retailers to tally up purchases. The battery life averages eight hours, which is standard for most mobile POS systems. I like that you can use it anywhere to take orders, ring up sales, and take payments.

The Clover Flex is durable, but you may want to add Clover Care, an extended protection plan, to replace any broken devices as needed. It’s a three-year warranty, so it’s conveniently within the same window of your 36-month plan. Take note that you can only replace up to three devices during the term.

In several user reviews, ease of use is the highest praise for Clover Flex. The device is intuitive and requires little training, which is good because many users also mention Clover’s support as less helpful than they’d like. Though if you need help learning how to use a POS system, there are guides that can teach you the basics.

Square Register

Overall Score

4.61/5

Hardware features

5/5

Payment processing

4.38/5

Pricing

3.75/5

Other features

5/5

User experience

4.92/5

Pros

- Sleekly designed register for countertops

- Easy-to-use touchscreens on both displays

- One-time fee or installment plan for purchasing hardware

- Includes free POS software

- Competitive flat-rate payment processing

Cons

- Requires you to use Square as your processor

- Expensive hardware with no built-in extras

- Not a portable POS

Why I chose Square Register

Square is well known for its POS software, specifically its free POS plan. Square is also a popular choice among retailers for its hardware because it’s easy to use, but there are more reasons why we chose Square as the best retail POS system. I’ve always been a fan of Square for that same reason; I’ve used it as a merchant and customer and I like how simple it is to use the components and the software. Though I’m more familiar with its small square card reader, I can see why it’s often named the best mobile POS system.

The Square Register is especially useful for brick-and-mortar stores that intend to have a stationary register. The standard setup is sleek, with a display for you and one for customers. Both are touchscreens connected by a 3-foot cable, which allows you to extend the customer display farther away from the register, should you choose to do so. The register display is a decent size at 12.5 inches by 10 inches, while the customer display is smaller at 6.85 inches by 6.85 inches.

Square offers a two-year limited warranty, which is nice for peace of mind. For two years, you’re protected from defective hardware, so you can get a replacement at no extra cost. It would’ve been nice if Square offered more built-in hardware accessories, but I like that you can add third-party components.

Toast Go 2

Overall Score

4.3/5

Hardware features

4.58/5

Payment processing

4.38/5

Pricing

3/5

Other features

4.69/5

User experience

4.85/5

Pros

- Designed to be drop-proof and water, dust resistant

- Offers pay-as-you-go plan with zero upfront cost

- Optional restaurant-related accessories available

- Lightweight handheld terminal

- Up to 24-hour battery life

Cons

- Expensive upfront investment

- Higher payment processing rates

- Must use Toast payment processing

Why I picked Vendor

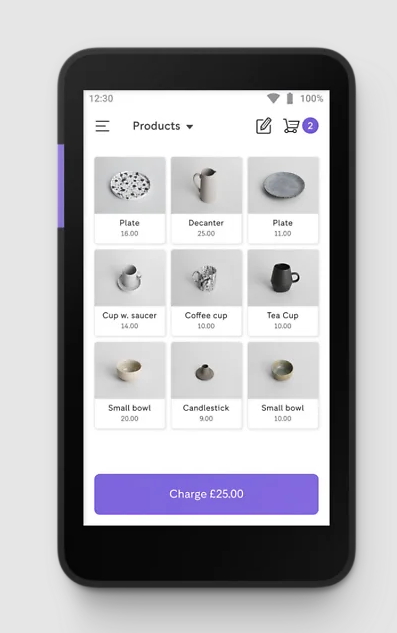

Zettle Terminal

Overall Score

4.2/5

Hardware features

4.86/5

Payment processing

4.38/5

Pricing

4/5

Other features

3.44/5

User experience

4.35/5

Pros

- Accepts alternative payments (PayPal, Venmo)

- Affordable hardware costs

- Competitive transaction fees

- Optional terminal with built-in barcode scanner

- Hardware peripherals available

Cons

- Requires you use PayPal payment processing

- No third-party barcode scanners compatible

- High transaction fees for alternative payments

Why I chose Zettle Terminal

PayPal’s Zettle Terminal is an example of how you can set yourself apart from the competition, and in Zettle’s case, it accepts payments most other POS hardware and payment processors don’t. Your customers can pay via credit or debit card, Apple Pay or Google Pay, or they can pay using their PayPal or Venmo accounts. I can’t tell you how many times I wish I could use alternative payments; if it were more common, I might leave funds in my PayPal and Venmo accounts.

The alternative payment option isn’t the only reason the Zettle Terminal makes this list of the best POS hardware. The handheld POS hardware is one of the lightest devices on the market, at less than one pound. It’s easy to use and can fit in a pocket. Its battery life isn’t as long-lasting as the Toast Go 2, but at 12 hours, it’s longer than the Clover Flex.

You can choose the standard POS Zettle Terminal, which includes POS software and payment processing, or you can opt for the model with a built-in barcode scanner. There’s a one-year limited warranty that protects against defects, which is standard for the industry.

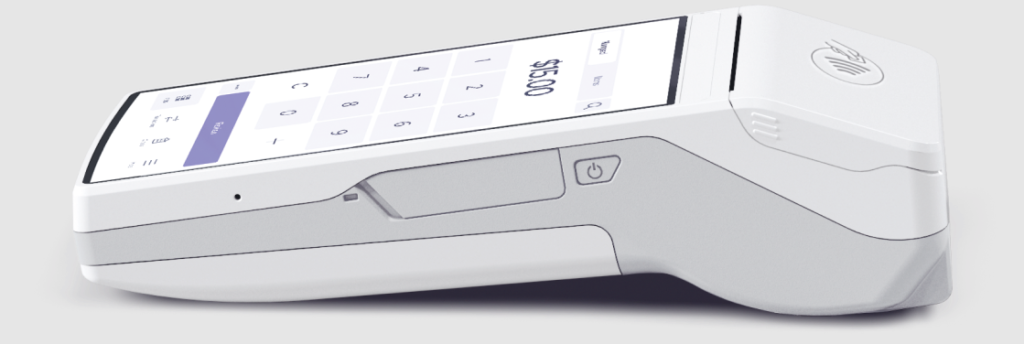

Helcim Terminal

Overall Score

4.16/5

Hardware features

4.86/5

Payment processing

4.06/5

Pricing

4/5

Other features

3.13/5

User experience

4.73/5

Pros

- Interchange-plus pricing structure

- Portable POS with printer

- Affordable device

- Option to pay upfront or in installments

Cons

- Better for established businesses

- No barcode scanner add-on

- Requires Helcim payment processing

Why I chose Helcim Terminal

Though there are several POS hardware options on the market, Helcim makes the cut on this list because it’s one of the few portable POS systems that’s a nearly complete all-in-one solution. In my opinion, the pros outweigh the cons over some other contenders we considered for this lineup of the best POS software. Namely, Helcim lets you accept most payments and print receipts all from a portable device; it even includes two rolls of printer paper. It isn’t the only all-in-one option available (the Clover Flex does all that and more), but it’s also affordable.

Helcim’s POS software includes features to help with inventory management and payment processing is built into the system. Its battery isn’t the longest life we’ve seen, but it is standard at eight hours even if you’re using the built-in printer. Charge time is about four hours to get the battery to full. Along with a WiFi connection, transaction speeds are fairly fast.

Key Components and Features of POS Hardware

There are many types of POS hardware you should consider adding to your POS system stack such as barcode scanners, kitchen display systems (KDS), receipt printers, and cash drawers. Most of these hardware components would be essentially useless without the core piece of any POS system: the terminal. It’s the terminal that includes key features that allow you to accept payments and track sales.

Here’s what you can usually do with POS terminals:

Accept payments: All POS hardware should be equipped to handle payments, whether by cash, card, or contactless payments. Some POS terminals have a built-in credit card reader, while others may require you to add one such as in the case of those who want to use tablets or mobile phones as their POS system.

Record sales: As you ring up sales, it’s important to keep track of those sales, along with returns, so you can calculate your profits and losses. Your POS terminal should have a place that records all transactions for the day.

Print receipts: Many POS terminals may include a built-in receipt printer or you can deliver a receipt digitally such as with Square Terminal, which offers both options. Receipts are vital for most businesses so customers can track their own spending or return an item.

Manage inventory: Not all POS hardware includes inventory management as a feature. This feature may be included in your POS software. Alternatively, you may need to invest in inventory management software separately and have it integrated into your POS system.

Run reports: Whether it’s sales reports, a P&L report, or even timesheets, POS hardware that includes a feature to generate reports is helpful. This may be part of your POS software, but some hardware offers reporting in its system.

Choosing the Right POS Hardware for Your Business

There are several POS hardware options that may work for your business, but to choose the best POS hardware, you should take many factors into consideration. The type of your business, connectivity needs, integration options, payments you want to take, and the durability of the POS hardware you choose are some of the factors.

Consider these needs before you sign a contract or shell out hundreds of dollars for your POS hardware:

Type of business

A mom-and-pop shop can get away with a simple POS system, but a busy restaurant is likely to need more technology to keep up with demand. Consider your sales volume and the type of device you want to use to accept payments. An iPad can work as a terminal if you plan to keep it at a counter, but if you’re mobile and dealing with slippery situations, you want a device that’s more durable.

Warranty

Clumsiness happens, so it’s important to consider the warranty of POS hardware. Dropping a tablet could mean expensive replacements. Even the most durable devices may break or have a glitch, which is why quality and length of warranty matter.

Connectivity

If you have reliable WiFi, most modern POS hardware should work well for you. Bluetooth could be a better option if you have a mobile business and need to rely on your cellular network. The more antiquated method of tethering requires you to be stationary, so it’s a better option for retail stores.

Payments accepted

You should expect all POS hardware to include the ability to accept payments by credit and debit cards. The best POS hardware also allows you to accept contactless payments such as by Apple Pay or Google Pay. There are a few that allow you to accept payment from popular cash apps, including Venmo and PayPal. Consider your customers and how they prefer to pay.

Payment processor

Many POS hardware companies include their own payment processing, which is part of the reason you may find free or cheap POS hardware available (they’ll make money on transaction costs). However, there are some that allow you to choose your own payment processor, which is great when you already have a good rate with a merchant services provider.

Contract type

To get hardware for your POS system, you may need to sign a contract either to lease the equipment or for your payment processor. Consider the terms carefully because some require you to sign up for at least a year, while others may only require month-to-month commitments.

Reliability

The POS system you choose is only as good as its reliability. Look for POS hardware companies that ensure good uptime for your payment processing. Keep in mind this isn’t just about the system; your internet provider may be at fault if you have disruptions.

Pricing

Though cost is always a factor for small business software, it isn’t the most important factor. There’s usually a balance you can strike depending on whether you use an all-in-one POS hardware, software, and payment processing system where you pay little to nothing for your equipment. Or pay more for equipment and use a payment processor that offers a better rate.

Training

Going from a pen-and-paper method to a complex system may require a bit of downtime for training. Consider what you and your team will need to adapt to new POS hardware and choose something that’s easy to learn and use or offers thorough training on the equipment and software.