Key takeaways

Stripe is the leading brand for customized online payment platforms, making it popular with software developers. PayPal is a pioneer of easy-to-use online payment apps with a huge consumer base.

Stripe vs PayPal is a common topic of debate among online business owners, developers, and entrepreneurs regarding which one offers the best online checkout. The key difference between the two is Stripe offers nearly unlimited scalability with its customization tools. PayPal, while also customizable, is best known for its simple and easy-to-use platform.

For tech-savvy online business, choose Stripe.

If your business needs fast setup, then PayPal is your best option.

Stripe: Best for growing businesses

Our rating

4.46/5

Pricing

4.25/5

Hardware

4/5

Payment Software

4.79/5

Support and Reliability

4.58/5

User Experience

4.69/5

User Scores

4.43/5

Pros

- Free merchant account

- Accepts cross-border payments

- Hundreds of integrations

- Advanced checkout customization tools

- High-level security features

Cons

- Limited virtual terminal functionality

- Advanced customization requires coding skills

- Add-on fees on invoicing and recurring payments

PayPal: Best for startups and freelancers

Our rating

4.21/5

Pricing

4.25/5

Hardware

4.25/5

Payment Software

4.17/5

Support and Reliability

3.33/5

User Experience

4.69/5

User Scores

4.60/5

Pros

- Free merchant account

- Can be used as additional payment method

- Integrates with most e-commerce platforms

- Widely trusted by consumers

- Fast access to funds via PayPal Balance

Cons

- Complicated pricing scheme

- Charges for access to virtual terminal

- Issues with frozen funds

How are Stripe and PayPal different?

Software type

Payments

Payments and POS

Fee structure

Flat rate

Flat rate

Customizations

Advanced, developer-based

Limited, no coding required

Enterprise solutions

Available

Available

POS integration

Custom software/app development

Server-driven integration

Integrates w/ some POS systems

Proprietary POS

Bank funding speed

2 business days, first deposit takes up to 14 days

3 business days

(Instant access to funds in PayPal balance)

On paper, Stripe and PayPal seem to be quite similar. However, a closer look shows how each provider is uniquely positioned to cater to slightly different business types.

Here are some of the key differences:

Ease of use

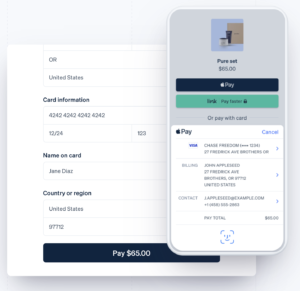

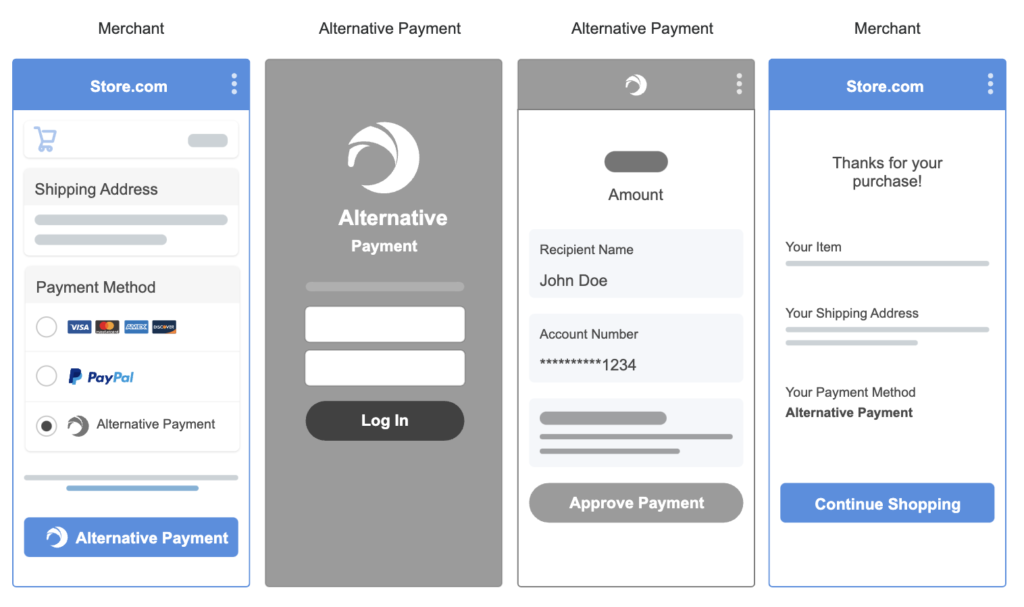

If we compare how easy it is to process transactions using Stripe vs PayPal, both are fast and efficient. For customers, both have a very streamlined checkout process; no unnecessary redirects or multiple logins required. Both Stripe and PayPal also have fast checkout services: Link (for Stripe) and Fast Lane (for PayPal).

The biggest difference between the two is on the business end, especially when it comes to setting up your account and online checkouts.

Signing up for a Stripe or PayPal merchant account is fast and easy. It takes only minutes and requires no approval process. Once you have accessed your account, provided all the necessary business information, and customized the settings, you’re ready to go.

However, as you start configuring your payment solutions, you will notice how PayPal has a clear edge over Stripe in terms of ease of use. While Stripe does offer simple checkout and payment link setup, everything else will likely require some level of coding. This can easily overwhelm new users, even with Stripe’s extensive support documentation.

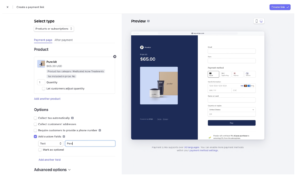

Customization options

Stripe’s strongest suit is its customization features that offer near-endless possibilities for growing a business from the ground up. The system offers both no-code and developer customizations to fit the needs of all business sizes. These customizations also extend to fraud monitoring, payment security, and chargeback management tools.

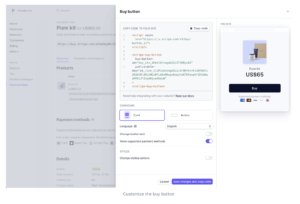

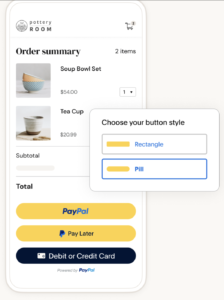

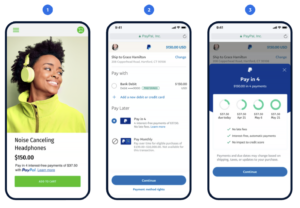

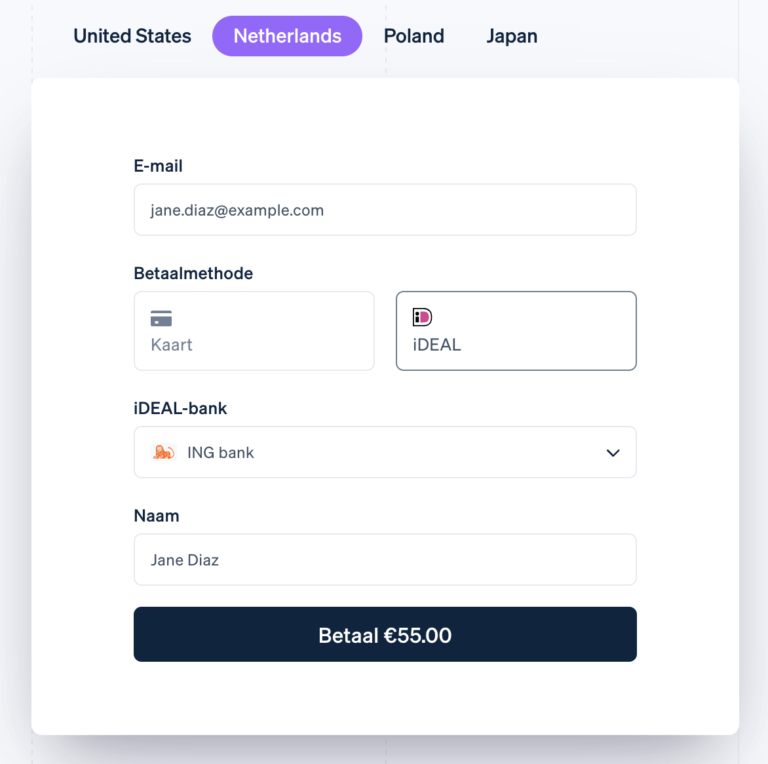

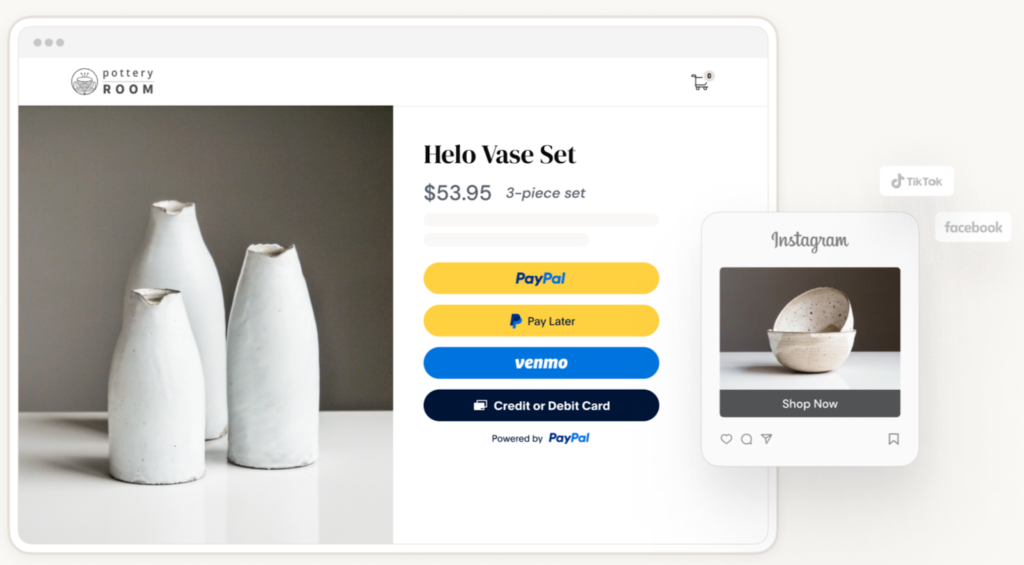

PayPal also has its own set of simple and developer-centric customizations. Although PayPal’s functionalities are not as feature-rich as Stripe’s, PayPal has the advantage of having its own set of checkout services. The PayPal checkout, with the PayPal branding, is trusted by most online consumers. It is accessible to all business sizes and can be customized to include alternative payment methods.

Compatibility with existing systems

Both Stripe and PayPal are easy to integrate with any e-commerce website. Stripe, in fact, is used widely by popular platforms, including Shopify. On the other hand, PayPal can be used as a primary payment processor or as an additional payment method.

For online businesses looking to expand, POS integrations are an important factor to consider. Stripe and PayPal differ significantly in this. PayPal has a free mobile POS app (PayPal Zettle) and also offers ready integration with a number of POS software, such as Hike and Clover. Stripe, meanwhile, requires coding to integrate with POS software or creating a custom app to work with POS hardware.

Read more: Best POS hardware

Security & stability

Stripe is arguably the most reliable of the two, particularly in terms of security. It offers advanced risk management, including machine learning fraud management filters and a chargeback management dashboard. PayPal also provides users with risk control settings, but not as advanced as Stripe’s.

As for account stability, both Stripe and PayPal provide aggregate merchant accounts. This means there is only one merchant ID for thousands of businesses using Stripe and PayPal’s services. While this makes for faster set-up and simpler fees, it makes businesses more susceptible to withheld funds and delayed deposits. PayPal minimizes the issue of fund access better than Stripe, but Stripe does not encounter numerous user complaints about frozen accounts and funds on hold.

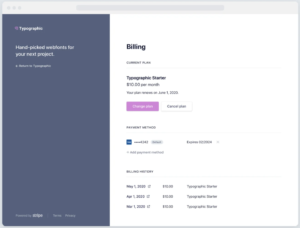

Funding option

Stripe deposits funds into your bank account in 2 business days, while PayPal takes an average of 3 business days. However, note that the first deposit with Stripe goes through additional validation processes, which can take up to 14 days.

Both Stripe and PayPal offer same-day funding for a 1.5% fee. However, only PayPal provides instant access to funds through the PayPal balance. The PayPal balance can be used to pay for online purchases like a digital wallet and withdrawn in ATMs if you have a PayPal debit card.

Stripe vs PayPal: Pricing

Monthly account fee

$0–$10

$0–$30

Online transaction fee

2.9% + $0.30

2.59% + $0.49 to 3.49% + $0.49

Cross border fee

1.5%

1.5%

ACH/E-checks

0.8%, $5 cap (ACH)

3.49% + 49 cents, $300 cap (E-check)

Invoicing/recurring billing

+ 0.4%–0.7%

+$10-$30 for recurring billing services

Discount for nonprofits

✓

✓

Available upgrades

✓

✓

Same-day funding

1.5%

1.5%

Chargeback fee

$15

$15

Volume discounts

> $250,000/year

> $250,000/year

At first glance, the two seem evenly matched when comparing PayPal vs Stripe fees. Stripe and PayPal both use a flat rate pricing model, where the base merchant account is free, but there may be additional monthly fees for optional payment services. However, it’s in the add-on costs where Stripe has some advantage over PayPal.

Stripe charges additional fees for:

- Custom domain for checkout pages: +$10 per month

- Invoicing services: + 0.4%–0.5% per invoice (Stripe invoicing)

- Recurring billing services: + 0.7% per billing volume (Stripe billing)

- Tap-to-pay on mobile: +10 cents per authorization

- Accepting international cards: +1.5%

In addition, Stripe offers volume discounts for businesses that process over $250,000/year in card sales as well as an option for custom interchange plus rates.

PayPal charges additional fees for:

- Virtual terminal: +$30 per month

- Advanced payment gateway: +$25 per month (Payflow Pro)

- Customizable PayPal payment checkout: +$30 per month (Payments Pro)

- Customized embedded checkout page: +$5 per month (Payments Advanced)

- Accepting international cards: +1.5%

- Recurring billing service: +$10 per month

- Recurring payments tools: +$30 per month

One particular downside of PayPal is its complicated pricing scheme, which sometimes makes it difficult to compare with alternatives like Stripe. That said, PayPal offers discounts for charities and nonprofits, while Stripe relies on default nonprofit interchange fees. It also charges significantly lower rates for in-person/mobile transactions.

Read more: Cheapest credit card processing companies

Stripe vs PayPal: Online payment services

Credit/Debit cards

✓

✓

Digital wallets

✓

✓

One-click

✓

✓

ACH/E-check

ACH

E-check

Invoicing/Recurring billing

✓

✓

International

✓

✓

Local payment methods

Requires coding

Requires coding

Virtual terminal

Limited

✓

Level 2 and 3 (for B2Bs)

Requires coding

Upgrade to Braintree

HIPAA compliance (healthcare)

✗

✗

Microtransactions

With integration

✓

BNPL

With integration

✓

Cryptocurrency

✓

✓

CBD

✗

✗

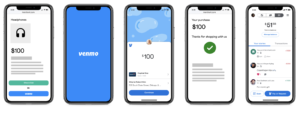

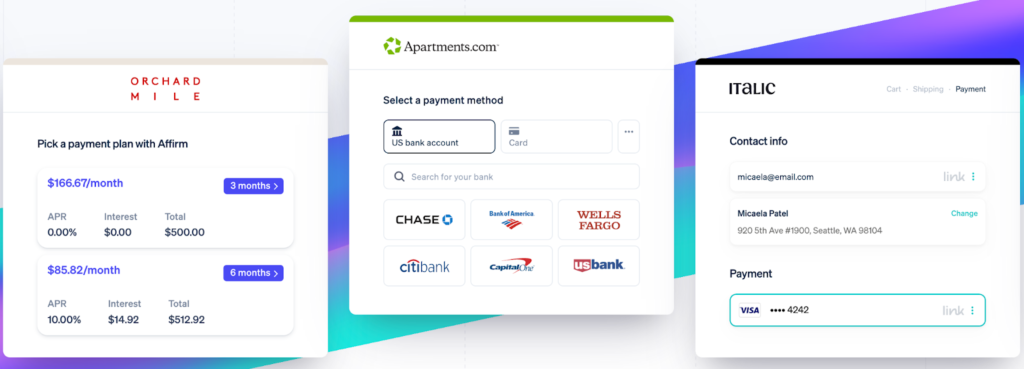

PayPal has a slight edge over Stripe regarding online payment services, primarily because it requires little integration to support its payment methods. Unlike Stripe, PayPal offers its own BNPL platform, Pay in 4, and peer-to-peer payment app, Venmo. Accepting micropayments with PayPal is also readily available, while this will require some coding to use on Stripe.

While Stripe may not be the easiest to set up, it does offer a lot of room for a more personalized payment solution for businesses. For instance, with developer tools, Stripe can support Level 2 and 3 data processing for B2B businesses to get better transaction rates. Using Stripe also means businesses can choose their preferred BNPL service and cryptocurrency wallet instead of just working exclusively with one.

Read more: Best payment gateways

Stripe vs PayPal: Customizations

Payments

Excellent

Great

Security

Excellent

Good

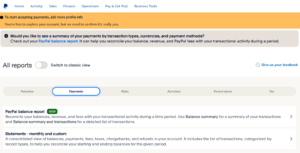

Reporting & Analytics

Excellent

Good

Options

Code-free

Developer setup

Integrations

Code-free

Developer setup

Integrations

Stripe’s customization features are hands-down better than PayPal’s. With advanced coding, Stripe can be designed to upgrade the look and feel of checkout pages with custom fields, automation, and branding. This also includes being able to detect a customer’s location, adapt the language and currency, and fine-tune fraud prevention protocols.

PayPal, on the other hand, relies very little on customizations to start accepting payments. Advanced developer tools are available to expand payment methods, add unique integrations, generate reports, handle disputes, and more. As a comparison, note that most of these tools are already available on Stripe as add-on products.

AI in payment customization

As more consumers become aware of the use of artificial intelligence (AI), it’s important to consider how AI benefits businesses in payment processing.

For instance, both Stripe and PayPal have tapped into machine-learning technology to manage payment security for their users. Reporting analytics also use some level of AI to generate relevant insights from large volumes of business data.

That said, Stripe is well ahead of embedding AI into their payment platform. It uses GPT-4 to manage its developer resources with virtual assistants and chatbots. Stripe also uses AI for facial recognition in selfie checks with its online identity verification feature.

Meanwhile, PayPal began 2024 with exciting updates centered around using AI to analyze customer data from around 400 million consumers who use its service. This includes accelerating the checkout process with biometric access (face or fingerprint) and guest checkout recognition (now used by BigCommerce).

Additionally, PayPal is using personalized AI to improve customer engagement with new tools such as Smart Receipts, which offer personalized recommendations and cashback, and the Advanced Offers platform, which uses specific merchant data instead of impressions to generate more relevant customer recommendations.

So while Stripe currently has the upper hand in customizations, PayPal is not far behind. The role that AI will play in both Stripe’s and PayPal’s improvements this year should also factor into your decision-making.

Stripe vs PayPal: E-commerce integrations

As big names in the online payment industry, both Stripe and PayPal are considered experts in e-commerce integrations.

Stripe’s expertise is in providing custom-branded checkout services for websites with a trove of payment methods to choose from—including PayPal. With its advanced customization tools, Stripe can be integrated with most ecommerce platforms for all business models, sizes, and types. Stripe’s marketplace lists hundreds of ready integrations with a variety of business tools, from accounting to project management platforms.

Meanwhile, PayPal has a similar marketplace for various business integrations, including e-commerce. But what’s unique about PayPal is that websites can use it alongside other payment processors at checkout. So even if businesses already have Stripe embedded on their e-commerce website, it’s still possible to add PayPal as an additional payment method option.

While Stripe also supports independent payment links, PayPal-branded “buy now” buttons are recognizable and easy to add to social media and instant messaging platforms.

Read more: Best ecommerce payment processors

Stripe vs PayPal: Security

Stripe and PayPal are both Level-1 data PCI-compliant. This means both providers are equipped with the layers of security and procedures to handle customer payment data. Both also have dispute resolution management tools.

However, Stripe has a longer list of security features to protect customers’ access to your e-commerce website and payment processing features. Aside from the standard security protocols, Stripe also comes with a number of products for risk and identity management, such as ID verification and biometric security.

However, what makes Stripe unique is its ability to allow businesses to fine-tune their fraud prevention rules according to their level of acceptable risk. This means businesses are less likely to lose out on legitimate sales.

Similarly, PayPal has its own fraud management filters that also allow companies to control the settings and choose among risk control options to implement. Although not as thorough as Stripe’s functionality, you still get to set their own list of monitored countries, place a cap on transaction amounts, address verification, security code verification, and more.

Based on the level of control over security and fraud management, Stripe’s features are clearly more suited for businesses with heavier sales activity, while PayPal provides the best security for businesses with low-volume sales.

Stripe vs PayPal: Ease of use

I find Stripe and PayPal equal in terms of ease of use for simple payment processing. Both providers are easy to sign up for, offering instant merchant account approval and pay-as-you-go contracts.

Stripe and PayPal offer basic payment processing setups that require no special coding skills to create a checkout page, invoice templates, or reports. However, I find PayPal’s merchant dashboard cleaner, easier to navigate, and more user-friendly overall.

On the other hand, while both Stripe and PayPal also offer developer tools for advanced payment processing and customization, Stripe provides more available functionalities.

Which is best?

After comparing PayPal vs Stripe, I find both products closely matched in pricing and ease of use. However, PayPal definitely stood out in terms of payment services, while Stripe edged out PayPal in customization and security features.

As for e-commerce integrations, PayPal and Stripe differ in intent. PayPal’s focus is on creating easy website checkout and other online platform payment options, while Stripe leverages ecommerce integrations to build a personalized online checkout experience.

Read more: Stripe vs Square

Making your choice

With intent being the key difference between these two providers, the choice between PayPal and Stripe depends heavily on business goals.

Stripe is a better payment service for businesses that need custom solutions, such as a fast-growing restaurant. However, the setup required to create a customized integration between Stripe and restaurant POS software will take longer to complete.

PayPal is more convenient and easier to use for businesses looking for simple checkout solutions, such as an additional payment method on their e-commerce platform or standalone “buy now” payment link to use without a website.