As with for-profit businesses, non-profit organizations must also account for and detail all their enterprise’s financial components, inflows, outflows, and operations. While a nonprofit’s goals and operating models differ in a few vital respects-specifically profits versus “results,” they still both engage in many of the same activities and have similar commitments to showing the use of funds, documenting overhead, making projections, ensuring compliance, disclosures, transparency, and accountability to shareholders, donors, and more.

This article will cover the basics of the purpose, components, and specifics of nonprofit financial reporting and producing non-profit financial statements for your non-profit. We will also discuss the components of a valuable, informative financial statement for nonprofits and how to interpret and utilize the information found in nonprofit statements.

Looking for a nonprofit CRM solution? Check out our Nonprofit CRM Buyer’s Guide.

What is a nonprofit financial statement?

A nonprofit financial statement summarizes a nonprofit organization’s financial activities and health over a specific period, typically a fiscal year or quarter. It includes various reports and disclosures that help stakeholders understand how the organization manages its resources and funds to fulfill its mission.

Typical critical or core components of a nonprofit financial statement found in most nonprofit profit and loss statements include a statement of financial position, a statement of activities, a statement of cash flow, and a statement of functional expenses. Some nonprofit financial reporting may contain additional components.

Nonprofit financial statements are crucial for demonstrating accountability and transparency to stakeholders such as donors, grantors, board members, and the public. Accurate and detailed non-profit organization financial statements also help nonprofit management assess fiscal performance, make informed decisions, and ensure compliance with legal and regulatory requirements.

Read more: Best Practices for Optimizing Donor Outreach

Types of nonprofit financial statements

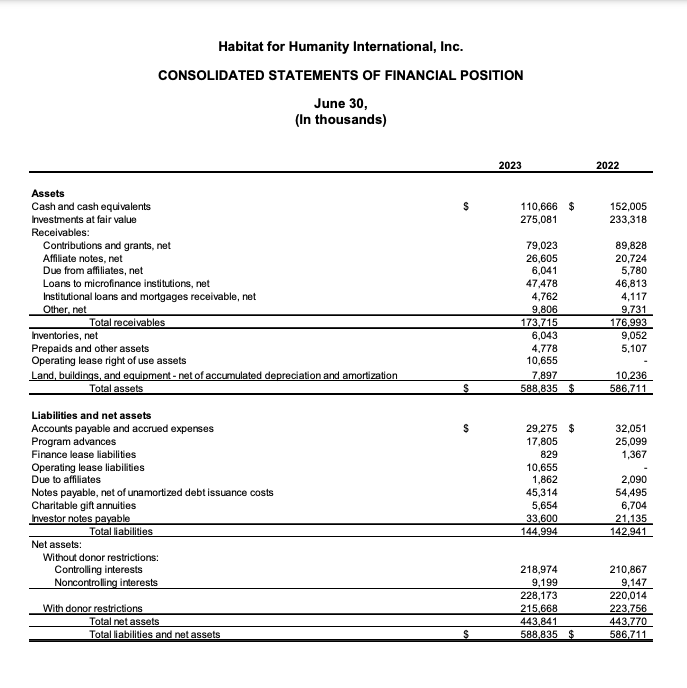

What is a non-profit statement of financial position?

First, let’s detail what a nonprofit statement of financial position, also known as a balance sheet, is. A nonprofit statement of financial position provides an accurate snapshot of the organization’s financial position at a specific time, typically at the end of a fiscal year or quarter. A non-profit balance sheet is similar to the balance sheet used by for-profit businesses; it presents the organization’s assets, liabilities, and net assets (or equity).

Here are the key components typically found in a nonprofit statement of financial position:

Assets: Assets represent what the nonprofit organization owns or controls and can use to accomplish its mission. They are categorized as current assets (those expected to be converted into cash within one year) and non-current assets (expected to provide benefits beyond one year). Common assets for nonprofits include cash, investments (bonds, stocks, etc.), accounts receivable, property, plant and equipment, and prepaid expenses.

Liabilities: Liabilities (debts) represent what the organization owes to creditors or other parties. They are also categorized as current liabilities (those due within one year) and non-current liabilities (those due beyond one year). Common liabilities for nonprofits include accounts payable, accrued expenses, deferred revenue, and long-term debt obligations.

Net Assets: Net assets represent the nonprofit’s equity or ownership interest. They are the residual amount left after subtracting liabilities from assets. Net assets are typically classified into three categories based on restrictions imposed by donors or the organization’s governing board:

Unrestricted Net Assets: Funds not subject to donor-imposed restrictions can be used at the discretion of the organization’s management to support its mission and operations. In other words, these net assets can be liquidated, exchanged, transferred, etc., without undue delays, permissions, or restrictions.

Temporarily Restricted Net Assets: Funds subject to donor-imposed restrictions that will be released once certain conditions are met or specific periods have elapsed.

Permanently Restricted Net Assets: Funds subject to donor-imposed restrictions that must be maintained in perpetuity and can only be used for specific purposes outlined by the donors.

The nonprofit statement of financial position provides stakeholders, including the organization’s donors, grantors, board members, and the public, insight into the nonprofit’s financial health, resources, and obligations. It helps assess the organization’s liquidity, solvency, and overall financial stability, providing transparency and accountability in its stewardship of resources toward achieving its mission.

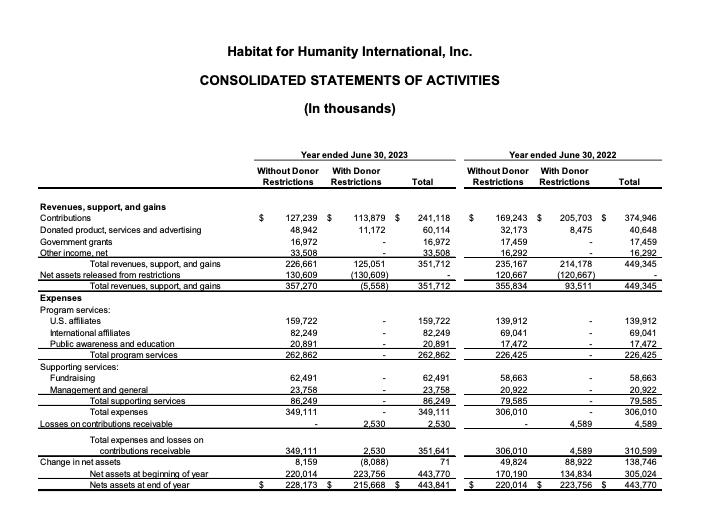

What is a nonprofit statement of activities?

A nonprofit statement of activities, also known as an income statement or statement of operations, is a financial statement that summarizes the organization’s revenues and expenses over a specific period, typically a fiscal year. It provides insights into the organization’s financial performance and ability to generate and utilize resources supporting its mission.

Here are the key components typically found in a nonprofit statement of activities:

Revenue: This represents the funds or resources earned or received by the organization during the reporting period. It includes various sources such as contributions, grants, program fees, fundraising events, investment income, and sales of goods or services. Revenue is typically classified into unrestricted, temporarily restricted, and permanently restricted categories based on donor-imposed restrictions.

Expenses: Expenses represent the costs incurred by the organization in carrying out its mission and operations. They include expenses related to program services, fundraising activities, and administrative functions. Program services expenses are those directly related to the organization’s mission and programs, while fundraising expenses represent costs associated with soliciting contributions and support. Administrative expenses include general management and overhead costs necessary to support the organization’s operations.

Change in Net Assets: The change in net assets is calculated by subtracting total expenses from total revenue. It represents the organization’s net income or loss for the reporting period. A positive change indicates a surplus, while a negative change indicates a deficit.

Net Assets: Net assets represent the organization’s equity or ownership interest at the end of the reporting period. They are the residual amount left after subtracting liabilities from assets on the statement of financial position (balance sheet). Net assets are typically classified into unrestricted, temporarily restricted, and permanently restricted categories based on donor-imposed restrictions.

The not-for-profit financial statement of activities helps stakeholders, including donors, grantors, board members, and the public, understand the organization’s financial performance and ability to generate revenue, manage expenses, and achieve its mission. It provides transparency and accountability in how the organization utilizes its resources to fulfill its charitable purposes and positively impact society.

Read more: Nonprofit Accounting Software Buyer’s Guide

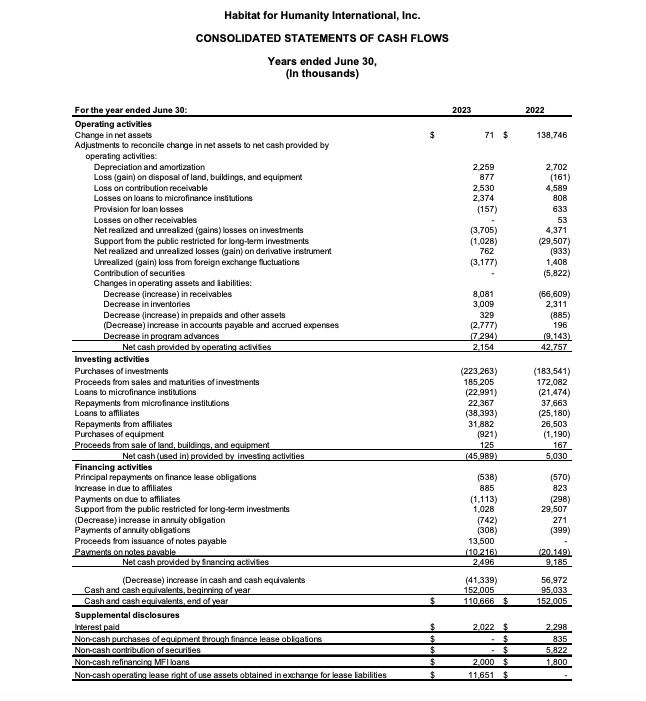

What is a nonprofit statement of cash flow?

A nonprofit statement of cash flows is a financial statement that provides information about a nonprofit organization’s cash inflows and outflows during a specific period, typically a fiscal year. It categorizes cash flows into three main activities: operating, investing, and financing.

Here are the key components typically found in a nonprofit statement of cash flows:

Operating Activities: Cash flows from operating activities represent the cash generated or used in the organization’s day-to-day operations. This includes cash received from contributions, grants, program fees, other sources, and cash payments for expenses such as salaries, utilities, supplies, and program delivery costs. Operating cash flows are essential for assessing the organization’s ability to generate cash from its core operations.

Investing Activities: Cash flows from investing activities represent the cash used for acquiring or disposing of long-term assets, such as property, plant, equipment, and investments. This includes cash payments for purchasing or constructing new facilities, purchasing equipment or vehicles, and investing in securities or other financial instruments. Investing cash flows helps stakeholders understand the organization’s capital investment decisions and asset management strategies.

Financing Activities: Cash flows from financing activities represent the cash raised or spent financing the organization’s operations and capital structure. This includes cash from borrowing or issuing debt and cash payments for repaying debt, paying dividends, or distributing funds to owners or shareholders. Financing cash flows help stakeholders assess the organization’s capital structure, debt management practices, and funding sources.

The non-profit financial statement of cash flows provides stakeholders, including donors, grantors, board members, and the public, insights into how the organization manages its cash resources, generates cash from its activities, and uses cash to fund operations, investments, and financing activities. It complements other financial statements like the income and balance sheets by providing a comprehensive view of the organization’s financial performance, liquidity, and cash flow dynamics.

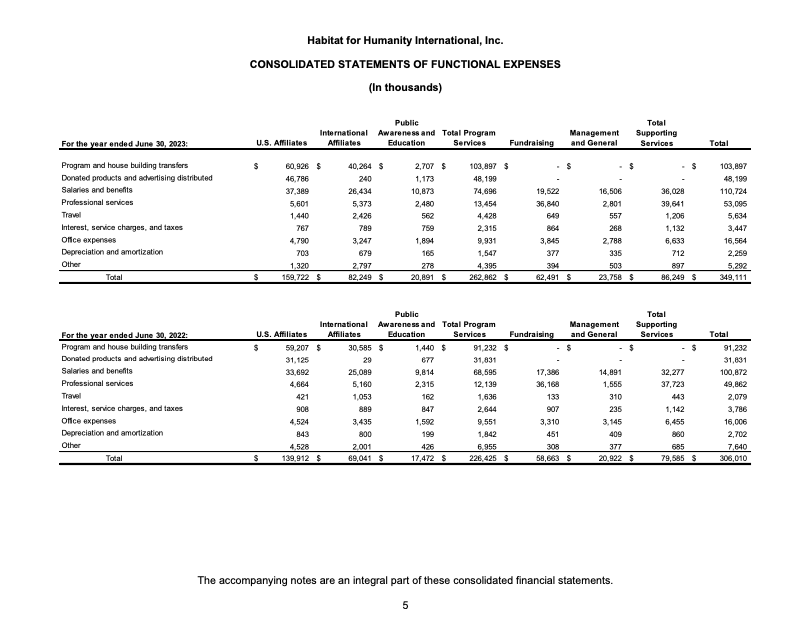

What is a nonprofit statement of functional expenses?

A nonprofit statement of functional expenses is a financial statement that categorizes the organization’s expenses by their functional classification, typically based on the nature of the activities they support. This statement clarifies how the organization allocates resources across different functions or programs.

Here are the key components typically found in a nonprofit statement of functional expenses:

Program Services Expenses: Program services expenses represent the costs directly related to the nonprofit’s mission and programs. These expenses support the organization’s core activities, services, and initiatives aimed at achieving its charitable purposes. Program services expenses may include salaries and benefits for program staff, program supplies, materials, and other direct program-related expenses.

Management and General Expenses: Management and general expenses represent the costs associated with the overall management and administration of the organization. These expenses support activities necessary for the organization’s day-to-day operations and governance, such as executive salaries, accounting and legal fees, office rent, utilities, insurance, and other administrative expenses.

Fundraising Expenses: Fundraising expenses represent the costs incurred in soliciting contributions and support for the organization. These expenses support activities aimed at generating financial support, including fundraising events, marketing and advertising campaigns, donor relations, and other fundraising initiatives.

The nonprofit statement of functional expenses may also include a breakdown of expenses by program or activity within each functional category, providing further detail on how resources are allocated across different initiatives. This breakdown helps stakeholders understand how the organization allocates resources to support its mission and programs, ensuring transparency and accountability in resource management and expenditure. It also allows donors, grantors, board members, and the public to assess the organization’s efficiency and effectiveness in achieving its charitable goals.

Read more: Best Nonprofit Software

Choosing the right nonprofit accounting software

Plenty of suitable nonprofit accounting and bookkeeping software options exist, including Freshbooks and Wave Accounting.

Freshbooks is used by millions of customers, including non-profits. It’s an easy-to-use accounting, invoicing, and general bookkeeping option currently offering a 30-day free trial. With Freshbooks, you can generate invoices, auto-billing notices, track time and expenses, and allow easy collaboration. It’s also in the cloud, so an organization doesn’t have to worry about data loss.

Wave Accounting is another popular nonprofit accounting and bookkeeping software option that millions of businesses and nonprofits use. Wave features a user-friendly interface dashboard, access to payroll, accounting, and labor coaches, expense tracking, tax preparation, and more.

How do nonprofit financial statements differ from for-profit statements?

Simply put, a for-profit business’s financial statement reflects the company using traditional accounting methods or systems to calculate and report the enterprise’s net income. In contrast, a nonprofit organization’s financial statements reflect the nonprofit’s revenues versus expenses. This reflects the differences in “missions” or goals of traditional for-profit businesses versus a nonprofit’s purposes or objectives.

Why are nonprofit financial statements necessary?

As with any enterprise, whether it’s a for-profit or a nonprofit, it’s important to keep track of expenses, assets, inputs, and outputs not only to ensure compliance with federal, state, and IRS regulations but also to determine if the enterprise is reaching its objectives, producing value or profits, accounting for all assets and debts, and ensuring transparency and ethical operations.

As described previously, obtaining, maintaining, and retaining a nonprofit’s 501(c)(3) status requires compliance, including in bookkeeping and financial statements. Failing to properly collect, prepare, and submit accurate, honest, and complete nonprofit financial statements can lead to issues, including losing the tax-exempt status.

Consider using robust, user-friendly accounting or bookkeeping software

After reading this article, it’s probably reasonably apparent that maintaining, processing, retaining, and producing non-profit financial statements requires a practical, proven nonprofit software solution. Trying to tackle this vital function and compliance necessity involves using software.

No matter which nonprofit accounting or bookkeeping software solution an organization chooses, it will help that nonprofit manage these critical core needs and functions. Choose the best fit for the nonprofit’s needs, budget, and ease of use for the entire staff.