Square is one of the industry’s most popular point-of-sale (POS) systems, with its all-in-one business solution and forever-free plan. Businesses have access to free payment processing, e-commerce, employee management features, and a wide range of cost-effective hardware options. That said, some companies might find Square’s features lacking or find themselves outgrowing its services.

To help you get started, I evaluated top POS and payment processors that are known Square competitors. These providers offer all-in-one solutions and a dynamic range of POS features at reasonable prices.

Top Square competitors

If you are searching for alternatives to Square, consider these eight competitors that offer comparable functionalities that may better match the way you run your business:

Company

Monthly Fee From

Transaction Fee

Free POS Plan

Hardware Cost

Lightspeed

$89–$339

2.6% + $0.10–$0.30

X

Not disclosed

Shopify POS

$0 or $89 + $39–$399*

2.4%–2.9% + $0.30

✓

$49–$399

Clover**

$14.95–$69.90

2.3%–2.6% + $0.10 to 3.5% + $0.10

X

From $49

Toast

$0–$165

2.49% + $0.15 to 2.99% + $0.15

✓

From $0

SpotOn

$0–$25

Not disclosed

✓

From $50***

Helcim

$0

Interchange plus 0.15% + 6 cents to 0.4% + 8 cents

✓

From $99

Stripe

$0

2.7% + 5 cents

✓

From $59

IT Retail

$99–$1,999

Custom

X

Included in monthly plan

*Shopify ecommerce software plan

**Based on Fiserv rates

*** Average price of mobile card readers (actual price not disclosed)

Lightspeed: Best Square alternative for inventory management

Overall Score

4.06/5

Pricing

3.44/5

Hardware

4.25/5

Software Features

4.5/5

Support & Reliability

4.38/5

User Experience

3.75/5

Average User Review Scores

4.07/5

Pros

- Advanced management tools for complex inventory

- Highly customizable reporting and analytics

- Works with third-party payment processors

Cons

- High price points

- Limited shipping integrations

- No free plans

Why I chose Lightspeed

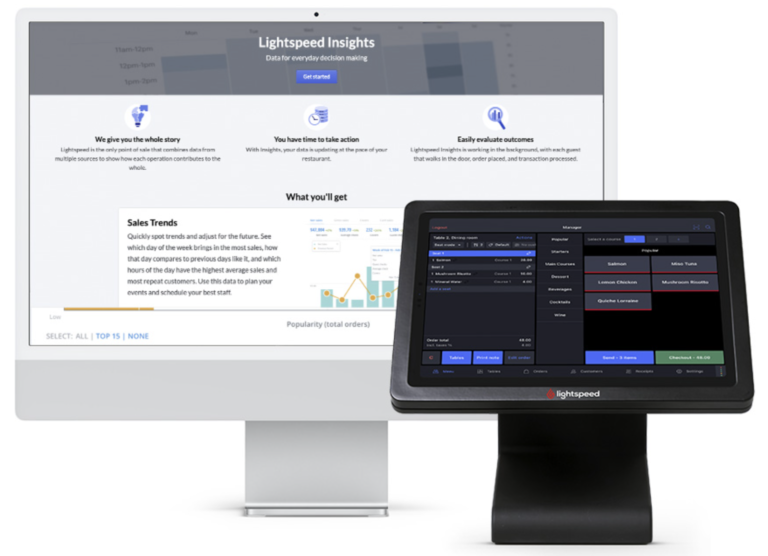

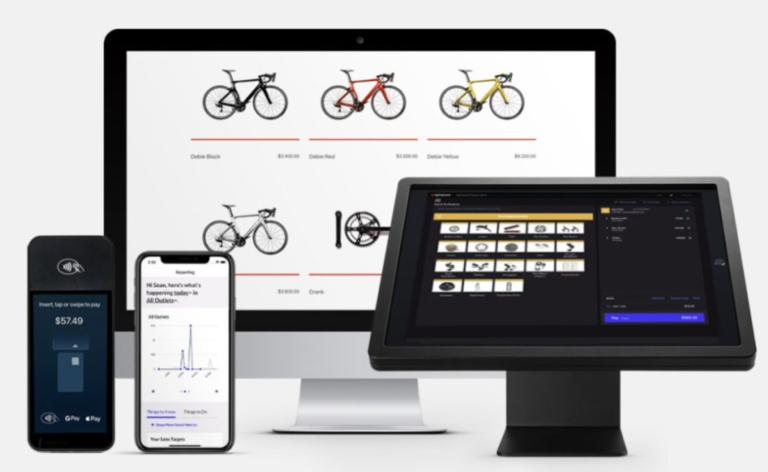

In recent years, Lightspeed has developed solid industry-specific software to rival most popular POS providers. However, its advanced inventory management features make Lightspeed stand out the most. Lightspeed makes it possible to easily track ingredient-level inventory with tools like customizable matrices, omnichannel ordering, and serial number tracking. The range of its advanced inventory tools makes it possible for Lightspeed to support niche businesses such as jewelry, sporting goods, bike shops, vape shops, golf courses, and more.

Like Square, Lightspeed provides all-in-one industry-specific POS solutions with hardware, built-in payments and ecommerce tools, and omnichannel features. However, Lightspeed is clearly the better choice for inventory management, making it the perfect Square alternative for businesses that love Square’s ease of use but have outgrown the software.

That said, Lightspeed’s price point may not be suitable for businesses on a budget. There are no free plans, and monthly fees start at $89.

Shopify: Best Square alternative for e-commerce

Overall Score

4.06/5

Pricing

3.44/5

Hardware

4/5

Software Features

4.25/5

Support & Reliability

4.38/5

User Experience

3.75/5

Average User Review Scores

4.57/5

Pros

- Free POS software available

- Native ecommerce platform

- Can run on desktops and iPads

Cons

- Limited features in the free POS plan

- Requires a Shopify ecommerce plan

- Charges commission on third-party payment processing

Why I chose Shopify

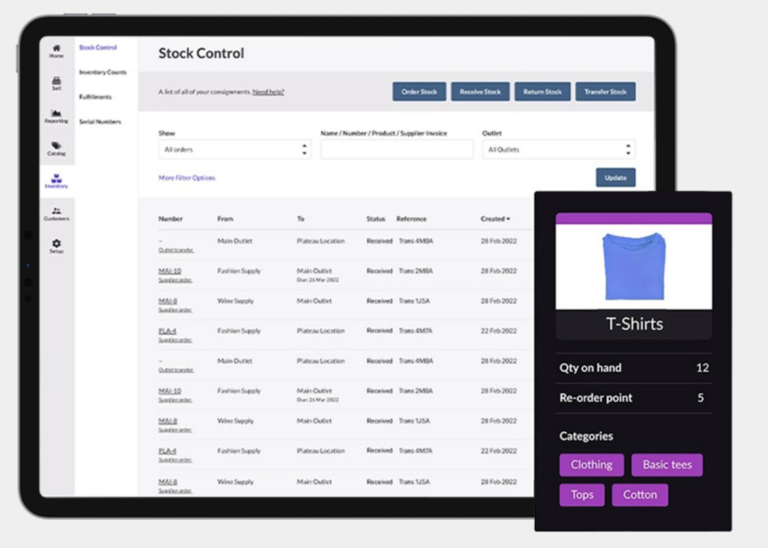

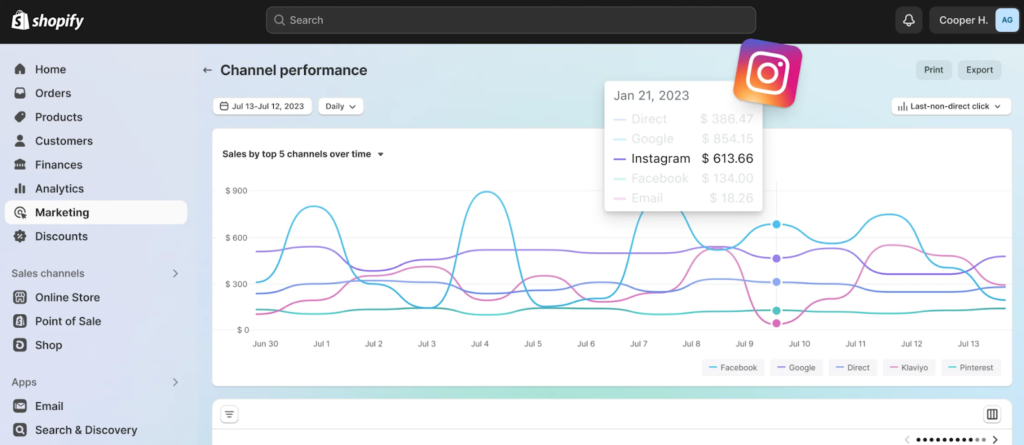

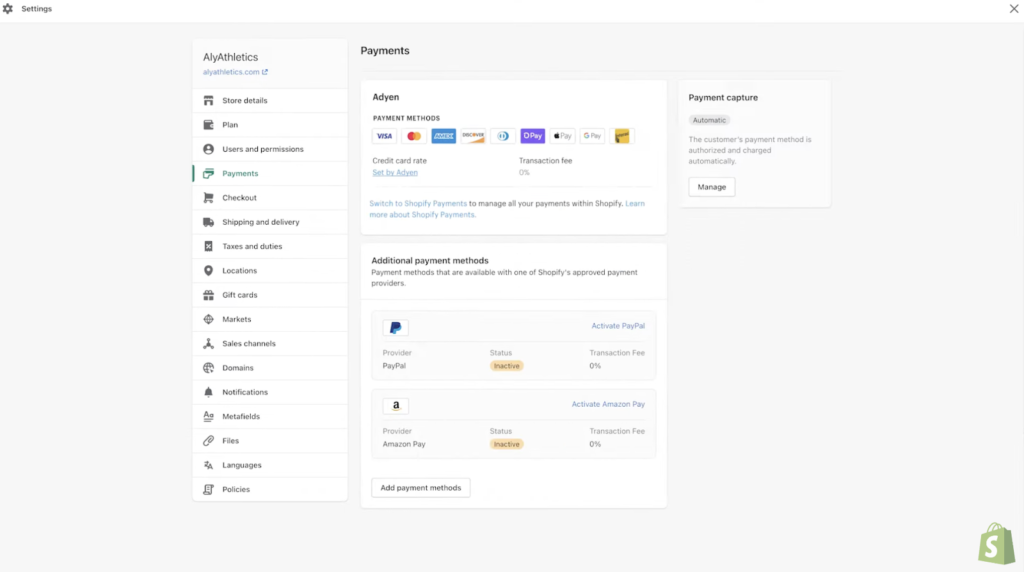

Advanced ecommerce features and multichannel capability make Shopify a solid alternative to Square for ecommerce businesses. Shopify offers easy inventory management, payment processing across multiple channels, and compatibility with a long list of third-party business software.

Shopify ecommerce is clearly miles ahead of Square’s online selling features. With Shopify, businesses can sell internationally, customize their checkout with multiple languages and currencies, and accept payment through third-party payment processors. Businesses that primarily sell online and are looking to expand to in-person sales will find Shopify POS the best alternative to Square.

Both Lightspeed and Shopify have versatile inventory management features. However, while Shopify’s POS has a free tier, you will need to subscribe to a paid plan software if you run a brick-and-mortar shop with steady sales.

Clover: Best Square alternative for flexible payment processing

Overall Score

4.05/5

Pricing

3.44/5

Hardware

4.5/5

Software Features

3.75/5

Support & Reliability

4.38/5

User Experience

4.38/5

Average User Review Scores

3.87/5

Pros

- Compatible with other payment processors

- Sleek and easy-to-use hardware

- Industry-specific POS software

Cons

- Terms and pricing depend on payment processor

- Hardware can be expensive

- Complex hardware and software bundle pricing

Why I chose Clover

Clover is a popular POS provider that offers solutions for retail, restaurant, and professional service businesses. It also offers a wide range of mobile card readers, terminals, and countertop registers. Like Square, Clover has a wide range of business solutions, so you have hardware and software to match your business as it grows.

Clover works with any processor on the Fiserv network, meaning businesses can keep their preferred payment processing service or shop around for the lowest rates. This is a clear advantage over competitors like Shopify and Square, which lock you into using their payment solutions.

However, if you choose to use Clover, it’s important to monitor fees and contract terms, as they vary widely depending on the payment processing partner, and Clover has little oversight over third-party pricing.

Toast: Best Square alternative for fast-growing restaurants

Overall Score

4.05/5

Pricing

3.75/5

Hardware

4.25/5

Software Features

4/5

Support & Reliability

4.38/5

User Experience

3.75/5

Average User Review Scores

4.2/5

Pros

- Free basic restaurant POS software

- Free hardware with pay-as-you-go plan

- Easy-to-use platform

Cons

- Very limited basic POS software

- Expensive add-on features

- 2-year long-term contract

Why I chose Toast

Toast is an all-in-one business solution for restaurants, making it the best Square alternative for food and beverage businesses. It offers a suite of restaurant management features and native add-on programs, along with industry-grade hardware that can withstand the heavy demands of a busy, greasy, and high-heat environment.

Among all the restaurant POS systems I evaluated, Toast was my top choice. Toast’s restaurant features, particularly its ingredient and delivery management tools, are far more efficient for growing businesses than Square’s restaurant POS software. Toast also offers more relevant third-party integrations, such as Zero-in for menus and ExpandShare for restaurant staff training.

If your business has evolved into an established, full-service restaurant, upgrading from Square to Toast makes sense. But if you are still working on a tight budget, note that Toast’s zero upfront cost starter kit includes a significantly higher payment processing fee and a minimum 2-year contract.

SpotOn: Best Square alternative for free retail POS

Overall Score

4.05/5

Pricing

3.75/5

Hardware

4.25/5

Software Features

3.75/5

Support & Reliability

4.38/5

User Experience

3.75/5

Average User Review Scores

4.4/5

Pros

- Free and affordable paid subscription plans

- Loyalty and marketing tools are included

- Built-in payments and ecommerce features

Cons

- Transaction fees for retail plans are not disclosed

- Basic product catalogs in free plan

- Limited reporting functionality

Why I chose SpotOn

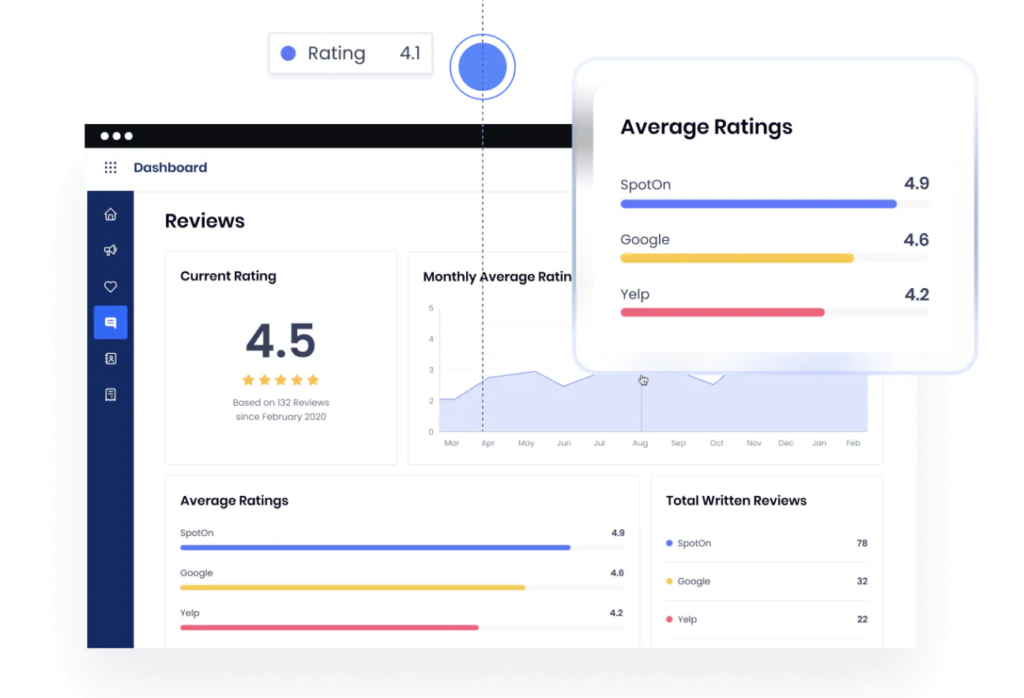

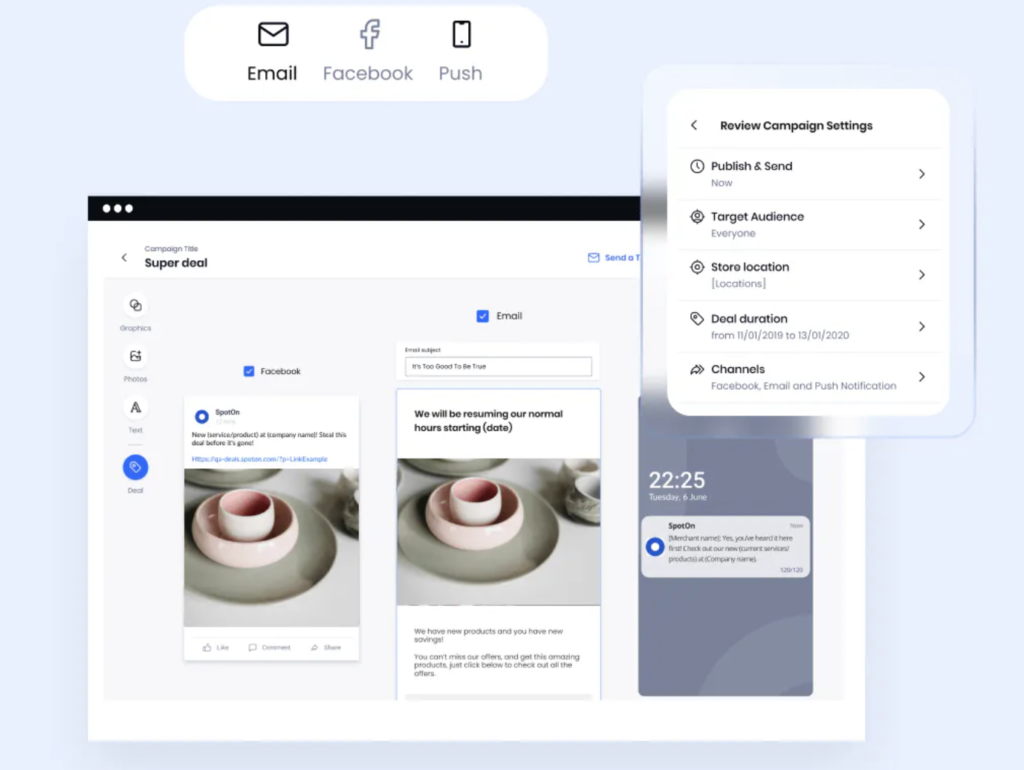

SpotOn has to be the closest to Square when it comes to affordability for retail businesses. Not only does SpotOn offer a forever-free plan similar to Square, but its paid plan is among the lowest in the industry at $25 per month. The paid plan already includes payment processing, inventory, ecommerce, omnichannel tools, and marketing and loyalty management (which are paid add-ons with Square).

Overall, SpotOn’s retail POS services are best for startups and small businesses, much like Square. And considering SpotOn is also an all-in-one solution, its price point is among the most cost-effective for businesses on a budget.

That said, it’s unfortunate that SpotOn does not advertise its payment processing fees, as low-volume businesses tend to pay more with flat rate pricing. Make sure to confirm SpotOn’s transaction fees and compare against Square’s before signing up.

Helcim: Best Square alternative for healthcare services

Overall Score

4.13/5

Pricing

4.75/5

Hardware

4/5

Software Features

3.75/5

Support & Reliability

3.75/5

User Experience

4.38/5

Average User Review Scores

4.17/5

Pros

- Zero monthly and add-on fees

- Interchange plus pricing w/ automated discounts

- Surcharging and level 2 and 3 data optimization

Cons

- Requires merchant account approval

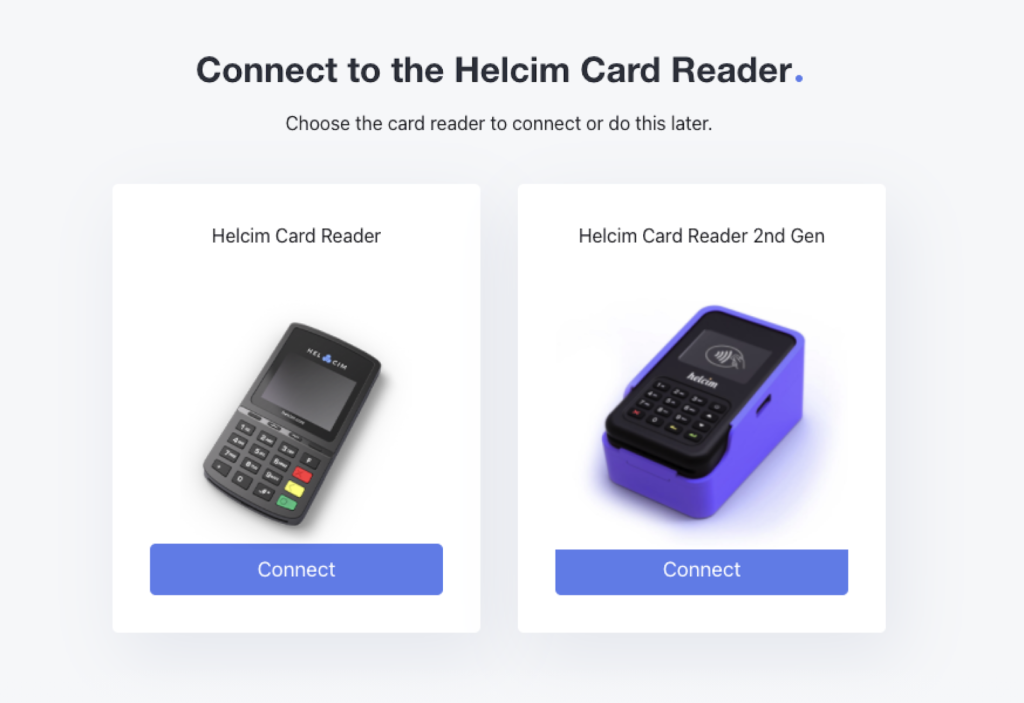

- Expensive card readers

- Poorly rated POS app

Why I chose Helcim

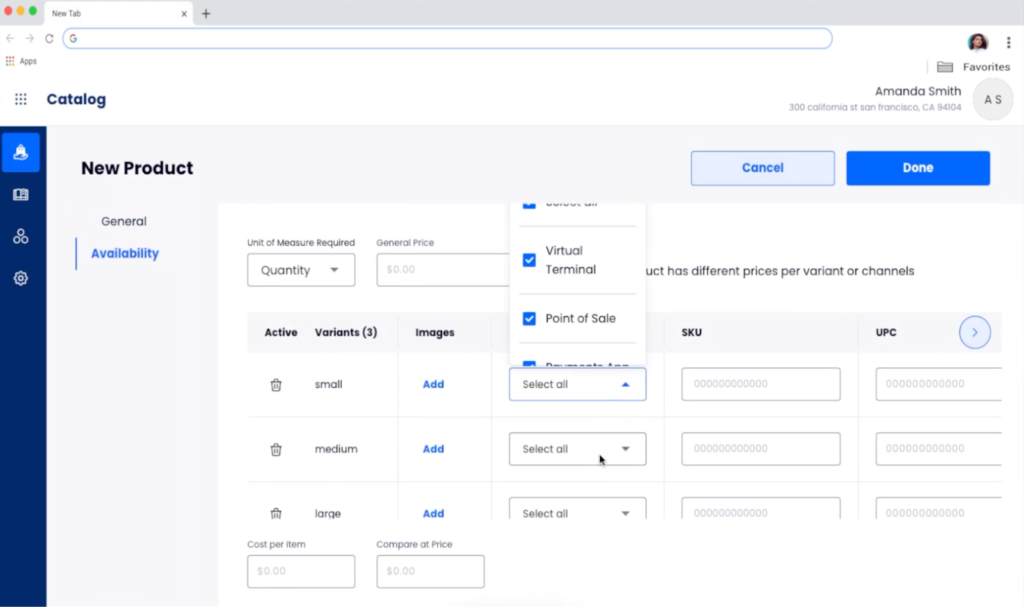

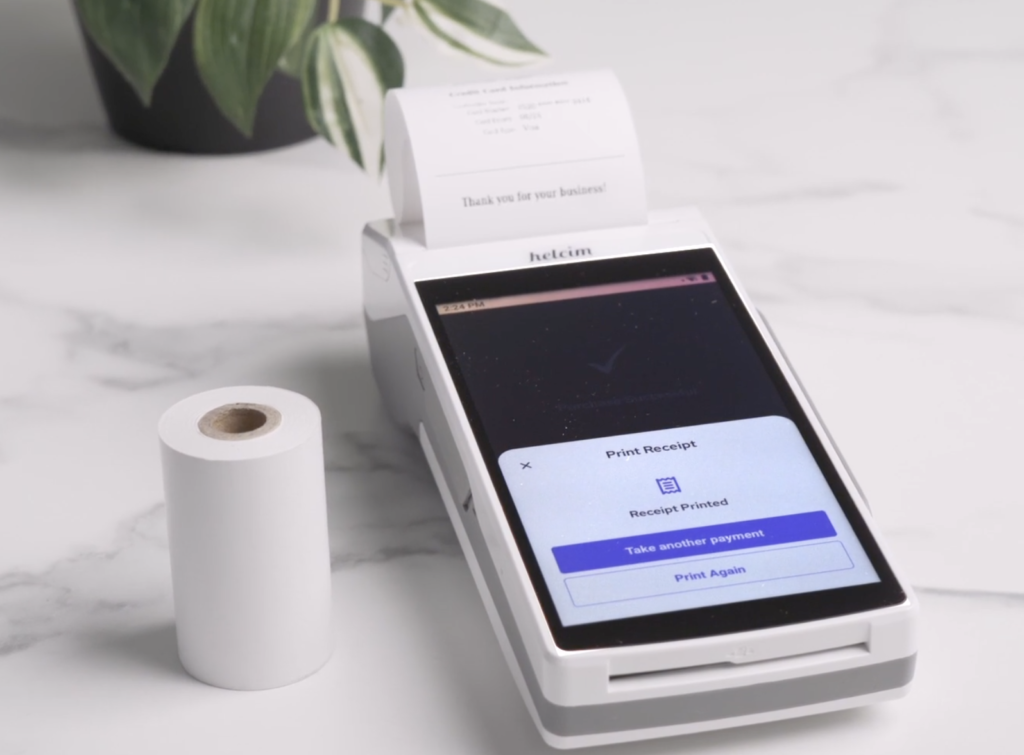

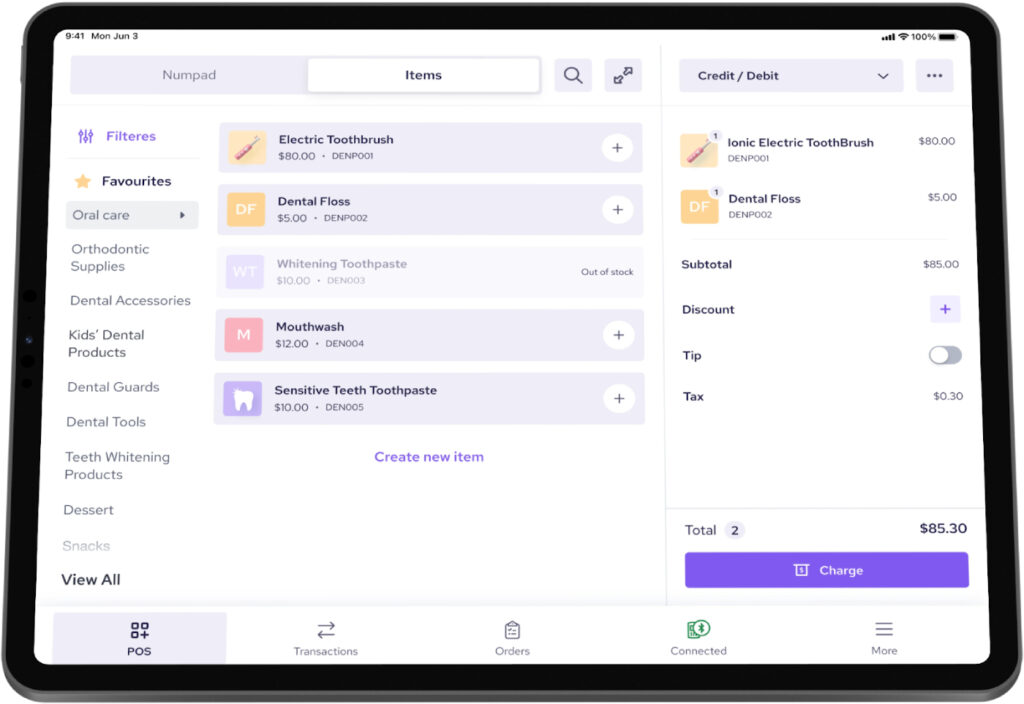

Helcim is a traditional merchant services provider with an automated volume discount program and free payment processing services. In the past few years, it has launched its own POS app and stand-alone handheld POS hardware, expanding its features to include a mobile POS solution.

Of all of the alternatives to Square, Helcim is the best healthcare service choice. Helcim goes into business associate agreements (BAA) with healthcare providers to provide payment integrations to dentists, veterinarians, optometrists, and more. Aside from its automated volume discount feature, Helcim offers cost optimization tools such as surcharging at no extra cost.

Read more: Best healthcare payment processors

That said, while a traditional merchant account like Helcim is more stable than aggregate merchant accounts like Square and other providers in our list, it requires an application and approval process. The application includes risk assessment for which new and small businesses may not qualify. Be sure to work with a Helcim account manager to have the best chance of getting approved for a merchant account.

Stripe: Best Square alternative for platform customizations

Overall Score

4.46/5

Pricing

4.25/5

Hardware

4/5

Software Features

4.79/5

Support & Reliability

4.58/5

User Experience

4.69/5

Average User Review Scores

4.43/5

Pros

- Free merchant account

- Advanced payment platform customizations

- Proprietary payment and POS app

Cons

- Requires some coding skills to set up

- Add-on fees for invoicing and recurring billing

- Limited in-person payments for native mobile app

Why I chose Stripe

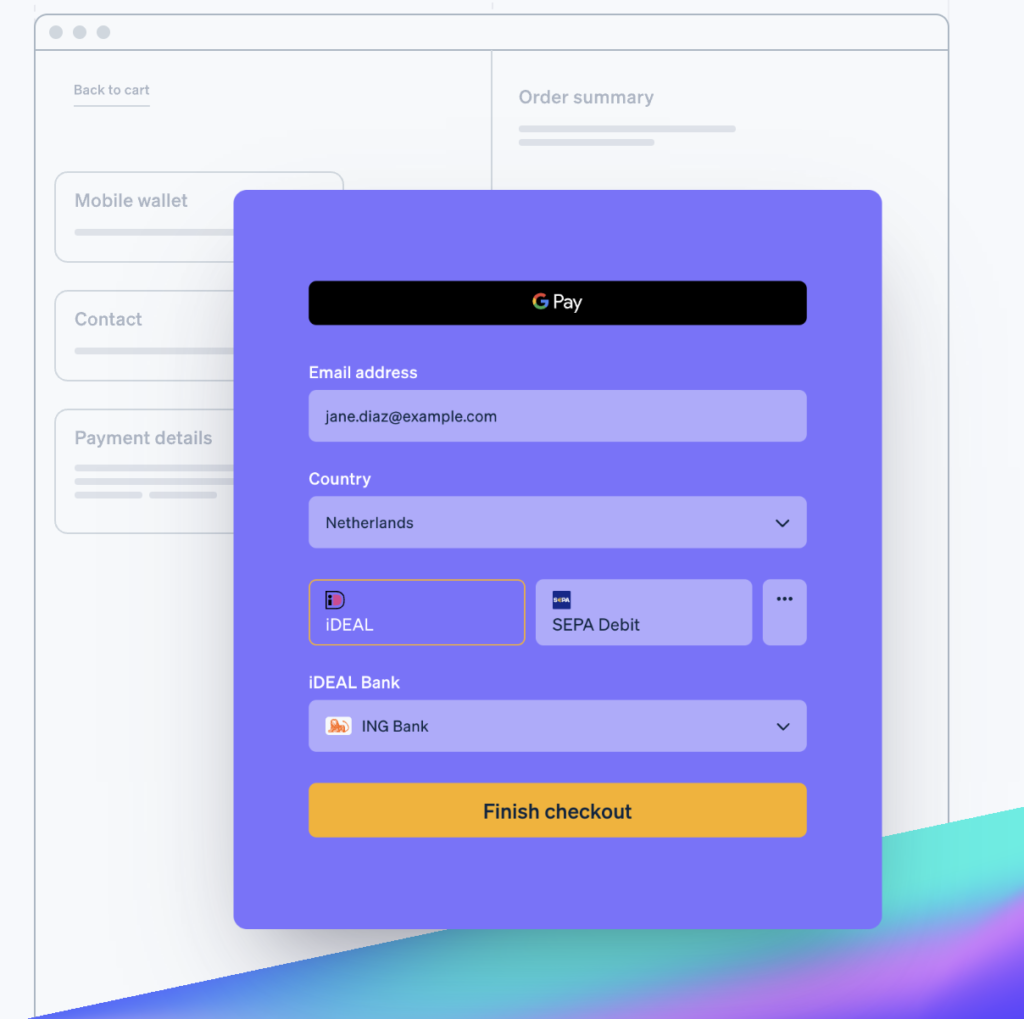

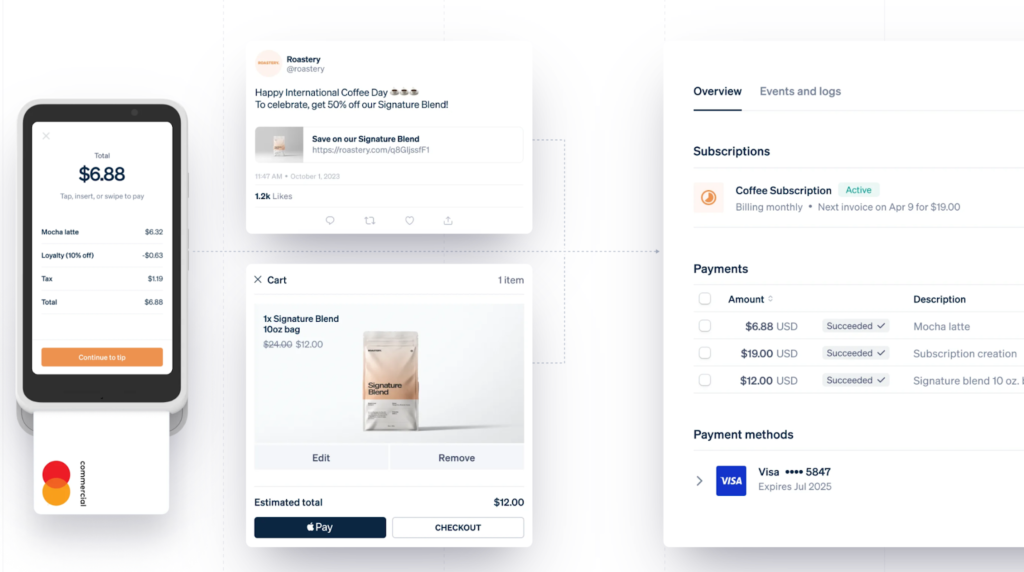

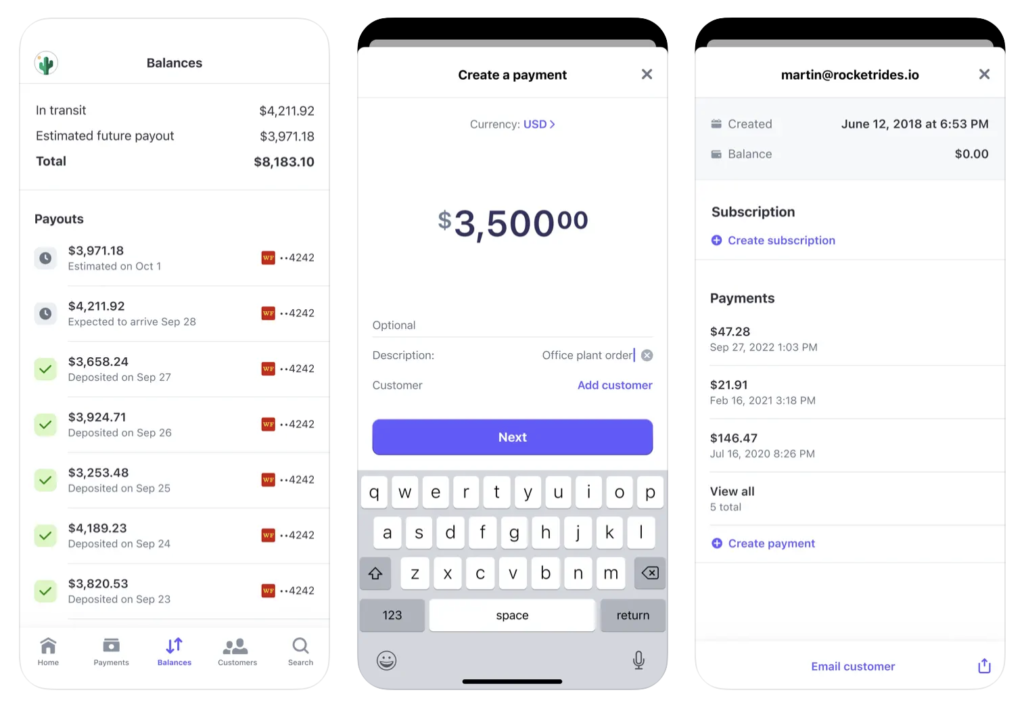

Launched in 2011, Stripe was developed to provide a user-friendly online payment platform that easily integrates with most ecommerce platforms and mobile apps via code. Today, it offers a broader range of online payment products, such as fraud prevention, embedded finance, and accounting automation. Its developer-first platform even powers payments for large companies such as Nord Security, Xero, Amazon, Shopify, and Lightspeed.

For years, Stripe has been behind Square due to its lack of plug-and-play payment and POS apps. However, with the launch of Stripe Dashboard and Stripe Terminal, Stripe is now a stronger competitor for simple payment setups.

Still, Stripe’s well-documented APIs, SDKs, and third-party integrations make it the best choice for businesses looking to upgrade to a tailored solution.

Read more: Stripe alternatives

IT Retail: Best Square alternative for high-volume retailers

Overall Score

4/5

Pricing

3.13/5

Hardware

4/5

Software Features

4/5

Support & Reliability

3.75/5

User Experience

4.38/5

Average User Review Scores

4.77/5

Pros

- Advanced inventory management

- Native tools for managing age-restricted products

- Built-in payment processing

Cons

- Pricey software/hardware plans

- Does not allow for third-party payment integrations

- Complicated setup

Why I chose IT Retail

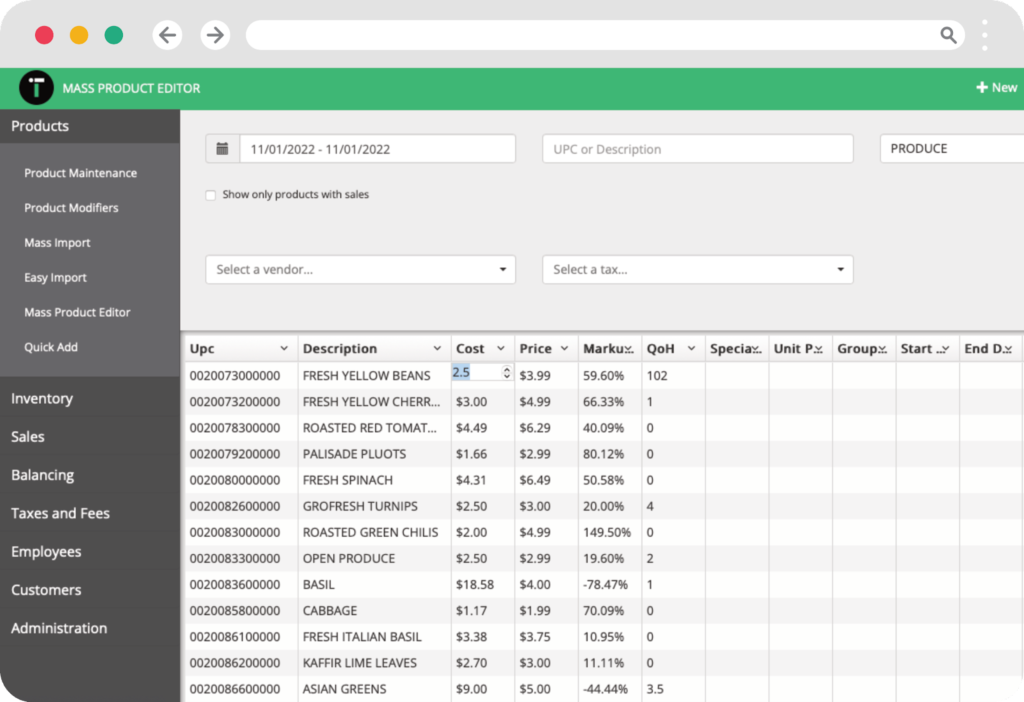

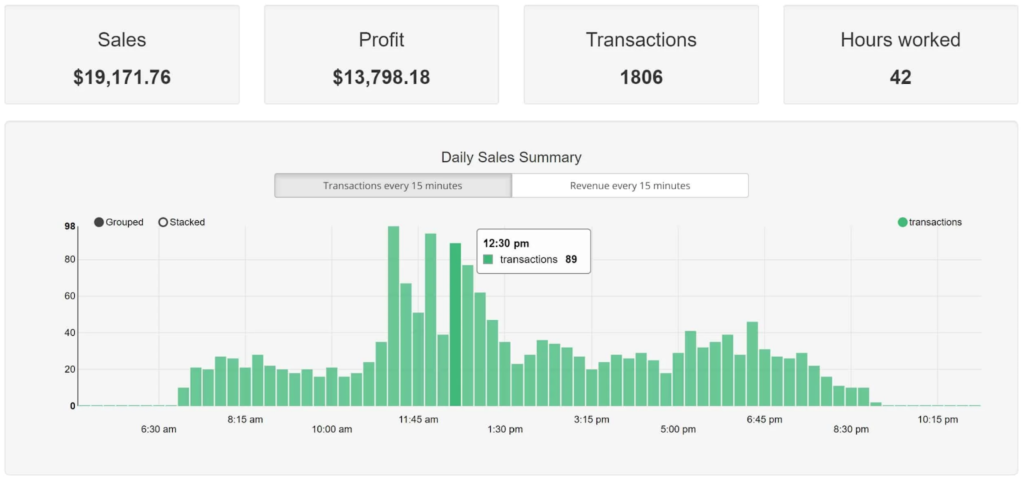

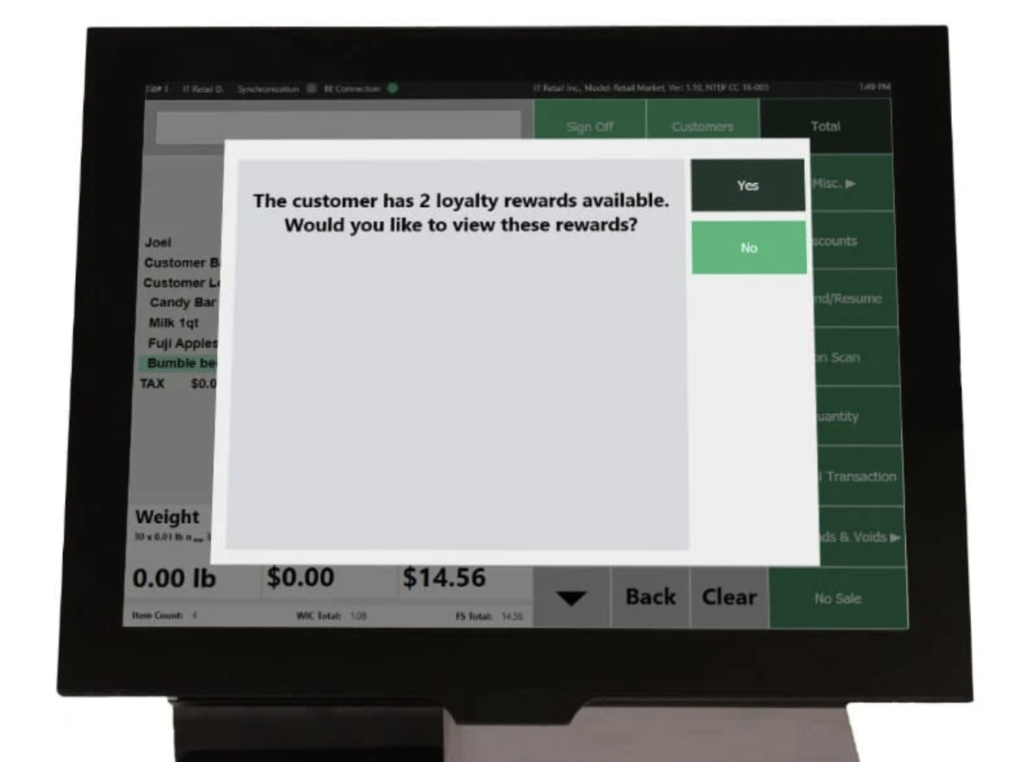

IT Retail is POS software designed for grocery and convenience stores carrying large quantities of fast-moving products. The advanced inventory management feature can track products based on different categories such as location, FIFO/LIFO, and shelf life. The system also comes with built-in tools for age-restricted products. IT Retail offers an all-in-one POS solution, with subscription plans that cover payment processing and hardware in one monthly payment.

Square is the perfect retail POS software for startups and small stores. However, its inventory management tools will not be able to keep up with growing product and sales volumes for specialty stores. This is where IT Retail comes in. IT Retail is the best Square alternative for mom-and-pop shops that have grown into busy grocery and convenience stores. Its advanced inventory management feature and custom loyalty programs will be a better fit for efficient stock control and customer engagement.

As retail businesses grow, set-up becomes more complex and expensive. Naturally, IT Retail is pricier and more complicated, not to mention takes longer to establish. Make sure to consider these factors before signing up.

Advantages of using Square: Why it’s so popular

Simply put, Square is an all-in-one POS system that offers easy and affordable setup, making it popular with startups and businesses operating on a tight budget. In fact, Square powers over four million merchants. Its pricing scheme allows businesses to start selling with zero initial investment and transaction fees as the only ongoing monthly cost.

Businesses that sign up for Square’s free plan get:

- Instant merchant account approval

- Basic industry-specific POS software

- Standard inventory features

- Mobile POS app

- Basic ecommerce platform

- Standard invoicing tools

- Virtual terminal

- Omnichannel sales

- Shipping and delivery management

- Starter team management plan

- First magstripe mobile card reader

- Waived chargeback fees of up to $250/month

Affordable upgrades

Upgrades for Square are also affordable. Advanced software plans start at $60 per location monthly for restaurants, $89 for retail, and $29 for appointments. Hardware costs start at $10 for an additional magstripe reader and $49 for a contactless mobile card reader, while more expensive POS hardware is available in installments.

Top-rated payment processing

Square’s payment processing service is also among the most versatile in the industry. Users can accept most payment types and process payments for specific industries such as healthcare (Square is fully HIPAA-compliant) and CBD (Square offers a CBD program). Square also comes with the native buy now, pay later (BNPL) service Afterpay and peer-to-peer payment service CashApp.

Easy to use

Square is also popular for its ease of setup and use. Square hardware is ready to use out of the box, and all users need to do is log on to their account and create their store with Square’s step-by-step guided prompt. The software itself is intuitive and requires very little training to learn how to use.

Highly mobile

Finally, most businesses also like Square for its mobility. Users can access their product catalog and ring up sales from the mobile POS app downloaded on a smartphone or iPad. It can even accept payments offline.

Square Disadvantages

Square does fall short in some areas, including:

Flat-rate pricing does not offer the most competitive rates

For one, Square’s flat-rate transaction fees are not the most affordable. As businesses grow, flat-rate fees can quickly eat up funds when transaction volumes are high.

For example, a supermarket with an average sales volume of $200,000 a year can have the choice between IT Retail’s custom quoted interchange-plus rate of 2.06% + 15 cents/transaction plus $99/month for POS software, and Square’s discounted 2.5% + 10 cents/transaction plus $89/month for POS software.

However, Square does offer custom discounted rates for transaction volumes above $250,000 a year.

Limited inventory management capabilities

Another key drawback of using Square is its inventory management limitations. Most of our recommended Square competitors, such as Lightspeed and Toast, have better inventory management features, handling complex product matrices, tracking the movement of large volumes of products, and having custom catalogs for vendor orders.

Aggregated merchant services can lead to account holds

Lastly, there are a number of complaints from Square users about frozen funds and accounts. While this happens more to businesses that end up, in one way or another, violating Square’s terms of service, it’s important to note that Square’s subscribers share a single merchant account (divided into sub-merchant accounts).

This means that after a while, a Square user’s merchant standing can be affected by issues committed by other sub-merchants, making them susceptible to card network sanctions like merchant accounts (and, of course, funds) being frozen.

Choosing the best Square alternative for you

Finding the right Square alternative can be tricky with all the available options in the market. Follow these simple guidelines to help you get started:

Identify your business goals

There are generally two types of businesses that look for alternatives to Square, and these are more often than not tied to their business goals. The first are small businesses that find Square lacking some business functionality they need. The second type is those that have outgrown the Square’s features. Identifying your business goals helps to narrow down your list of alternatives by looking for the specific features that Square could not provide.

Consider your budget

Budget is a big factor when choosing POS software. Once you have identified your goals and Square’s features that no longer match your business requirements, create a short list of Square competitors that can offer the most cost-effective solution. Not the cheapest as it’s unlikely to grow a business without investing in better equipment and advanced software tools.

Apart from these outright costs, also keep in mind ongoing expenses. For example, consider an alternative that offers better transaction rates for your growing sales.

Read more: Cheapest credit card processors

Understand your customers

Before making a decision, it may be a good idea to identify your customers. How do they like to shop? How do they prefer to make payments? Is there room for better customer engagement that can potentially boost your sales? When you know the answers to these questions, you can quickly identify Square competitors that could help grow your business the most.