Key takeaways

What is credit card processing?

Credit card processing is the process of requesting, validating, and approving a payment request. It involves a system of financial institutions and payment software working together to allow businesses to exchange goods and services for a customer’s bank-supported credit. Businesses are charged a portion of the transaction amount as a processing fee.

How does credit card processing work?

The credit card payment process begins at the point of sale (in-store, mobile, or online) and card data is secured before it goes through a series of validations. The customer’s bank settles the transaction for approved payment requests.

Key components

To understand how credit card processing works, we first have to be familiar with the key components and their roles in accepting credit card payments.

For the customer:

For the business:

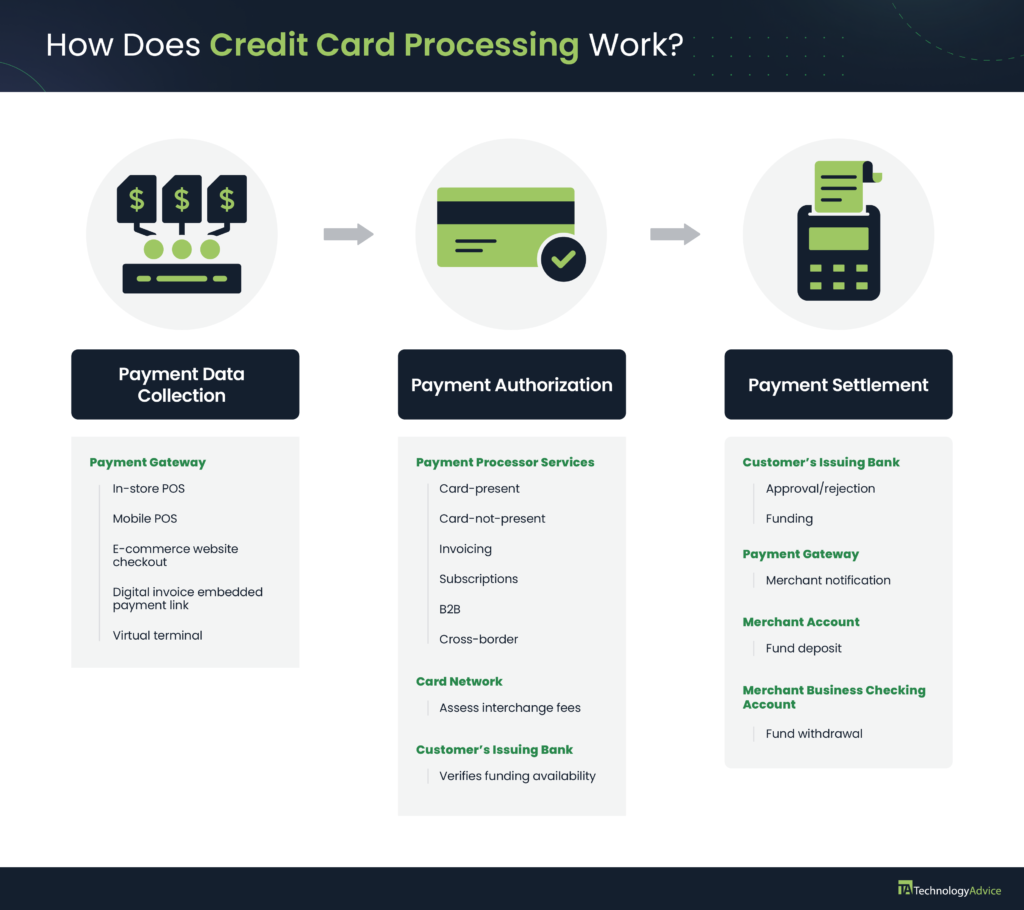

Stages of credit card processing

We break down credit card processing into three stages and look closer at the roles played by each key component.

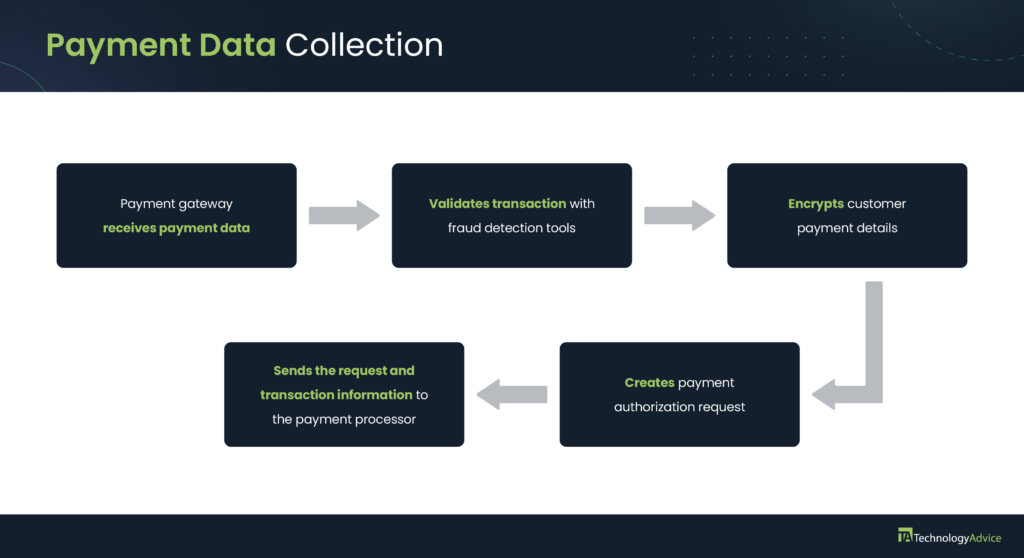

Payment data collection stage

In the data collection stage, the customer enters their credit card information on the payment gateway embedded in the merchant’s business software. Fraud protection tools, such as address and IP verification, work at the back end to verify the identity of the user making the payment. Once authenticated, the payment gateway encrypts the credit card data and sends a payment request to the customer’s issuing bank via the payment processor.

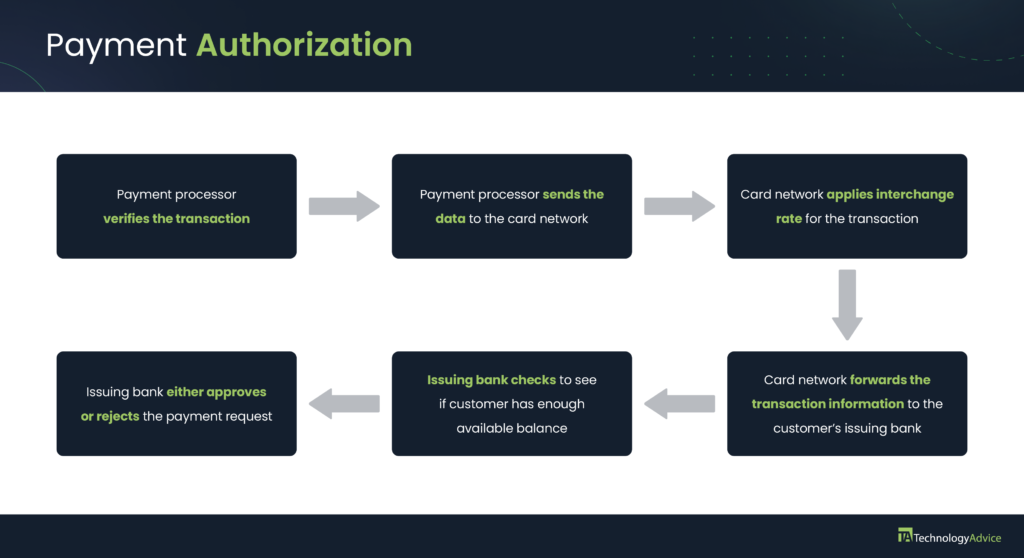

Payment authorization stage

The payment authorization stage begins with the payment processor verifying the transaction type and determining the card brand used for the transaction. The payment processor then forwards the information to the card brand, where the latter applies the interchange fees.

Lastly, the data is sent to the customer’s issuing bank, which approves the payment if:

- It verifies the customer’s account, and

- It confirms that the customer has the credit balance to fund the transaction

Otherwise, the customer’s issuing bank informs the payment processor that the payment request is denied and the result is displayed on the payment gateway. At this point, the merchant can request a different credit card from the customer, which restarts the data collection stage.

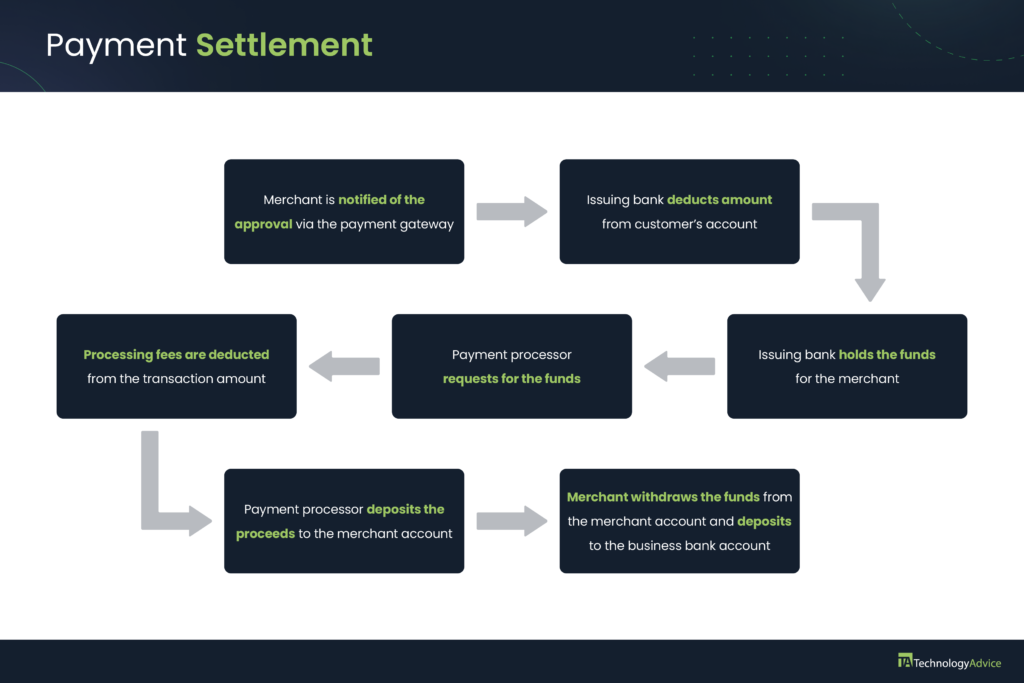

Payment settlement stage

For approved payments, credit card processing moves to the settlement stage. It begins with a notification sent to the payment processor of the approval and displayed on the payment gateway. The issuing bank deducts the requested amount from the customer’s balance and holds it until the payment processor requests for the transfer.

The transaction fees are deducted before the proceeds are deposited into the merchant account. Afterward, the merchant’s funds within the merchant account undergo “batch processing,” where the funds are withdrawn and sent to the merchant’s business bank account. Note that it takes two to three business days, on average, for the funds to appear in the merchant’s account.

How much does credit card processing cost?

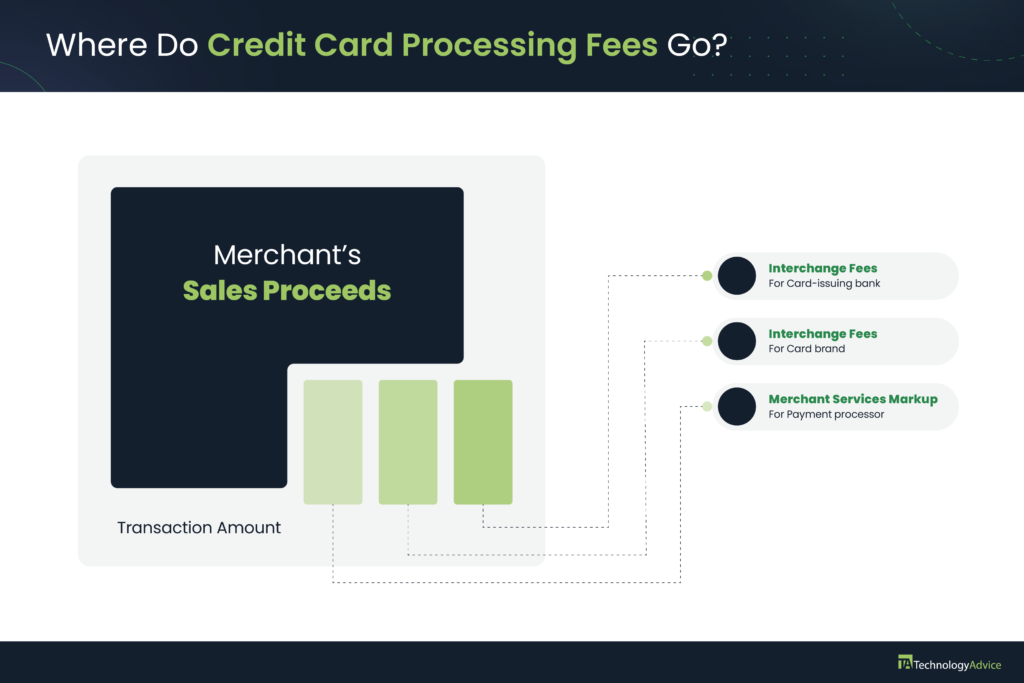

The cost of processing credit card payments differs for every business. This is because fees are assessed based on a number of factors and combine charges from the card network, card-issuing bank, and payment processor. To date, the average credit card processing fee of traditional (low-risk) businesses ranges from 1.5% to 3.6% per transaction.

Credit card processing fee is computed as: Interchange fee + Assessment fee + Merchant services markup

Interchange fee

An interchange fee is based on the percentage of each transaction. Card networks have their own fee matrices that assign interchange rates based on a number of factors such as card type and business type. Card brands set the interchange fee, but the proceeds are paid to card-issuing banks for handling and acquiring the risk of the transaction.

- Visa: 1.23% to 3.15%

- Mastercard: 1.15% to 3.15%

- American Express: 1.10% to 3.15%

- Discover: 1.56% to 2.40%

Assessment fee

Credit card service providers charge merchants a fee for the convenience in using their brand. The amount is based on a percentage of the total monthly sales. Card networks impose and collect the fees.

- Visa: 0.14%

- Mastercard: 0.14% (transactions < $1,000); 0.15% (transactions > $1,000)

- American Express: 0.13%

- Discover: 0.17%

Visit card brand sites to learn more about their fees:

Merchant services markup

The merchant services markup is the cost imposed by the merchant’s payment processor that provides the software for processing credit card payments. It is based on a percentage of each transaction plus monthly and incidental fees. Merchant services markup varies widely depending on what fee structure a service provider uses.

- Flat rate: Monthly account fee + (% + cents per transaction)

- Interchange plus rate: % + cents per transaction

- Wholesale rate: Monthly account fee + (cents per transaction)

Read more: Check out transaction fees of the best credit card processing companies in 2024

In general, fees are lower if the credit card payment is done in-person than when the credit card is not physically present owing to the higher risk involved. Other factors that affect the cost of accepting credit card payments include:

- Sales volume: Businesses that regularly process large-volume credit card transactions are qualified for volume discounts.

- Business type: Businesses considered high-risk are charged higher transaction rates compared to traditional businesses.

Read more:Cheapest credit card processing companies

Credit card processing best practices

Accepting credit card payments carries some challenges, and the following best practices should help minimize the risks.

Secure all payment information

Securing information is an important factor to consider when processing a credit card transaction. There are regulations around this that should be observed for businesses to keep their ability to accept credit card payments. This means both business hardware and software that are involved in transmitting credit card data should have security measures in place.

Some methods of securing payment data are:

- Installing fraud detection tools to authenticate the user before accepting credit card payments

- High-level encryption protocols to make the data unusable to hackers in the event of a breach

- Password-protected access to all hardware and payment terminals

- Working only with PCI-compliant payment processors that offer secure software for processing and storing credit card data

Provide clear payment policies

Businesses that intend to process credit cards should have clear and transparent payment policies in place. These policies should help set a customer’s expectations on everything from returns and refunds to shipping and incidental fees. It’s also important to make sure that the payment policies are visible at the checkout counter, on your receipt, and at the checkout page on your website right before a customer clicks on the “Pay Now” button. This helps businesses protect themselves from any potentially fraudulent chargeback claims in the future.

Keep card network compliance

The card network ultimately sets the regulations for businesses that accept credit card payments. And as card networks fall under federal jurisdiction, it’s a safe bet that whatever is prohibited under federal law would also be unacceptable with the card networks. This includes:

- Guidelines for storing credit card information and keeping payment systems secure implemented by the PCI Security Standards Council (PCI SSC)

- The types of businesses that can accept credit card payments. For example, marijuana sales are legal in most states. But, using credit card to pay for it is illegal because marijuana sales are still prohibited under federal laws

- Keeping your business chargeback rate below 1% to avoid being classified as high-risk

Note that any breach in a merchant account agreement will land a business in a card network blacklist (MATCH list).

Find ways to lower credit card transaction costs

The cost of accepting credit card payments can grow if not properly managed. While interchange rates are non-negotiable, payment processor markups are, and there are a number of ways to keep your credit card fees low.

Such as:

- Encouraging more in-person credit card payments as the card-present transaction fees are lower compared on card-not-present transactions.

- Opting for an interchange plus fee structure instead of a flat rate so you have better visibility of the costs

- Applying for volume discounts when possible

- Choosing a less expensive setup, such as a mobile reader and smartphone POS app

Read more:

- Best credit card payment apps

- Best mobile credit card processors

- Best card readers for small businesses