A merchant service provider is vital for facilitating seamless payment transactions for businesses. Choosing the best merchant services is crucial for mid- to large-sized businesses looking to optimize their payment processing efficiency and business operations.

In this article, I evaluate the top free merchant account providers based on their affordability, scalability and performance, support and service, security and compliance, and ease of use and integrations. All of my picks have no minimum monthly fees and offer competitive rates.

Based on my evaluation, the best merchant services for 2024 are:

SPONSORED

Software Spotlight: PaymentCloud

Flexible payment processing for any business

- 98% of applications are approved for a merchant account

- Wide range of payment options – including no-cost (surcharging)

- Month-to-month contract

- No setup, application, or annual fees

Visit PaymentCloud

Best merchant services comparison

Providers

Our score (out of 5)

Processing fee structure

Quick integrations

Customer Support

Helcim

4.48

- Interchange-plus

- Surcharging

- Automatic volume discounts

Limited

Monday – Friday: 7am – 5pm MT

Saturdays: 9am – 5pm MT

Braintree

4.33

- Flat rate

- Interchange-plus (custom for large-volume businesses)

Extensive

24/7

Payment Depot

4.22

- Interchange-plus (custom add-on rate)

- Surcharging

Good

24/7

Square

4.13

- Flat rate

Good

Monday – Friday: 6am – 6pm PST

Stripe

4.09

- Flat rate

- Interchange-plus (custom for large-volume businesses)

Extensive

24/7

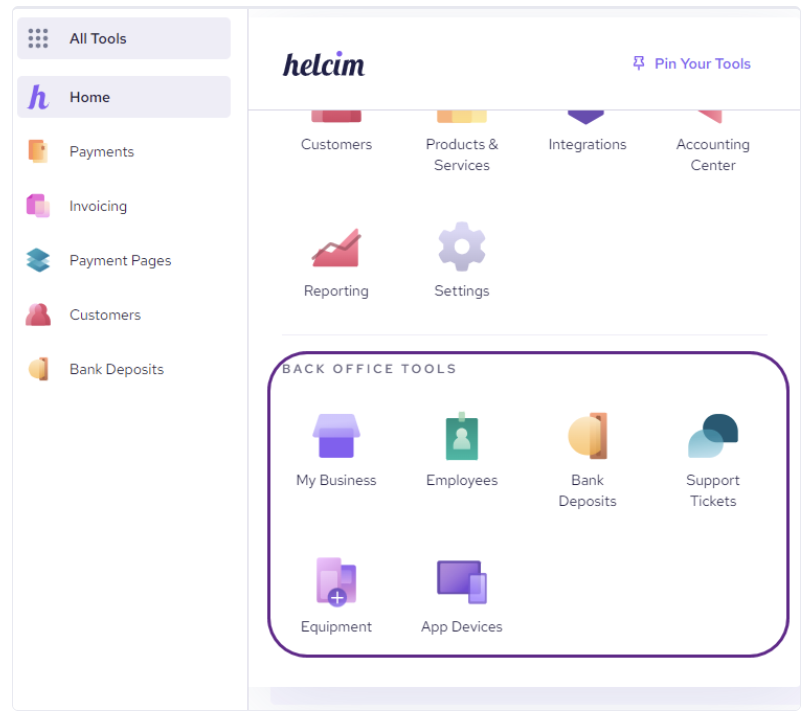

Helcim: Best overall merchant service

Overall Reviewer Score

4.48/5

Affordability

5.31/5

Scalability and Performance

4.25/5

Support and Service

3.75/5

Security and Compliance

5/5

Ease of Use and Integrations

4.08/5

Pros

- Interchange-plus pricing

- Automatic volume discounts

- Instant approval and quick set-up

Cons

- Limited integrations

- Limited customer support hours

- Limited hardware options

Why I chose Helcim

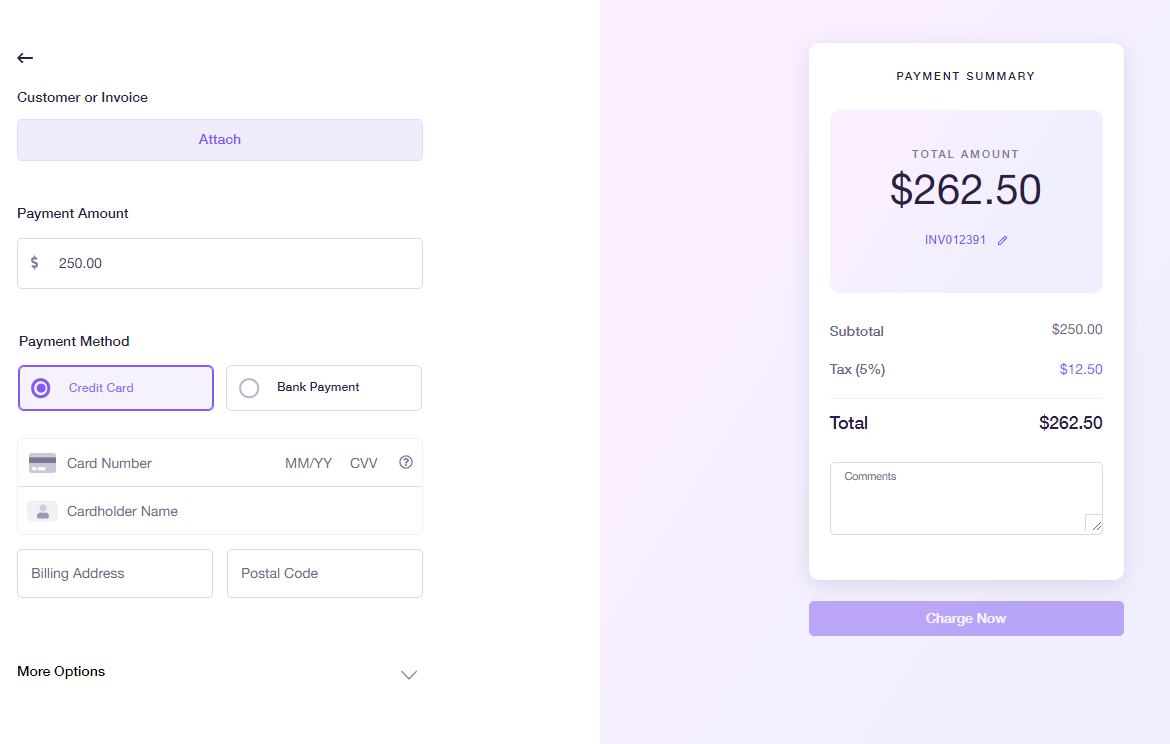

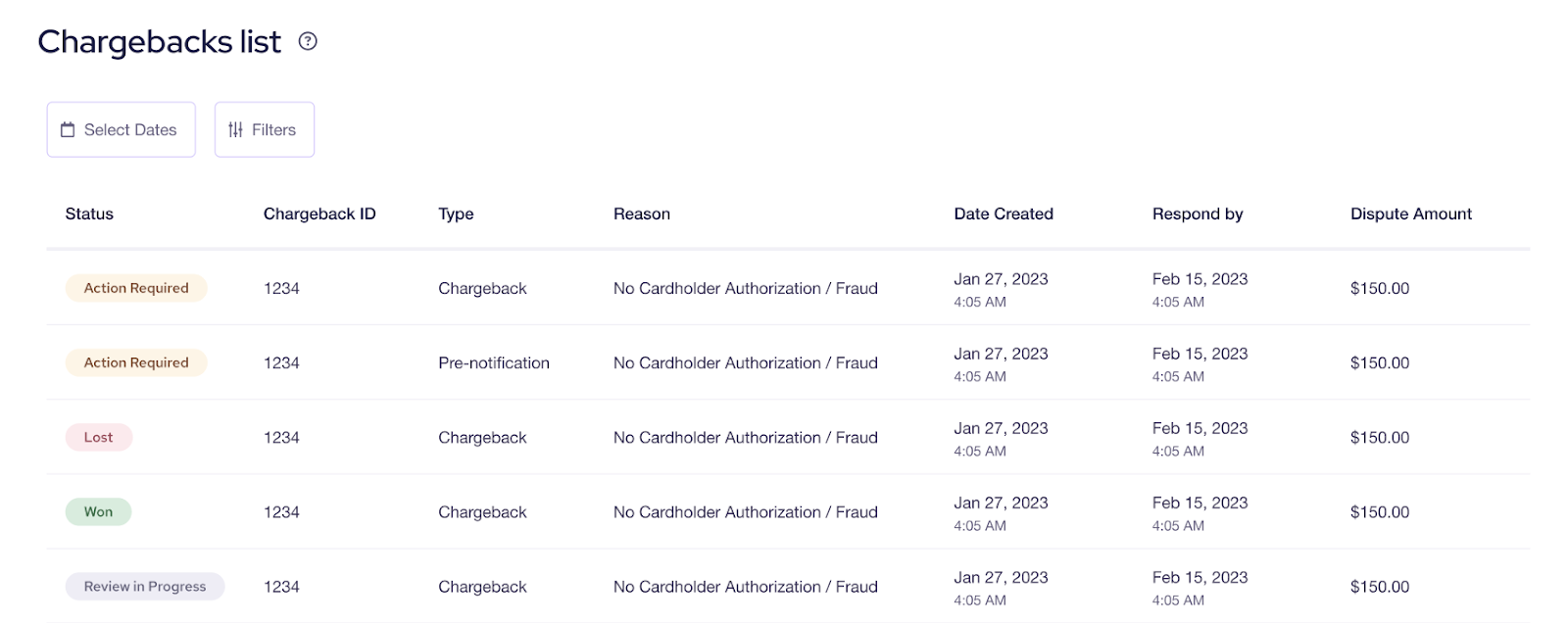

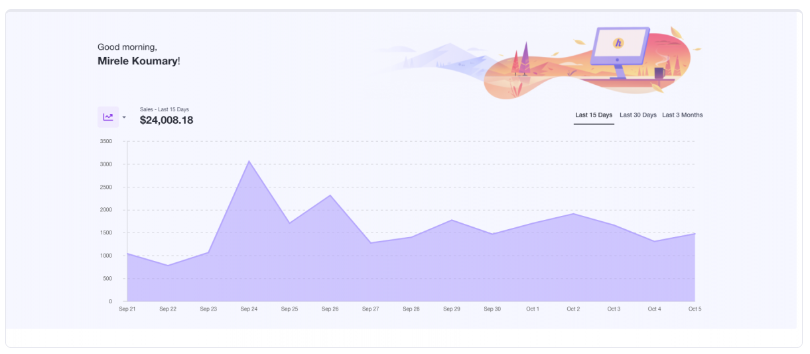

Helcim emerged as the overall best merchant service due to its exceptional affordability, comprehensive security measures, and robust international transaction capabilities. It is the only provider in this guide that has automatic volume discounts and one of two providers that offer both surcharging and interchange-plus pricing.

Its pricing structure ensures businesses can scale without worrying about escalating fees, and companies that want to scale globally can do so without any add-on processing fees. Aside from these, Helcim’s robust security features, such as fraud protection tools and end-to-end data encryption, provide a high level of trust and reliability.

Despite some limitations in hardware options and customer support availability, Helcim’s overall performance in key areas such as scalability, performance, and security makes it the top choice for mid-market to large enterprises looking for a cost-effective, secure, and versatile free merchant account provider.

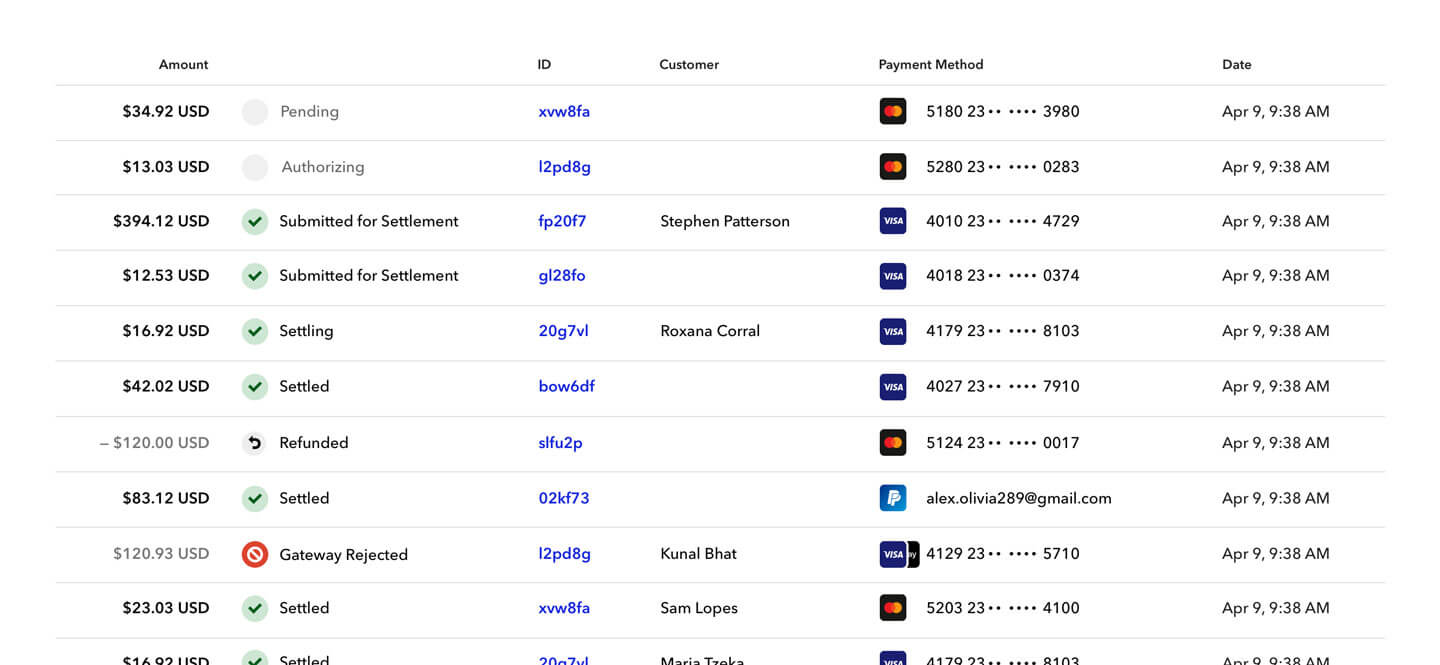

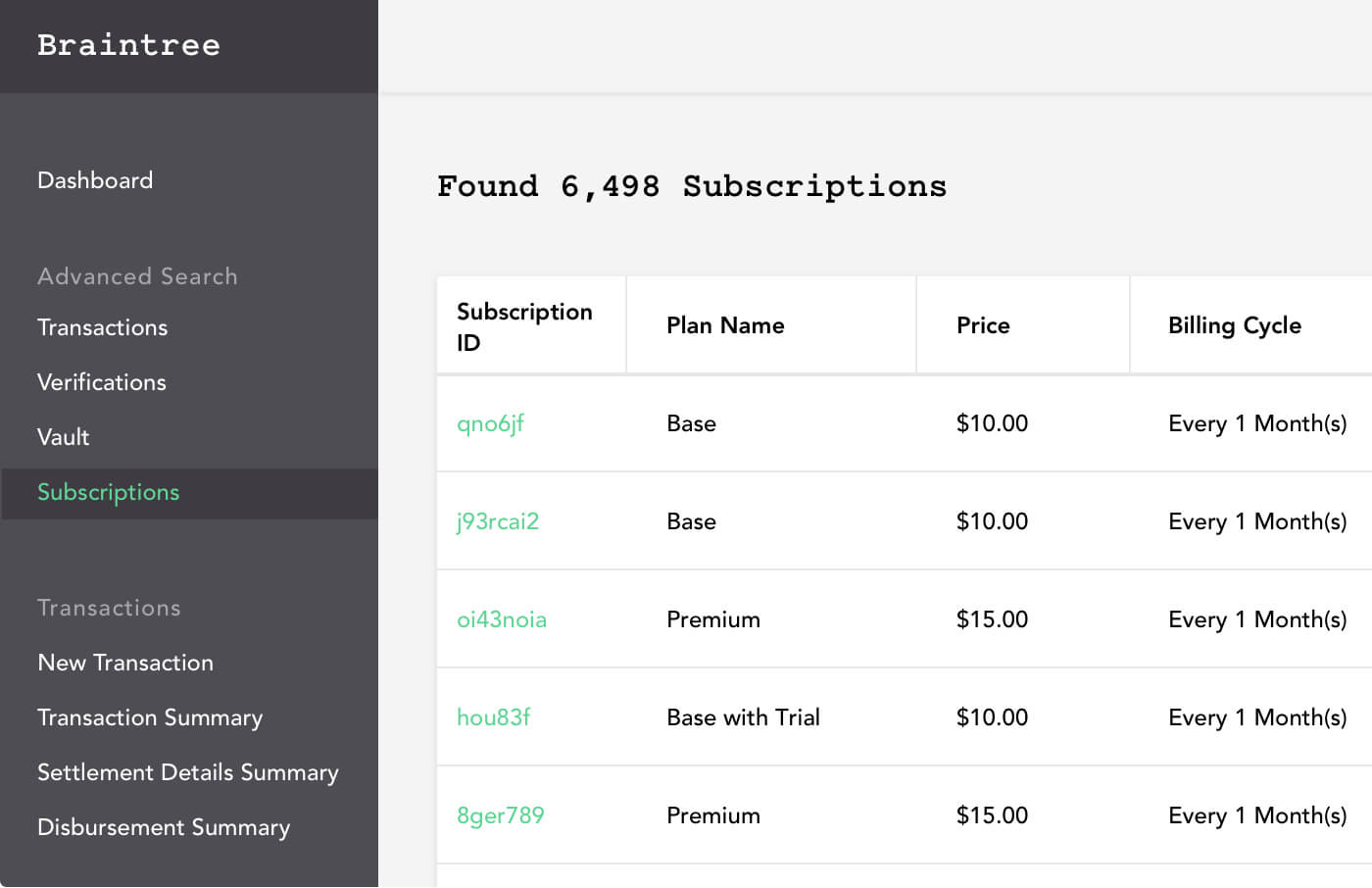

Braintree: Best for white-glove support

Overall Reviewer Score

4.33/5

Affordability

4.06/5

Scalability and Performance

3.50/5

Support and Service

4.58/5

Security and Compliance

5/5

Ease of Use and Integrations

4.5/5

Pros

- White-glove support and PayPal brand recognition

- Extensive integrations

- Custom interchange plus pricing for high-volume merchants

- Sandbox environment for testing

Cons

- Limited hardware options

- In-person capabilities may require API/SDK integrations

- No native invoicing tool

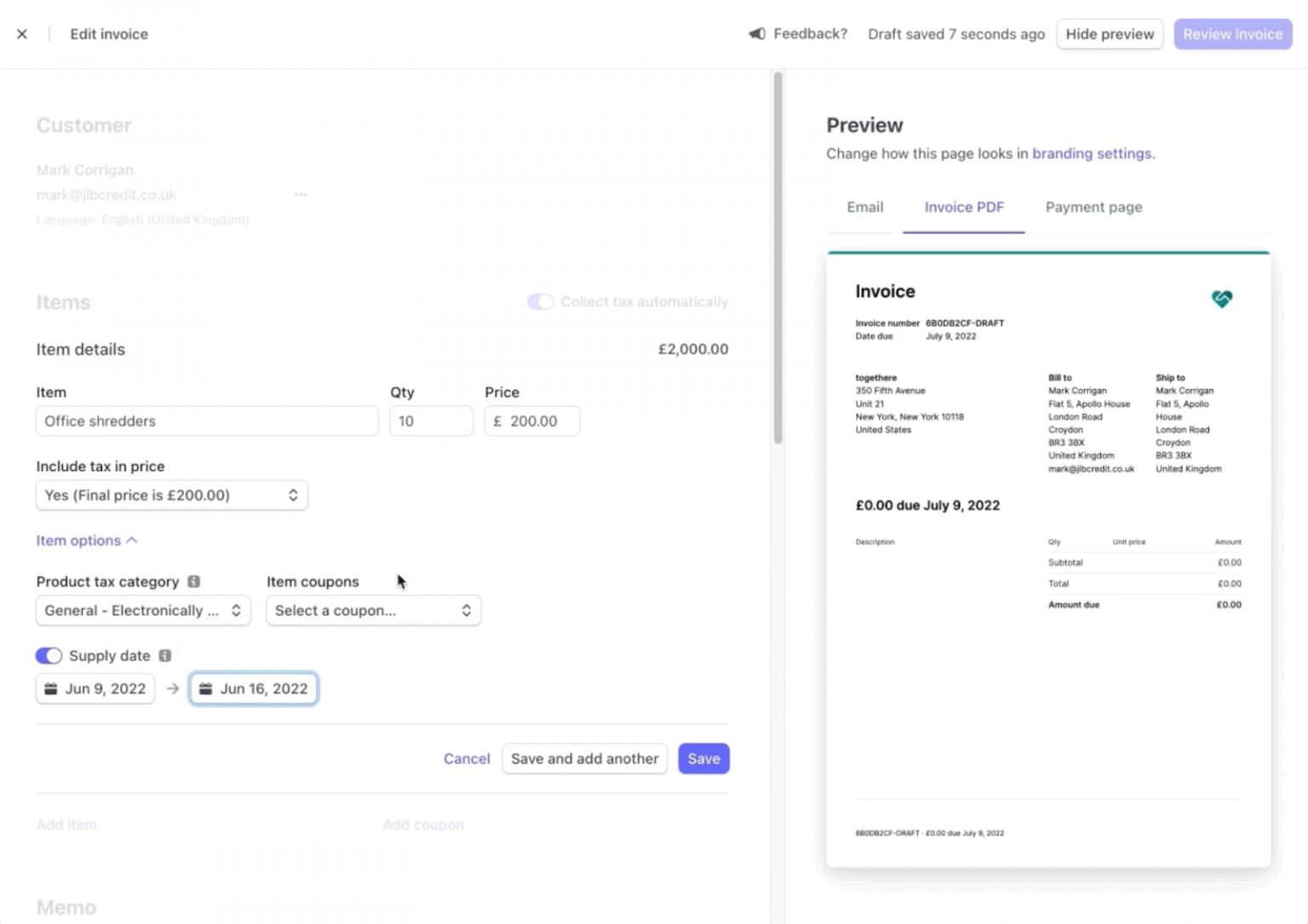

Why I chose Braintree

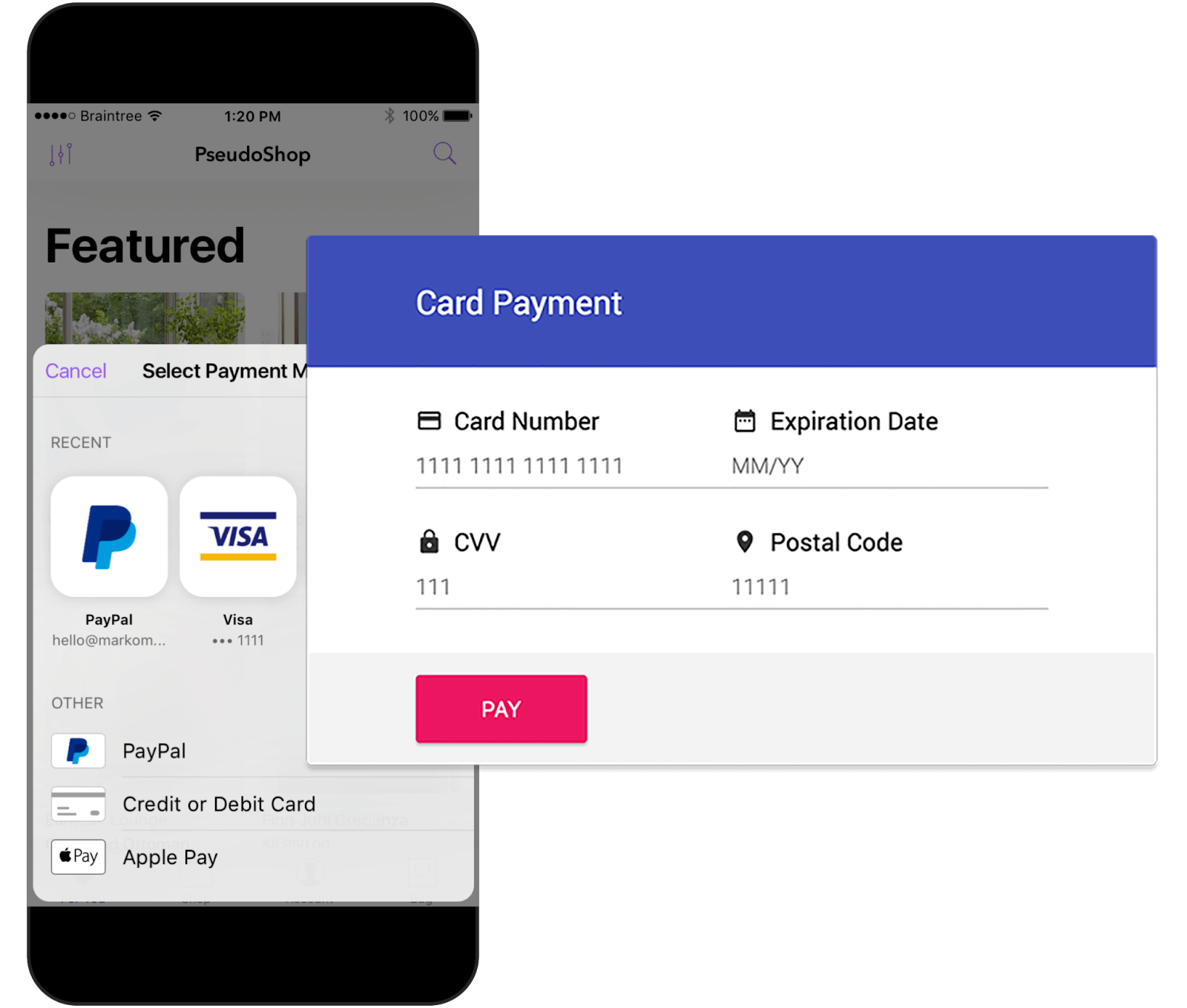

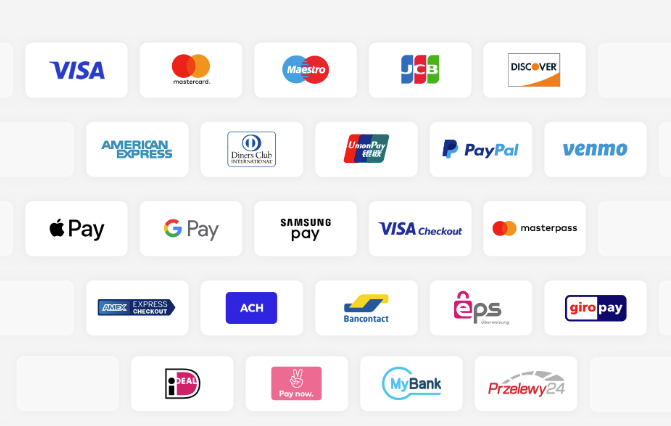

Braintree stood out as a top contender for best merchant account providers due to its white-glove support, extensive integration capabilities, and tailored pricing for high-volume merchants. One major advantage of Braintree is that it is a PayPal company, so you get the easy recognition and the extra perk of being able to accept PayPal and Venmo payments.

However, if your business does a lot of heavy in-person payment processing, using Braintree will require API/SDK integrations. This inconvenience of not having an out-of-the-box in-person payment solution is eased by its white-glove support from start to finish. The platform also provides a sandbox environment for testing, which allows businesses to thoroughly evaluate and fine-tune their payment processes before going live.

The platform’s extensive integrations mitigate the lack of a native invoicing tool, enabling seamless connections with other business systems. Braintree’s high-touch support, affordability, scalability, and integration capabilities make it a reliable choice for mid to large-sized businesses.

Payment Depot: Best for custom pricing

Overall Reviewer Score

4.22/5

Affordability

4.38/5

Scalability and Performance

4/5

Support and Service

3.75/5

Security and Compliance

5/5

Ease of Use and Integrations

3.96/5

Pros

- Custom interchange-plus pricing

- Surcharging program

- 24/7 customer support

Cons

- No instant or same-day setup

- Limited online support resources

- Only for businesses in the US

Why I chose Payment Depot

Payment Depot earns its place in this list of the best merchant services due to its custom interchange-plus pricing and surcharging program. Its 24/7 customer support and hardware options make it an excellent option for businesses that need both in-person and online payment processing solutions.

However, Payment Depot’s setup process is not instant or same-day, which may be a drawback for businesses needing quick implementation. Additionally, its online support resources are somewhat limited, and it is only available for businesses in the US. Despite these limitations, Payment Depot’s cost-effective pricing structure and reliable support make it an excellent choice for US-based businesses seeking a transparent and supportive merchant account provider.

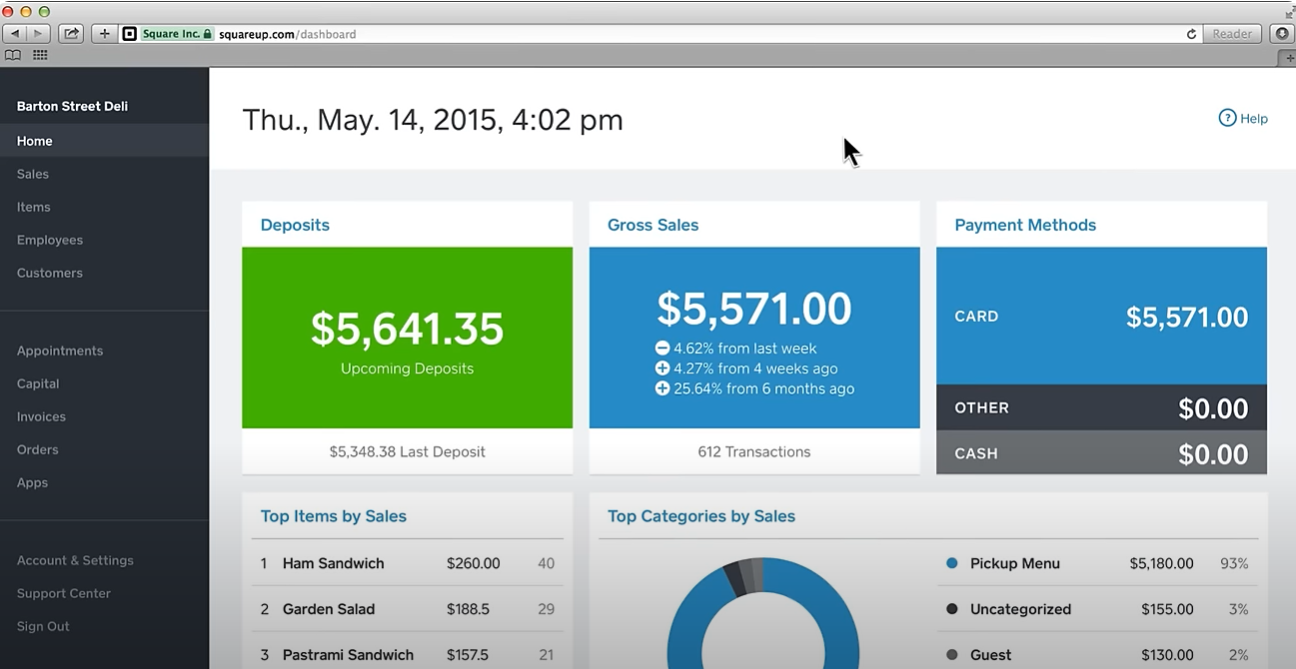

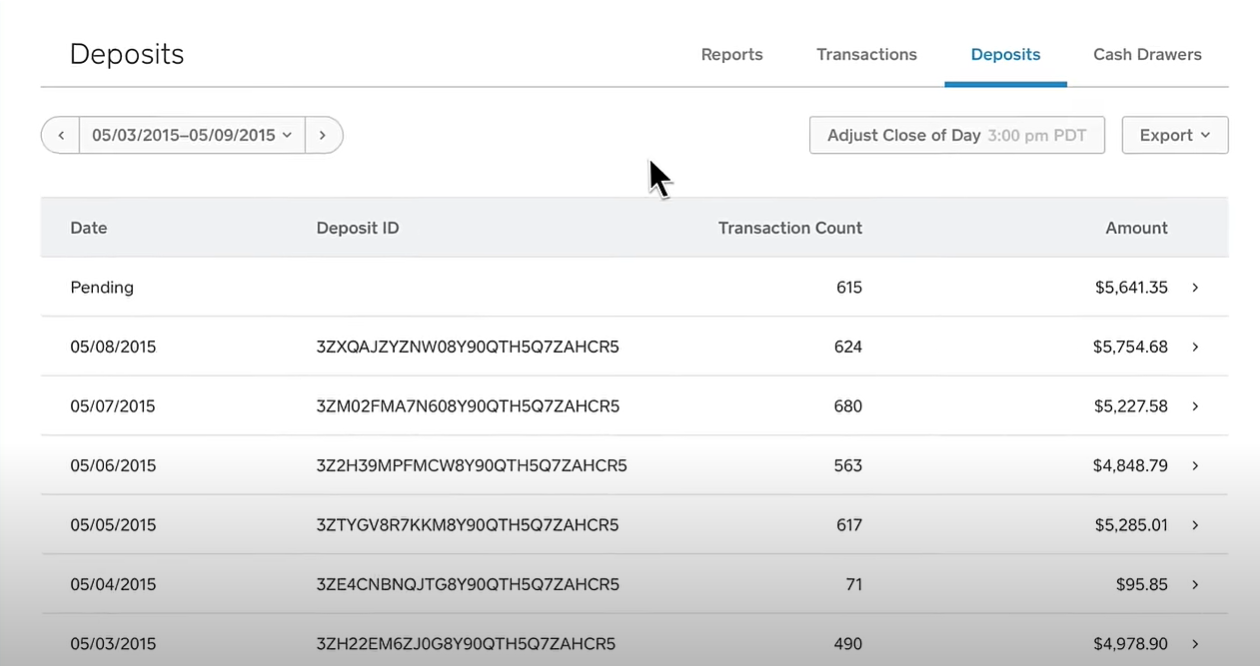

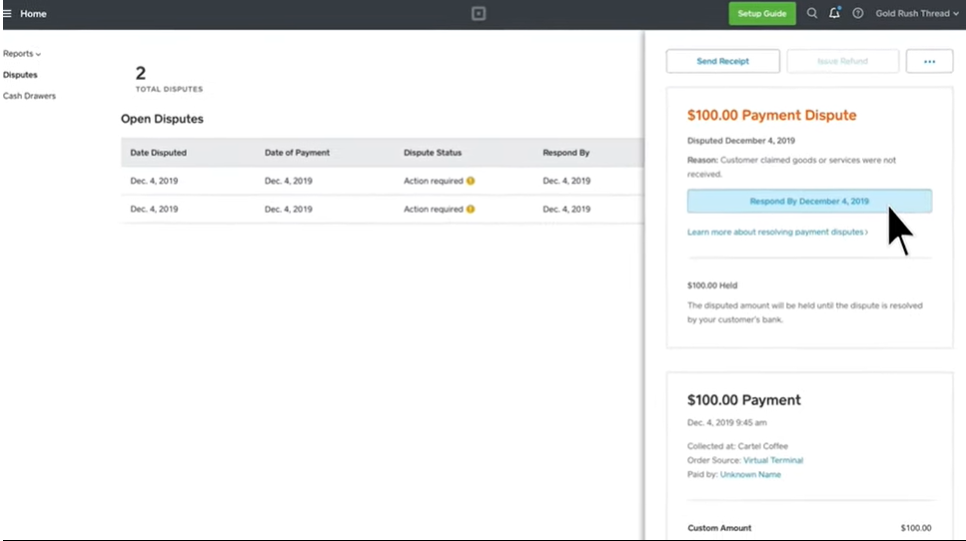

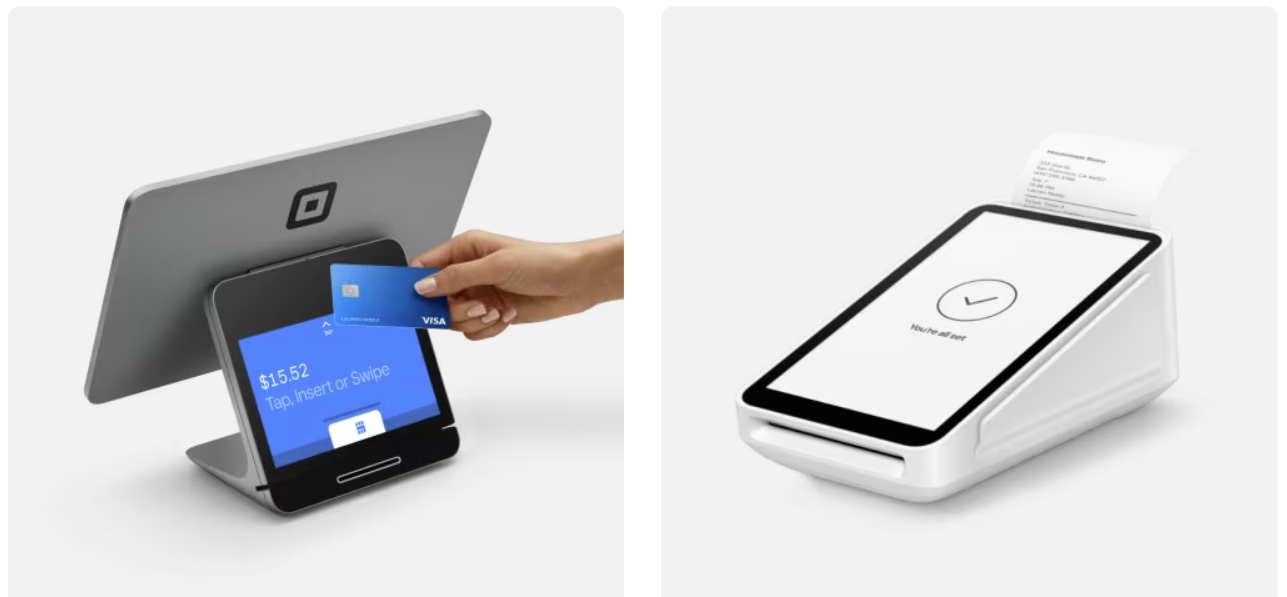

Square: Best out-of-the-box solution

Overall Reviewer Score

4.13/5

Affordability

2.50/5

Scalability and Performance

4.75/5

Support and Service

3.75/5

Security and Compliance

5/5

Ease of Use and Integrations

4.67/5

Pros

- Seamless omnichannel payment solutions

- User-friendly intuitive interface

- Offers a full POS system

- Custom rates for businesses processing over $250,000 monthly

Cons

- Limited customer support hours

- Has a processing limit for the free plan

- Flat-rate fees only

Why I chose Square

Square stood out for its seamless omnichannel payment solutions, offering an integrated system that works effortlessly across in-store, online, and mobile platforms. This comprehensive ecosystem allows businesses to manage all payment processes in one place, enhancing efficiency and customer experience. Additionally, Square’s out-of-the-box solution and user-friendly interface ensure that both tech-savvy and less experienced users can navigate the system with ease.

Although it has limitations like flat-rate fees, which are very expensive for large-volume transactions, and restricted customer support hours, Square’s robust POS system and intuitive design make it an excellent choice for businesses seeking versatile and reliable payment solutions.

Related:

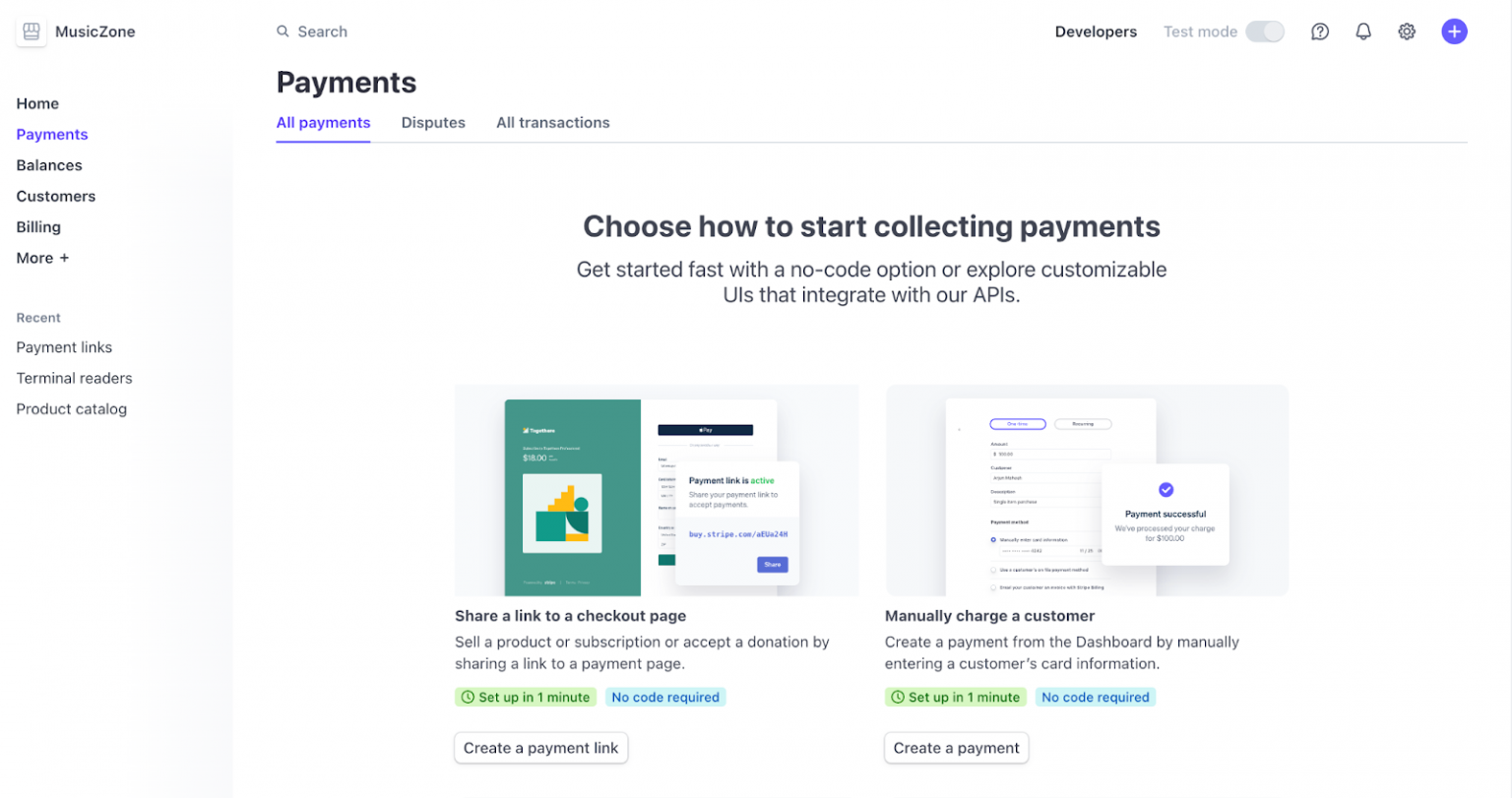

Stripe: Best for custom solutions

Overall Reviewer Score

4.095/5

Affordability

3.75/5

Scalability and Performance

3.75/5

Support and Service

4.17/5

Security and Compliance

4.17/5

Ease of Use and Integrations

4.64/5

Pros

- Robust developer tools and powerful APIs

- Quick instant set-up

- 24/7 support

Cons

- Requires integration for in-person payment processing

- Additional fee for fraud protection tools

- Account freezes

Why I chose Stripe

Stripe stands out as the best option for custom payment solutions due to its robust developer tools and powerful APIs. These tools allow businesses to create highly tailored payment processing systems, fitting unique needs and workflows seamlessly. The platform’s quick, instant setup ensures that businesses can start accepting payments with minimal delay, while its 24/7 support provides continuous assistance.

However, Stripe requires integration for in-person payments, which might not suit every business. Additional fees for fraud protection tools and potential account freezes are considerations to remember. Despite these drawbacks, Stripe’s flexibility and powerful customization capabilities make it an excellent choice for businesses seeking a custom payment processing solution tailored to their specific needs.

Benefits of merchant services

Merchant services provide businesses with tools to process payments efficiently and securely. These services enhance operational capabilities, boost customer satisfaction, and support business growth. Here are some key benefits:

- Accept various payment methods, including credit and debit cards.

- Enhance customer convenience and satisfaction.

- Secure transaction processing to reduce fraud risk.

- Detailed transaction reporting for better financial management.

- Tools for invoicing, recurring billing, and customer management.

- Streamline business operations and improve cash flow.

- Support business growth and scalability.

How to choose the best merchant account provider

Selecting the best merchant account provider for your business involves careful consideration of several factors to ensure the provider meets your specific needs. Here are some key steps to guide you in making the right choice:

- Identify your business needs: Determine what features and services are essential for your business, such as in-person payments, online transactions, recurring billing, or mobile payment options.

- Compare pricing structures: Evaluate the cost-effectiveness of different providers by comparing processing fees, setup fees, monthly fees, and any hidden charges. Look for providers with transparent pricing models, such as interchange-plus pricing.

- Check for scalability: Ensure the provider can support your business as it grows, with the ability to handle increased transaction volumes and offer advanced features.

- Evaluate security and compliance: Prioritize providers that offer robust security measures, including PCI compliance, end-to-end encryption, and fraud protection tools to safeguard your transactions.

- Assess customer support: Consider the quality and availability of customer support. Look for providers that offer 24/7 support, dedicated account managers, and comprehensive onboarding assistance.

- Examine integration capabilities: Ensure the provider can seamlessly integrate with your existing business systems, such as POS systems, accounting software, and e-commerce platforms.

- Read user reviews: Look for feedback from other businesses similar to yours to gauge real-world performance and customer satisfaction.

Which is the best merchant service provider?

The best merchant service provider depends on specific business needs, such as transaction volume, required features, and payment methods. However, in our evaluation, Helcim stands out as the best overall due to its comprehensive affordability, robust security, and scalability. With automatic volume discounts, both surcharging and interchange-plus pricing, and extensive fraud protection tools, Helcim offers a versatile and cost-effective solution. Despite some limitations in hardware options and customer support hours, Helcim’s exceptional performance in key areas makes it ideal for businesses of all sizes, from small businesses to mid-market and large enterprises.