The best online payment processors provide you with varied payment methods such as online checkout pages for accepting credit card payments through websites, digital invoicing, virtual terminals, mobile wallets, and even manual payment methods (like keyed-in transactions).

I have reviewed dozens of payment processors and curated the top providers below.

SPONSORED

Software Spotlight: PaymentCloud

Flexible payment processing for any business

- 98% of applications are approved for a merchant account

- Wide range of payment options – including no-cost (surcharging)

- Month-to-month contract

- No setup, application, or annual fees

Visit PaymentCloud

What is An Online Payment Processor?

A payment processor handles all the steps needed to ensure payment transfer. It helps businesses accept varied payment methods securely and quickly and transfers funds from the customer’s account to the business’s account.

Best Online Payment Processors At A Glance

Product

Our Score (out of 5)

Monthly Fee (starts at

Online Payment Fee

Invoicing

Virtual Terminal

Stripe

4.54

$0

2.9% + 30 cents

Incurs extra costs

Yes

Authorize.net

4.50

$25

2.9% + 30 cents

Yes – Single and recurring

Yes

Helcim

4.48

$0

Interchange plus 0.15% + 15 cents to 0.50% + 25 cents

Yes – Single and recurring

Yes

Square

4.42

From $0

2.9% + 30 cents

Yes – Single and recurring

Yes

Shopify

4.29

From $5

2.9% + 30 cents

Yes – Single and recurring

Yes

PayPal

4.27

$0

2.59%–2.99% + 49 cents

Recurring incurs extra costs

Incurs extra costs

Chase

4.20

From $0

2.9% + 25 cents

Yes – Single and recurring

Yes

CardX

3.51

From $29

From 2.91%

Yes – Single and recurring

Yes

Stripe: Best overall, customization, and multi-currency payments

Overall Reviewer Score

4.54/5

Pricing & Contract

4/5

Payment Types

4.72/5

Sales & Account Management Features

4.53/5

User experience

5/5

User scores

4.47/5

Pros

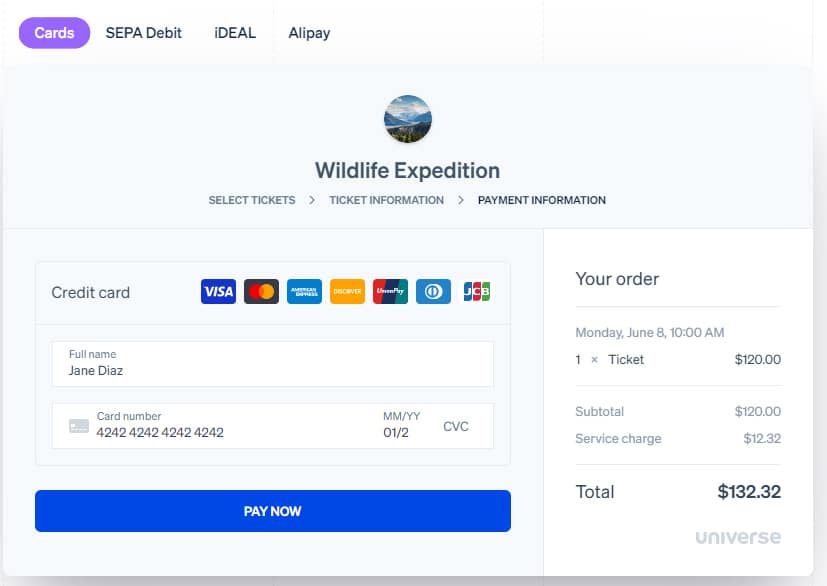

- Highly customizable checkout options

- Can process transactions in 135+ currencies

- Great API and hundreds of integrations

Cons

- Limited functionality for in-person sales

- Requires coding and developer skills for customization

- Add-on fees for recurring billing and invoicing

Why I chose Stripe

Stripe is a highly favored and popular payment processor that is also part of our recommended payment gateways and merchant services. It accepts dozens of payment methods online and transacts in more than 135 currencies. B2B businesses, in particular, can benefit from its invoicing tool and inexpensive ACH transaction fees—the lowest among the software in this list (0.8%, $5 cap), except for Helcim (zero fees).

What I like about Stripe is that, in addition to its varied accepted payment methods, its checkout customizability can’t be beat. It has the most integrations among the providers I have evaluated in this list, and its online knowledge base and APIs are a clear favorite of developers in the reviews I have read.

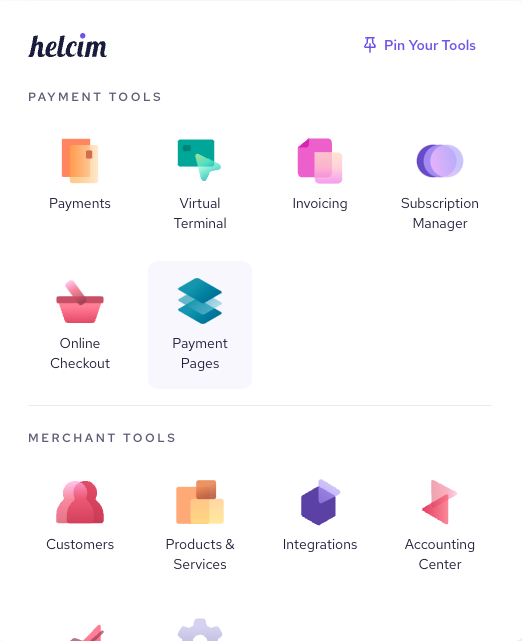

Helcim: Best for automated volume discounts

Overall Reviewer Score

4.48/5

Pricing & Contract

4.5/5

Payment Types

4.31/5

Sales & Account Management Features

4.38/5

User experience

5/5

User scores

4.2/5

Pros

- Interchange plus pricing

- Automated volume discounts

- Free credit card processing

Cons

- Limited business integrations

- Additional fees for AmEx transactions

- First payout takes two weeks

Why I chose Helcim

As a traditional merchant services provider, Helcim offers maximum stability to its users. But what I like most about Helcim is that it has built its platform around automation. Volume discounts are automated, every merchant account is automatically qualified for the in-person and online zero-cost processing program, and even B2B business information is automatically gathered for qualification for level 2 and 3 discounted rates.

Square: Best for omnichannel payments

Overall Reviewer Score

4.42/5

Pricing & Contract

4.5/5

Payment Types

3.89/5

Sales & Account Management Features

4.06/5

User experience

5/5

User scores

4.67/5

Pros

- No chargeback or PCI compliance fees

- HIPAA-compliant

- Offers CBD program

Cons

- Flat-rate fees

- Custom fees available only by request

- Complaints of frozen funds

Why I chose Square

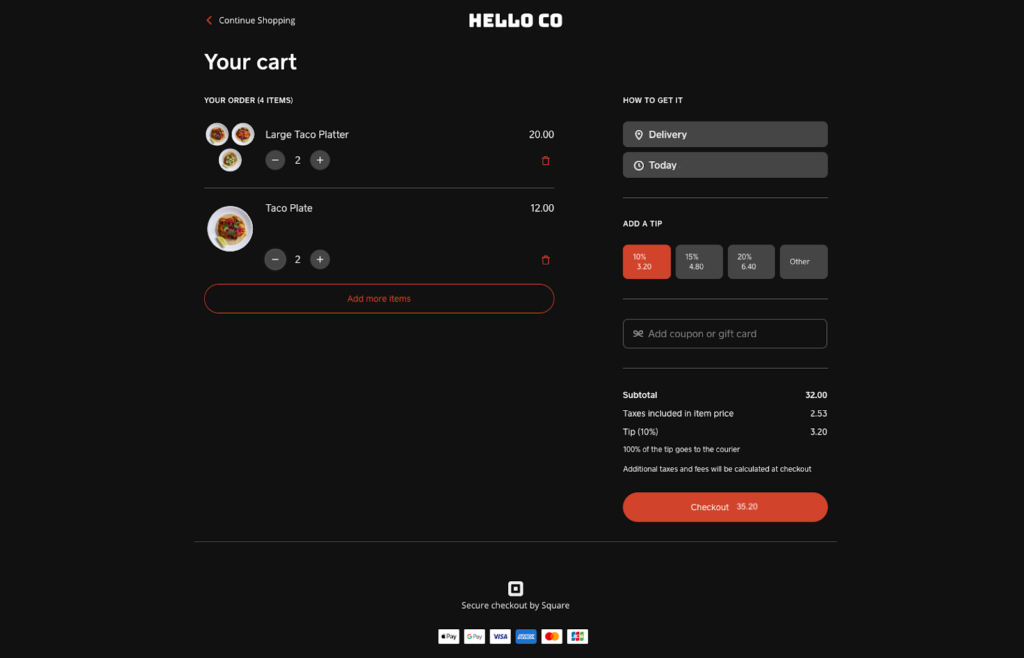

Square is an all-in-one point-of-sale (POS) solution with a built-in payment processing system. Its greatest advantage is that it can provide a full suite of tools for in-person and online selling, with minimal startup costs and no monthly fees.

Square offers a free POS system with every free Square Payments account. You can also build a free ecommerce website with its free Square Online website builder and Square automatically syncs your online and in-person orders and inventory.

Given all the tools you can get for free, Square provides the best value for new businesses, with minimal startup costs and no monthly fees. It is also compatible with small healthcare services because it is HIPAA compliant and merchants that sell cannabis products because it has a CBD program.

Shopify: Best for ecommerce merchants

Overall Reviewer Score

4.29/5

Pricing & Contract

3.5/5

Payment Types

3.89/5

Sales & Account Management Features

4.53/5

User experience

5/5

User scores

4.53/5

Pros

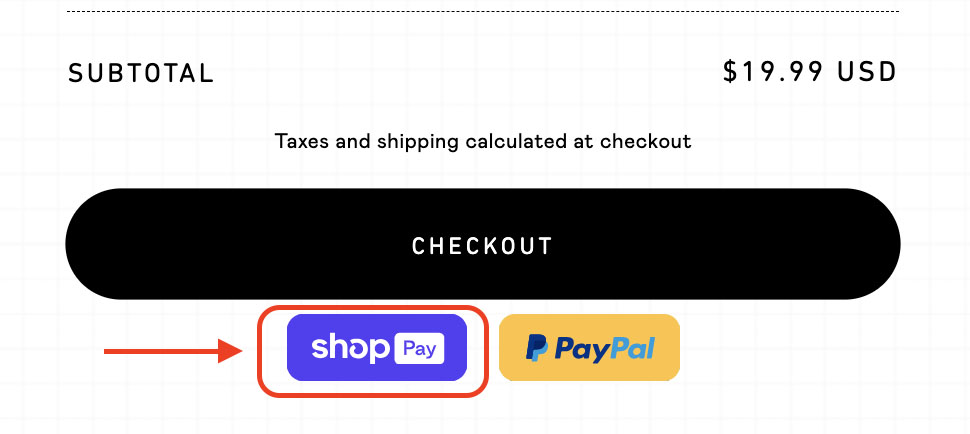

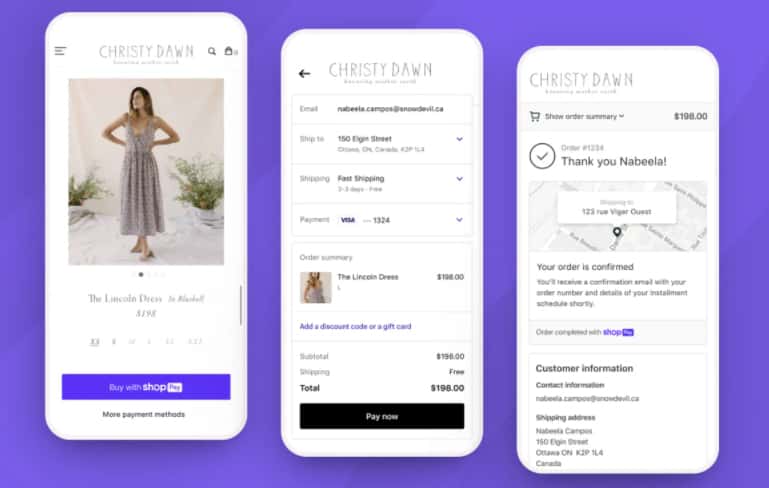

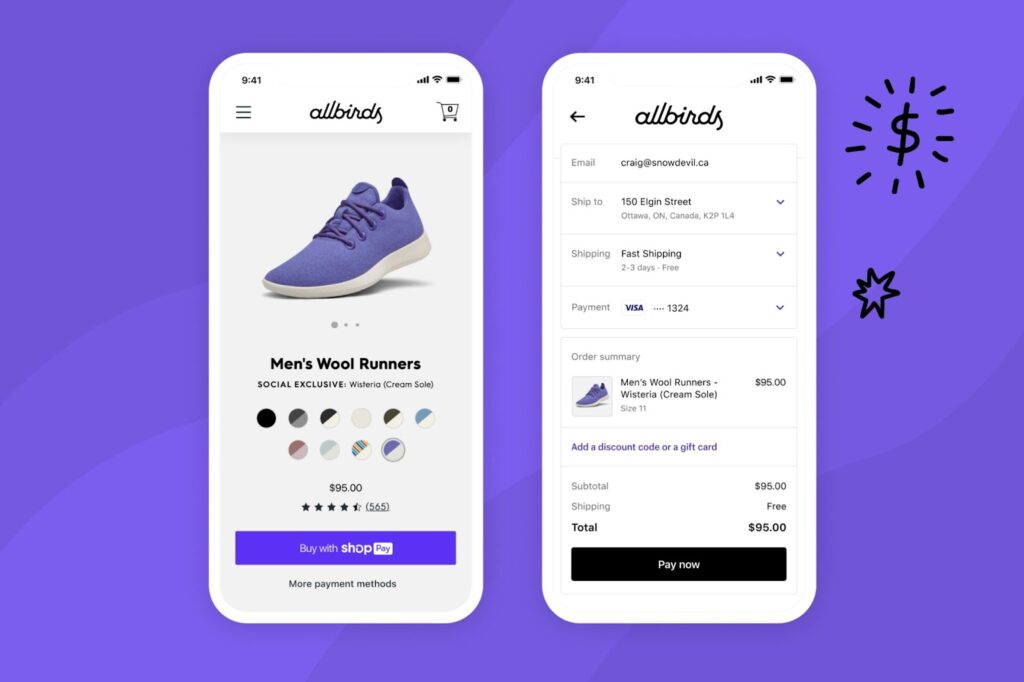

- Shop Pay (one-click checkout)

- Waived Shopify transaction fees

- Customizable checkout pages

Cons

- Exclusive to Shopify platform; unavailable to other ecommerce platforms

- Ecommerce plan is required to use Shopify Payments (comes with monthly fees)

- User complaints of account holds

Why I chose Shopify

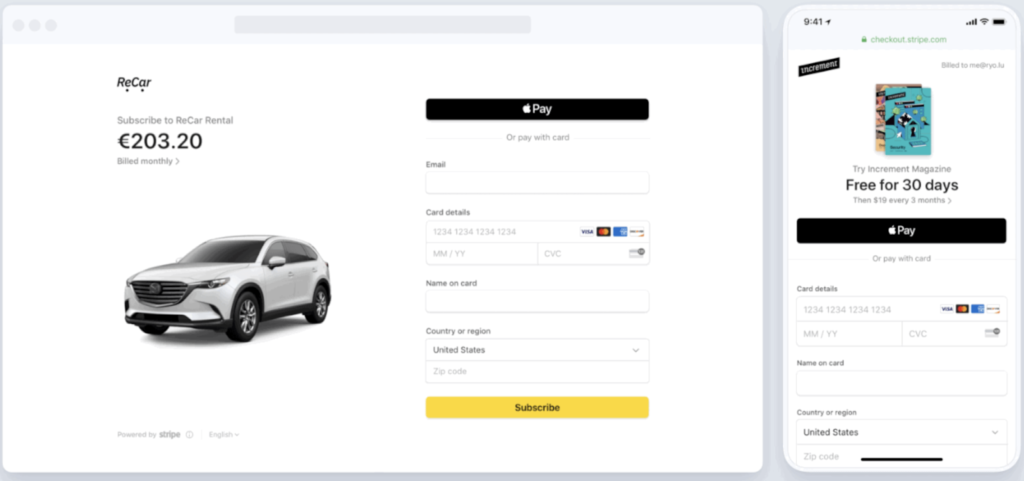

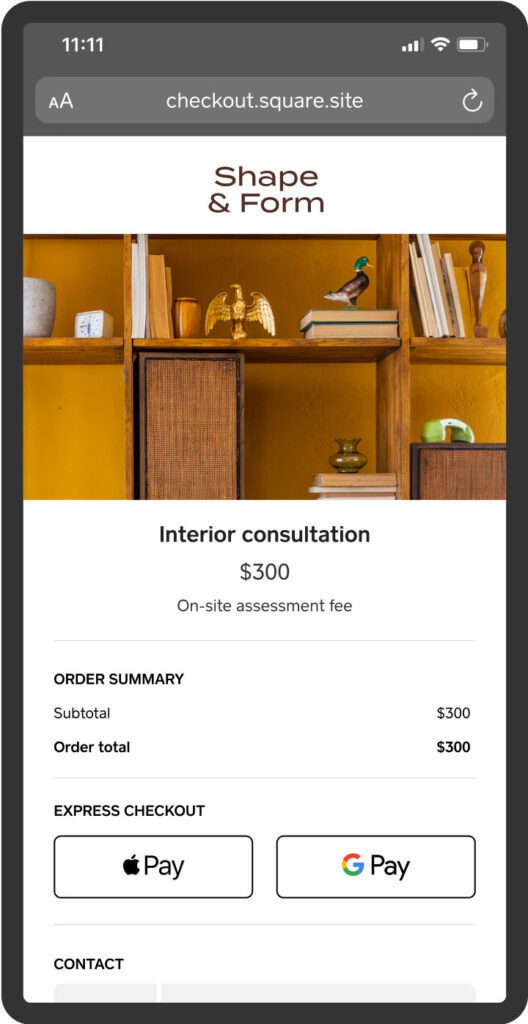

While Shopify Payments is exclusive to Shopify sellers, Shopify is the best ecommerce platform for real-world users and experts alike, making the system very ideal for ecommerce merchants.

I like Shopify Payments’ one-click checkout option, Shop Pay, and the various payment methods available for online merchants (even manual and in-person payments). Shopify is the standard for omnichannel and ecommerce point-of-sale (POS) solutions. I highly recommend going with Shopify Payments for online-first retail businesses.

PayPal: Best for additional payment methods

Overall Reviewer Score

4.27/5

Pricing & Contract

3.75/5

Payment Types

3.61/5

Sales & Account Management Features

4.38/5

User experience

5/5

User scores

4.6/5

Pros

- Widely available, known and trusted platform by consumers

- Seamless online checkout integration

- Easy integrations

Cons

- Complicated pricing structure

- Account stability issues

- Unpredictable freezing of funds

Why I chose PayPal

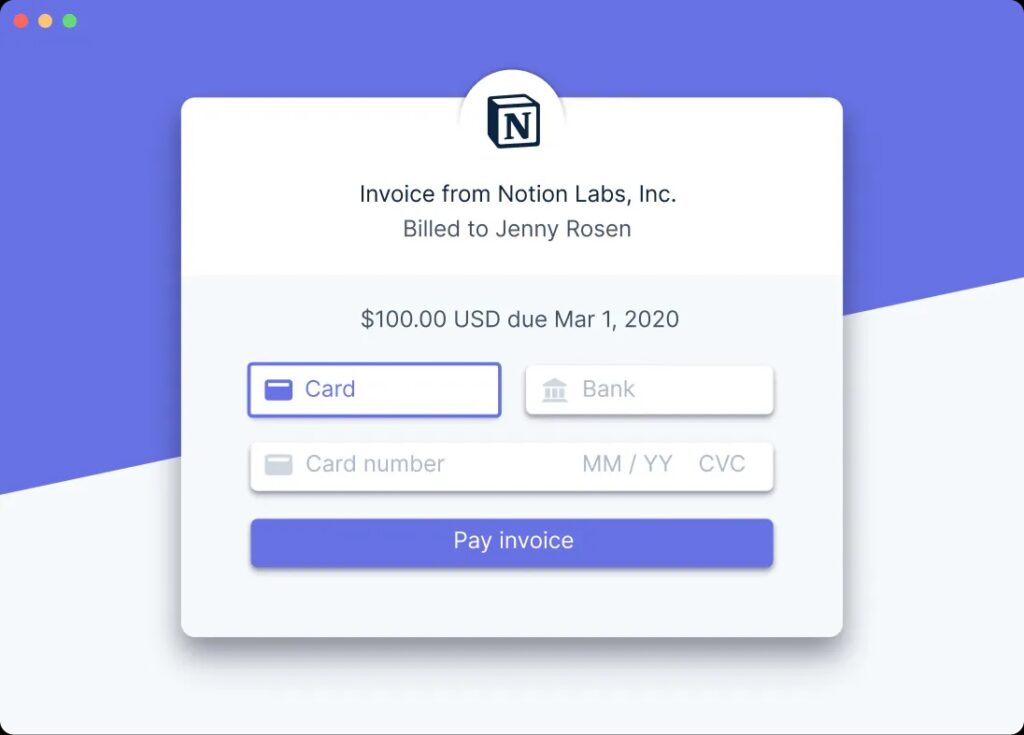

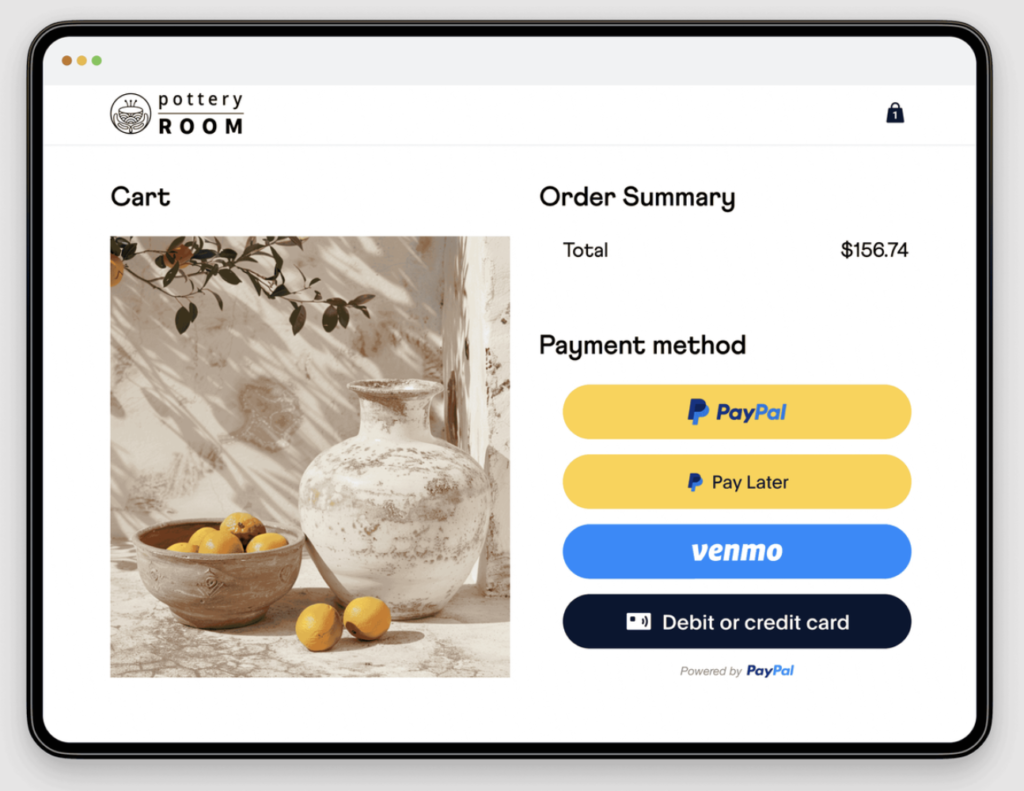

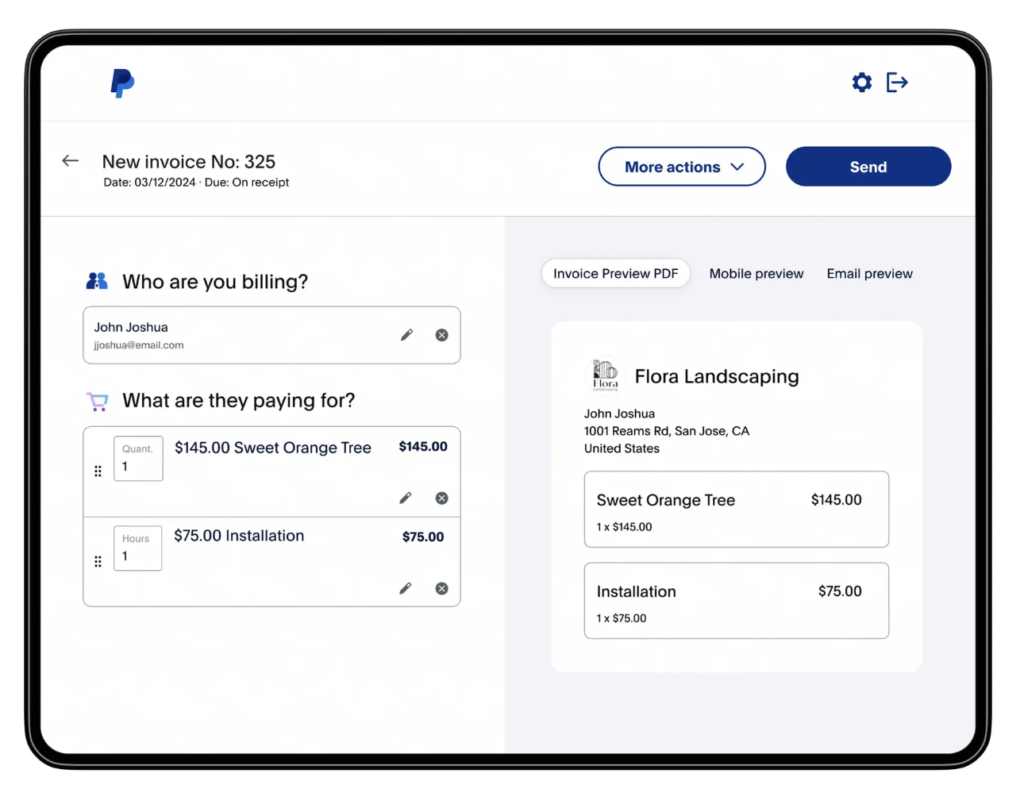

PayPal is a widely-trusted and used payment method all over the world. It is often used as an added payment method with other payment types. I find PayPal very easy to use, with Buy Now buttons for social media and checkout buttons for adding to your websites.

PayPal has its own BNPL tool and can accept cryptocurrency—the only provider that supports this on this list.

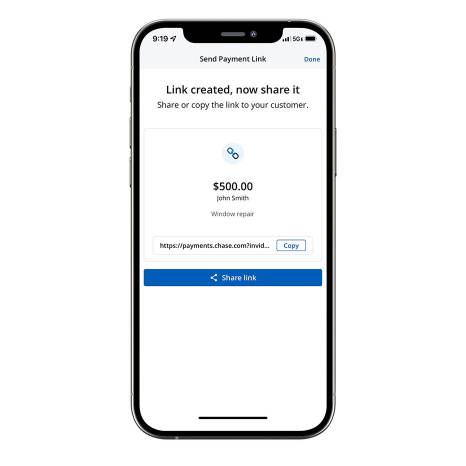

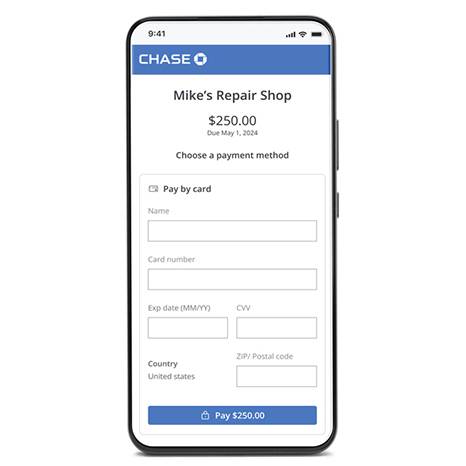

Chase Payment Solutions®: Best for fast deposits

Overall Reviewer Score

4.20/5

Pricing & Contract

3.75/5

Payment Types

4.31/5

Sales & Account Management Features

4.22/5

User experience

4.38/5

User scores

4.33/5

Pros

- Free same- and next-day funding

- Faster approval of international payments

- Fully HIPAA-compliant

Cons

- Chargeback fee can increase based on volume

- Maintaining bank balance required for same-day funding

- Add-on monthly fee for ACH transactions

Why I chose Chase Payment Solutions®

Chase provides traditional merchant account services and as a financial institution, you gain access to fast deposits and have higher chances of approval in accepting cross-border payments because of Chase’s strong connections to global banks. Chase offers the fastest deposit times for free among the providers on the list, with the caveat that you sign up for a Chase business checking account.

You get to enjoy the payment processing features other providers offer and the business and banking funding services a financial institution can provide.

Limited-time offer: Get $100 off the Chase Point of Sale (POS)SM Terminal. Visit Chase to learn more. Terms and conditions apply.

CardX: Best for surcharging

Overall Reviewer Score

3.51/5

Pricing & Contract

4/5

Payment Types

3.06/5

Sales & Account Management Features

3.13/5

User experience

4.38/5

User scores

3/5

Pros

- Fully compliant and automatic credit surcharging for online and in-payment transactions

- Auto-detection of debit and credit cards

- Built-in virtual terminal and subscription management tools

Cons

- Lacks same-day funding

- Lacks invoice customization tools

- Does not accept cross border payments

Why I chose CardX

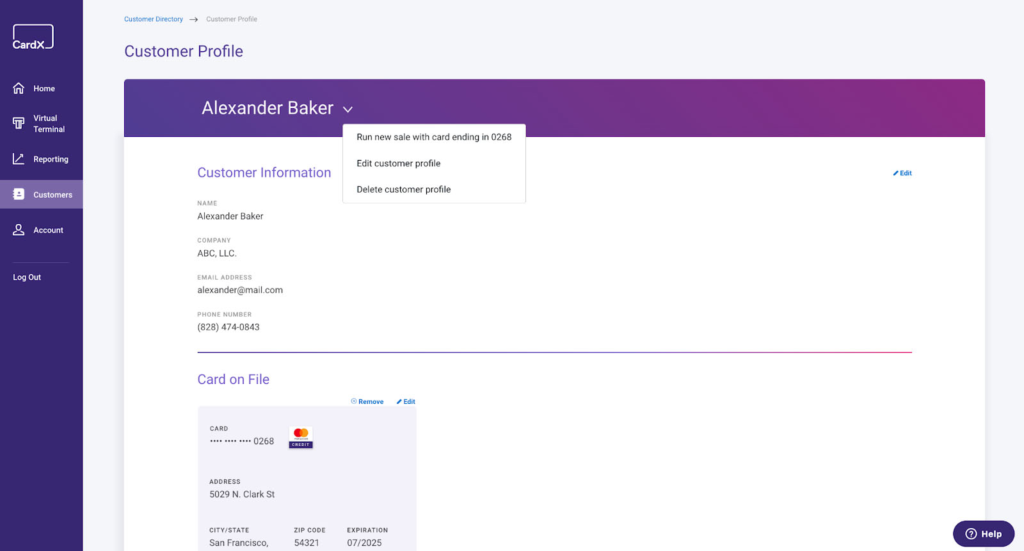

CardX offers surcharging programs for online and in-person transactions, provides invoicing and subscription management features, a CRM tool, and virtual terminal.

I like how CardX is an expert on surcharging compliance. It doubles down on compliance to provide merchants with a surcharging program and even conducts free merchant training. It is fully compliant with federal and local regulations in all states where credit surcharging is legal. Mastercard appointed CardX as its official surcharging partner and provides merchants with the Mastercard Click-to-pay feature for their website checkout.

I also like how its subscription management tools are integrated with CardX’s customer profiles, so you can easily track and manage accounts receivables.

A Guide To Accepting Payments Online

Accepting payment online involves several steps, from identifying priorities, choosing a provider, to integrating that provider with your website and systems. The process also varies depending on your business requirements, needs, and the provider’s regulations. Overall, the steps involved are as outlined below:

- Identify your business needs. Determine what types of payments you need to process and whether your business just needs one-time payments or the ability to do recurring billing, manual payments, and more. If your business operates in multiple countries, you might need to support payments in different currencies. These requirements will determine your next steps.

- Choose a payment processor. Once you determine your business needs, go with a processor that can support all your requirements and integrate with your existing business systems with minimal friction. We also outline all the considerations you need to look into when deciding on a payment processor in the next section.

- Integrate the payment processor into your website. Once you have chosen a provider, you need to create an account and go through the verification process. Once approved, you can integrate the processor into your website. Most provide prebuilt plugins or APIs for integration, but this step will vary depending on your website and the provider you choose.

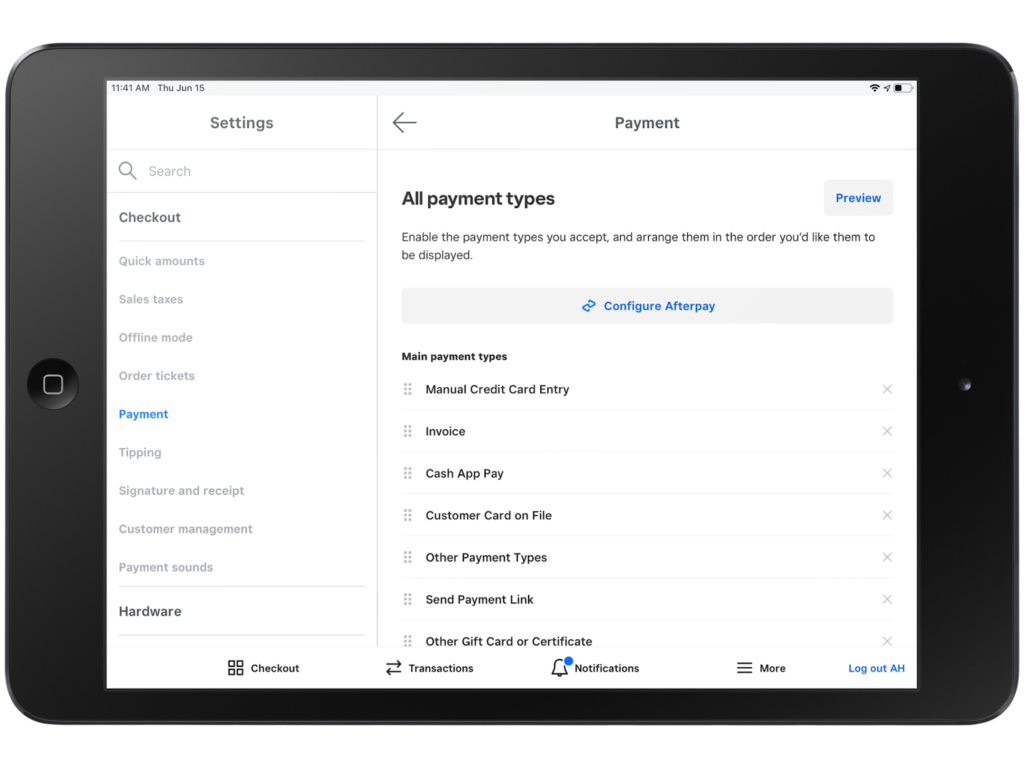

- Configure payment settings. Once successfully integrated, it’s time to set your payment options. Set up the payment methods you are willing to accept. Now is also the time to set up subscription models, BNPL options, and recurring billing methods.

- Test the system. Payment processors typically have testing modes to help simulate payment transactions and ensure everything works properly before you launch and go live.

- Launch the payment system. Once it is tested thoroughly, it’s time to go live! Start accepting payments and regularly monitor transactions. Most provide dashboards and tools to help with monitoring sales and handling disputes or chargebacks.

- Consistently adhere to compliance and accounting requirements. Once it is launched, you need to stay on top of compliance regulations and PCI DSS standards.

Choosing the Best Online Payment Processor For Your Needs

The best online payment processor will depend on your businesses. When choosing an online payment system for your business, consider the following:

- Security: Security is crucial when accepting payments online. Ensure your provider is PCI-compliant. The good providers also use the latest encryption technologies that protect credit information from theft.

- The industry risk of your business: There are payment processors that don’t cater to specific industries because of the risk involved in accepting certain payments. Examples include gas stations (high rates of fraudulent transactions), telemarketing sales (high rates of chargebacks), and sales that are regulated under federal law, like firearms.

- Accepted payment methods: The payment processor should support the payment methods your business needs to process. For example, if you process payments via phone or invoicing, shortlist systems that support these options.

- Integrations: Integrations allow you to automate and efficiently coordinate your business systems. As a rule, you must be able to integrate your processor with your shopping cart. Check if your existing software (accounting, CRM, ecommerce platform) has native integrations with your shortlist.

- Contract length: Some payment processors offer month-to-month contracts without cancellation fees while others don’t. Study contract agreements, especially if you own customer data if you choose to transfer providers—there are services that allow it, some don’t. For example, if you have a loyalty program and switch providers, that would mean you need to start again from scratch.

- Customer support: Live 24/7 support is ideal but may not be a necessity for all businesses. However, if your business accepts keyed-in payments from across the country, takes mobile payments at weekend events, or operates outside business hours, an issue with processing payments can come at various times and you risk loss of revenue if the issue isn’t resolved promptly.

- Timeline for payouts or fund transfers: Generally, the time it takes to receive funds from online payments should be short—next-day payouts are standard. However, same-day deposits can be important for some businesses. Most providers offer same-day payouts with added fees, while others don’t have the capability to provide this need. If so, factor in the fees involved with same-day payouts and estimate the added cost per month.

- Over all cost (fees, charges, monthly subscriptions): The overall cost of payment processors includes transaction fees, monthly fees, chargeback fees, and less-obvious costs such as membership fees, setup costs, PCI compliance fees, and cancellation fees. When comparing providers, look into their setup fees, hidden charges, refund fees, and international transaction fees. Check if it can also provide interchange-plus pricing instead of flat-rate pricing for processing fees, especially if your business has a high volume of monthly transactions.